U.S. energy giant Chevron Corp. (NYSE:CVX) is set to release its second-quarter 2017 results before the opening bell on Friday, Jul 28.

In the preceding three-month period, the San Ramon, CA-based supermajor reported better-than-expected earnings amid the recovery in commodity prices, improving domestic refining margins and the success of its cost savings initiatives.

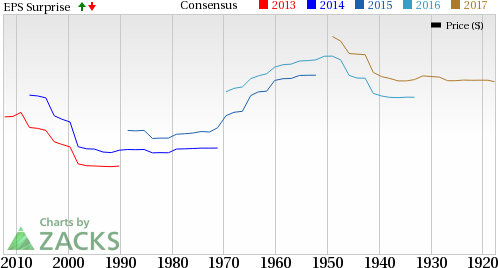

Coming to earnings surprise history, Chevron has a good record: it beat estimates in three of the last four quarters.

Let’s see how things are shaping up for this announcement.

Factors to Consider This Quarter

Oil prices have been on a freefall over the past few weeks, erasing all the gains associated with the OPEC-led output cut. The continued rise in domestic production thanks to soaring shale output have dragged down the commodity well below the psychologically-critical $50 threshold. This will hamper earnings and cash flows for Chevron and its upstream unit in particular.

Moreover, weak realizations limit the companies' internally-generated cash flow amid high capital spending and dividend payments. Worse, refining margins – that have saved the blushes for the supermajors over the last few quarters – have shrunk considerably and will further hamper profits.

However, Chevron’s successful cost reduction initiatives and efficiency gains are expected to cushion the results. In particular, decline in unit development and operating cost present a bright spot for the group. The company also expects to see additional output growth during the quarter from the third unit of Gorgon natural gas project in Australia, apart from continued ramp-ups from other developments such as Mafumeira Sul project offshore Angola and the Moho Nord site off the coast of the Republic of Congo. As it is, Chevron's focus on the prolific Permian basin should allay investor fear about production growth trajectory over the next few years.

Earnings Whispers

Our proven model does not conclusively show that Chevron will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat consensus estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is -5.38%. This is because the Most Accurate estimate stands at 93 cents, while the Zacks Consensus Estimate is pegged higher, at 82 cents.

Zacks Rank: Chevron’s Zacks Rank #4 (Sell) further decreases the predictive power of ESP, making us less confident of an earnings surprise call.

As it is, we caution against Sell-rated stocks (Zacks Ranks #4 and 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Share Performance: Chevron has lost 2.8% of its value during the second quarter versus the 3.1% decline of its industry.

Stocks to Consider

While earnings beat looks uncertain for Chevron, here are some energy firms you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this quarter:

TransCanada Corp. (TO:TRP) has an Earnings ESP of +7.84% and a Zacks Rank #1. The energy infrastructure developer is expected to release earnings results on Jul 28. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Patterson-UTI Energy Inc. (NASDAQ:PTEN) has an Earnings ESP of +3.57% and a Zacks Rank #3. The onshore contract driller is anticipated to release earnings on Jul 27.

QEP Resources Inc. (NYSE:QEP) has an Earnings ESP of +5.26% and a Zacks Rank #3. The oil and gas company is likely to release earnings on Jul 26.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Chevron Corporation (CVX): Free Stock Analysis Report

Patterson-UTI Energy, Inc. (PTEN): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

QEP Resources, Inc. (QEP): Free Stock Analysis Report

Original post