The Blackstone Group L.P. (NYSE:BX) is scheduled to report second-quarter 2017 results before the opening bell on Jul 20. Its revenues and earnings are expected to grow year over year.

Last quarter, the company’s economic net income surpassed the Zacks Consensus Estimate, driven by a significant rise in revenues, which was partially offset by higher expenses.

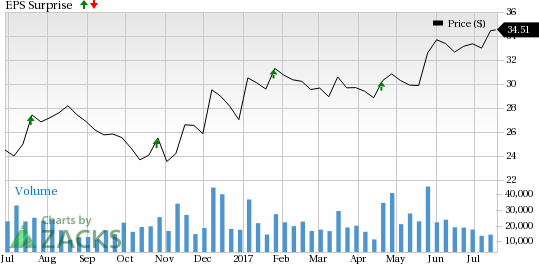

Blackstone also boasts an impressive earnings surprise history, having beaten the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 12.1%.

These, along with fundamentals, helped Blackstone’s shares gain nearly 27.7% year to date, outperforming the Zacks categorized Financial - Investment Management industry’s growth of 18.3%.

Will the rally in stock price continue post second-quarter earnings release? To a great extent, it depends on if the firm is able to maintain its trend of beating earnings estimates.

Our proven model shows that Blackstone has the right combination of two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: The Earnings ESP for Blackstone is +3.33%. This is because the Most Accurate estimate of 62 cents is above the Zacks Consensus Estimate of 60 cents.

Zacks Rank: Blackstone has a Zacks Rank #3, which when combined with a positive ESP makes us reasonably confident of an earnings beat.

Factors to Influence Q2 Results

On the expense side, as the company’s well-performing funds require more headcount, compensation and benefit costs are expected to increase.

With improvement in the overall economic scenario, the company’s fund-raising ability should aid the uptrend in its fee-earning AUM and total AUM. This will lead to stable or improving fee income for the company.

Also, Blackstone continues to expand its investment activity to capitalize on public market dislocation and should report higher deployment of capital during the quarter.

However, Blackstone’s activities during the quarter failed to win analysts’ confidence. The Zacks Consensus Estimate of 60 cents for the quarter declined by almost 3.2% in the last 30 days.

Other Stocks that Warrant a Look

Here are a few finance stocks that you may want to consider, as our model shows that they have the right combination of elements to post an earnings beat in the upcoming release.

Citizens Financial Group, Inc. (NYSE:CFG) is slated to report second-quarter results on Jul 21. It has an Earnings ESP of +1.70% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fifth Third Bancorp’s (NASDAQ:FITB) Earnings ESP is +2.38% and it carries a Zacks Rank #3. The company is expected to release second-quarter results on Jul 21.

Huntington Bancshares Incorporated (NASDAQ:HBAN) has an Earnings ESP of +4.35% and a Zacks Rank #3. It is scheduled to report second-quarter results on Jul 21.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN): Free Stock Analysis Report

The Blackstone Group L.P. (BX): Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG): Free Stock Analysis Report

Original post

Zacks Investment Research