Every central banker and monetary authority understands economics. Each recognizes that debt-centric spending, interest rate repression and eye-popping additions to total government obligations will not sidestep inevitable defaults and/or worthless currencies in the future. So why has every influential central bank on the world stage – Federal Reserve, Bank of Japan, People’s Bank of China, Bank of England, European Central Bank – pursued policies that merely delay the moment of reckoning? Why does kicking the “catastrophe can” down the path always get the nod over fundamental changes in behavior?

The primary answer is that central bankers are politicians. They know that slower economic growth, stagnant wages and income inequality directly result from can-kicking endeavors. Yet they are also aware that pushing problems out into the future means they will not be in power to be held responsible and that even the illusion of prosperity feels better to the public than having those people address inconvenient realities right now.

Who likes the notion of facing the music today to ensure longer-term prosperity? It is so much easier to live wonderfully in the moment, regardless of where the dollars, euros or drachmas come from, while letting others worry about out-of-control borrowing. And when it comes time to deal with the byproducts of “kicking the debt can down the pathway” (e.g., stagnant wages, income inequality, sub-par economic growth, etc.), politicians promise to “fix” the problems with force; leaders push higher wage laws and higher taxes to redistribute wealth. Unfortunately, concepts of fairness notwithstanding, the cost of goods rise alongside the higher wages, meaning that nobody is keeping more of that money. Similarly, redistributing the wealth pie does not increase the size of the pie itself.

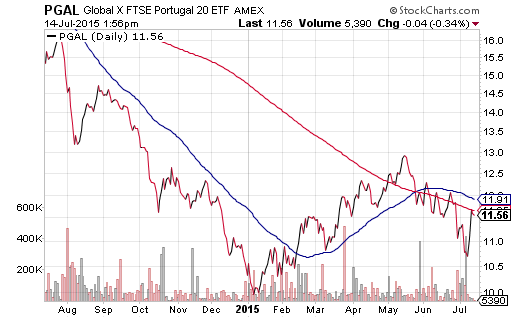

Perhaps the idea that Greece will receive yet another euro bailout is one that temporarily calms anxious equity investors. Or perhaps the contentious battle that has been playing out over the last few weeks has scratched the cloak of central bank invincibility. Tracking Global X FTSE Portugal (NYSE:PGAL) and iShares MSCI Spain (ARCA:EWP) may provide the best clues going forward. For example, the anticipated jump off the July lows for PGAL reflects initial excitement over the euro-group’s tentative agreement with Greece. On the other hand, the slope of the 50-day moving average and the slope of the 200-day moving average are negative, suggesting that Portugal still remains handcuffed by its downtrend.

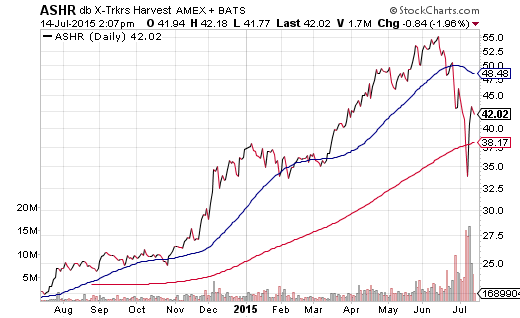

As I mentioned last week, the People’s Bank of China (PBOC) would likely find a way to stop the rapid-fire crashing of Chinese equities on the Shanghai SSE (LONDON:SSE) Composite. I might have anticipated media suppression. I might even have expected efforts such as the forced acquisition of shares by brokerages. Yet the banning of short-selling – alongside the banning of regular selling for six months by those who own more than a 5% stake – may provide plunge protection in ways that have never been tried in more developed countries. If Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (NYSE:ASHR) stays above and holds above its 200-day moving average, one might as well dismiss China’s debt-fueled excesses for the time being. We would be witnessing one more instance where trusting the central banks/21st century governments led to profitable opportunities.

To be clear, I am not recommending these ETFs for portfolios. I would never choose PGAL over a broader European holding like Vanguard Europe Pacific (NYSE:VEA) or iShares MSCI EAFE (HEFA). And ASHR is a speculative play on successful government manipulation alone. I bring the aforementioned ETFs up in discussion as a means for monitoring the collective confidence of market participants; that is, central banks may inflate stock prices, decrease borrowing costs and/or depreciate currencies, but someday, market participants may lose the faith.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI