On May 1, 2014 I wrote a post titled "Retail Sales - Various Thoughts" concerning various notable changing aspects of retail sales, including aspects of rising stress in retailing.

Subsequent to that post, there have been additional noteworthy developments concerning retail sales and retail stocks.

As many are aware, April advance retail sales were considered to be disappointing. In addition, various individual retailers have posted quarterly results that either have been below estimates and/or otherwise were found to be disappointing.

As well, various retail stocks seem to be exhibiting notable "price action," with many under pressure. Among these stocks include Amazon.com (NASDAQ:AMZN). A broader selection of prominent retail stocks – as well as the Retail SPDR (NYSE:XRT) – appear to be flagging in price momentum.

AMZN and XRT are seen depicted on a daily basis below since 2008, compared against the S&P 500, in green. For reference purposes, I have added the 200-dma to each chart:

(chart courtesy of StockCharts.com; chart creation and annotation by the author)

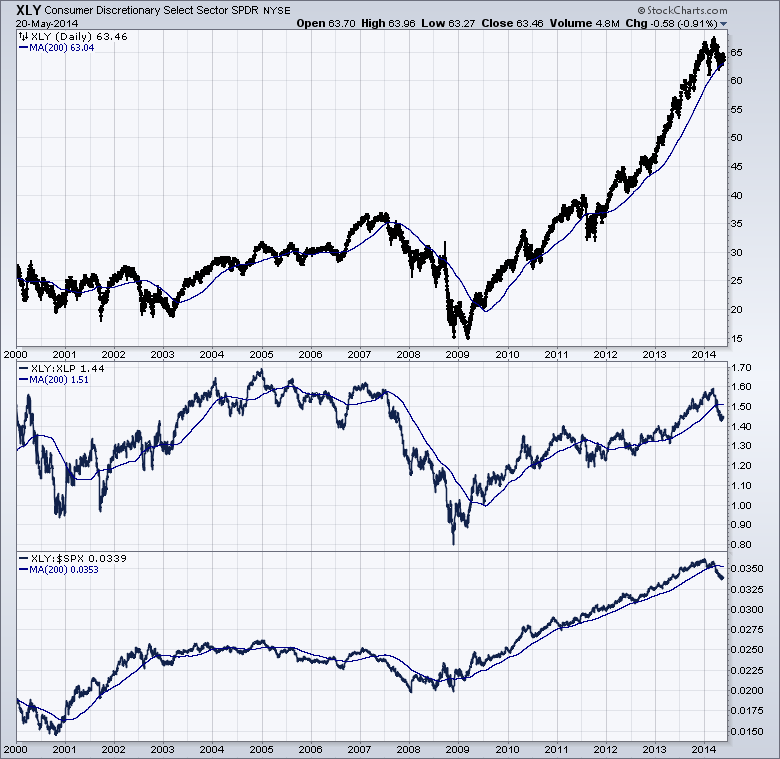

Additionally, the ratio between "consumer discretionary" stocks and "consumer staples" stocks has lately taken on a different tone. Many view this ratio as an indicator of the vitality of consumer spending. I view the (ARCA:XLY) (consumer discretionary SPDR) and the SPDR - (ARCA:XLP) (consumer staples SPDR) as proxies for the consumer discretionary and consumer staples stocks. The chart below shows the XLY, the XLY:XLP ratio and the XLY as a ratio to the S&P 500, all with 200-dma lines added. As can be seen, the XLY:SPX ratio has recently significantly broken below the 200dma and the XLY:XLP ratio – even though it is still at high levels – lately has been undergoing a significant decline, one of only a few since mid-2009:

(chart courtesy of StockCharts.com; chart creation and annotation by the author)

Other notable aspects in retailing include increasing price discounting, which appears to be intensifying in many segments. I have frequently discussed these pricing issues in my profitabilityissues.com site.

While, all told, retail sales and retail stocks still (especially from a long-term perspective) generally appear to exhibit various degrees of growth, many of the changing dynamics will continue to present challenges both for retail sales as well as the broader economy in general.