Investing.com’s stocks of the week

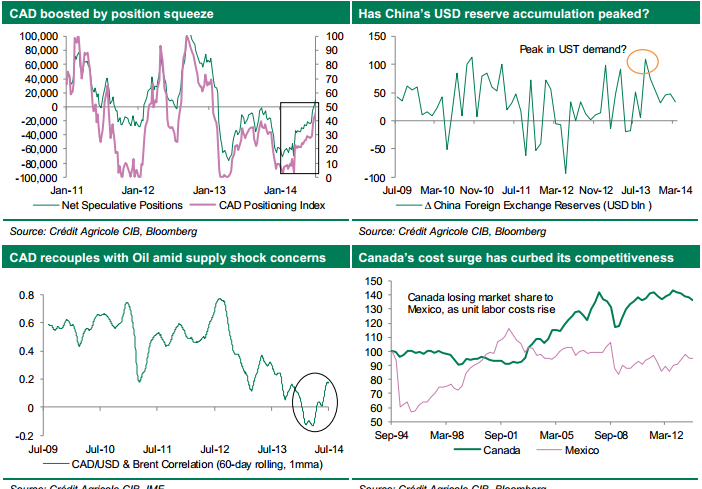

CAD traded largely flat over the past month, after rallying nearly 4% against the USD CAD/USD from late March to May. Position squaring, the spike in oil prices and gradual rise in official sector capital flows helped CAD recover some its Q1 losses against the greenback. Indeed, we suspect the moderation in US yields and reserve accumulation (and diversification out of USD) from China and other Asian central banks were keys sources of demand for CAD in H1. However, data from the PBOC suggests that the pace of reserve accumulation has peaked. What’s more, the BoC’s dovish bias persists. For instance, at the recent policy meeting it pushed against the rise in prices, highlighting that the rise in inflation is temporary.

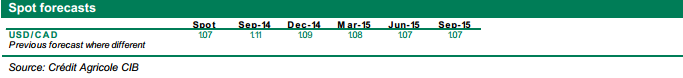

We look for USD/CAD to move higher in Q3 and target a move back to 1.11. Specifically, we suspect that much of the rally since early June is driven by the feedback loop of temporary factors.

First, the biggest driver of the move is the sharp capitulation in the short CAD trade. The market maintained a sizeable short CAD position since March of 2013 but suddenly flipped to a net long position in early July. The position adjustment is likely a function of the upside inflation surprises in H1 and hopes that the BoC would shift to a more hawkish tone. The BoC remains dovish and CAD is vulnerable to a reversal.

The second key driver for the CAD’s outperformance is the unexpected surge in oil prices. While CAD’s price action has recently decoupled from commodity prices, the surge in oil prices led to a re-coupling of the long-held correlation. Recall, oil prices (Brent) rose 4.26% from March to June – the biggest three month rise since September 2013 – as conflicts in Iraq increased oil supply concerns. However, the ‘fear premium’ in oil markets has diminished and oil market fundamentals suggest that oil prices are likely to resume a downtrend. Third, and final, we fear that Canada’s structural issues will hobble its ability to leverage stronger growth in the US. The lagging impact of Canada’s Dutch disease has seen unit labour costs soar relative to its competitors while Canadian exports continue to disappoint BoC expectations. To illustrate, Canadian job growth continues to lag the US while domestic wage growth remains weak, as Canada’s negative output gap persists.