Ally Financial Inc. (NYSE:ALLY) is slated to announce second-quarter 2017 results on Jul 27, before the market opens. Its revenues are projected to rise year over year, while earnings are expected to fall marginally.

Escalated expenses and higher provisions largely led Ally Financial’s first-quarter earnings to lag the Zacks Consensus Estimate. However, higher net revenues supported results to some extent.

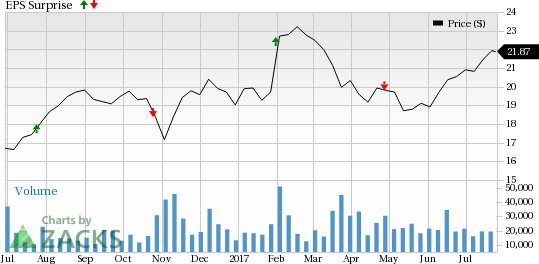

Analysts seem to be happy with the company’s business activities in the just concluded quarter. Hence, the Zacks Consensus Estimate remained stable over the last 30 days. Also, the stock has a decent earnings surprise history. The company’s earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters, with an average beat of 2.9%.

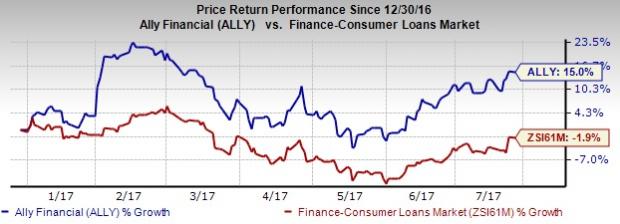

Further, the company’s price performance has been decent as well. Its shares have jumped 15% so far this year against the industry’s decline of 1.9%.

Factors at Play

Lower used vehicle prices to hurt results: With management’s expectations of decline in used vehicle prices, Ally Financial’s earnings are likely to be adversely impacted to some extent as it primarily deals in auto loans.

Further, lease revenues are projected to fall during the quarter owing to a smaller lease portfolio as well as lower used vehicle value.

Higher rates to support net interest income (NII): Given the higher interest rates and Ally Financial’s efforts to diversify into mortgage business, NII is expected increase in the second quarter.

Operating expenses to rise: Ally Financial has been making efforts to grow inorganically, introduce new products and diversify operations. Given these initiatives, the company will likely witness an increase in operating expenses. Management expects expenses to be $760 million in the second quarter.

Earnings Whispers

Our proven model does not conclusively show that Ally Financial is likely to beat earnings this quarter. That’s because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy) or at least 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as elaborated below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: The Earnings ESP for Ally Financial is -1.89%. This is because the Most Accurate estimate of 52 cents is below the Zacks Consensus Estimate stand at 53 cents.

Zacks Rank: Ally Financial has a Zacks Rank #3, which increases the predictive power of ESP. However, we need a positive ESP to be confident of an earnings surprise.

Stocks to Consider

Here are a few finance stocks that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases:

Hilltop Holdings Inc. (NYSE:HTH) is slated to release results on Jul 27. It has an Earnings ESP of +2.33% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Franklin Resources, Inc. (NYSE:BEN) has an Earnings ESP of +1.37% and a Zacks Rank #2. It is slated to report June quarter-end results on Jul 28.

OM Asset Management PLC (NYSE:OMAM) has an Earnings ESP of +2.63% and a Zacks Rank #2. The company is expected to release results on Aug 3.

"More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>”

Ally Financial Inc. (ALLY): Free Stock Analysis Report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

OM Asset Management PLC (OMAM): Free Stock Analysis Report

Hilltop Holdings Inc. (HTH): Free Stock Analysis Report

Original post

Zacks Investment Research