XRP whales reemerge as prices hit a pivotal resistance barrier.

Key Takeaways

- XRP is up nearly 2% in the past 24 hours as whales go into a buying spree.

- The recent upswing took XRP to retest a critical hurdle that has been rejecting upward price action over the last two months.

- Busting through this barrier will signal a move towards $0.30 while failing to do so could trigger a correction to $0.20.

XRP kicked off the week with a bang, with prices rising over 2% in the past day. Further buying pressure could push Ripple’s cryptocurrency out of a two-month-long correction.

Bullish Breakout on XRP’s Horizon

XRP went through a brutal correction over the past two months relative to the rest of the market. The cross-border remittances token saw its price plummet by more than 30% after the coin went from a high of $0.33 in early August to a recent low of $0.22.

A descending parallel channel developed over the past two months on XRP’s 1-day chart. A descending line rejected upward price action while a parallel trendline on the lower end of the channel kept falling prices at bay.

The most recent rejection from the channel’s upper boundary suggested that this cryptocurrency was doomed to retrace further. Today’s bullish price action could have invalidated the pessimistic outlook.

If demand continues to rise, XRP may have the strength to break through the overhead resistance and turn the 50-day and 100-day moving averages into support. Under such circumstances, prices might shoot up by more than 20% towards the next area of interest, around $0.30. This target is determined by drawing a parallel line equal to the channel’s width.

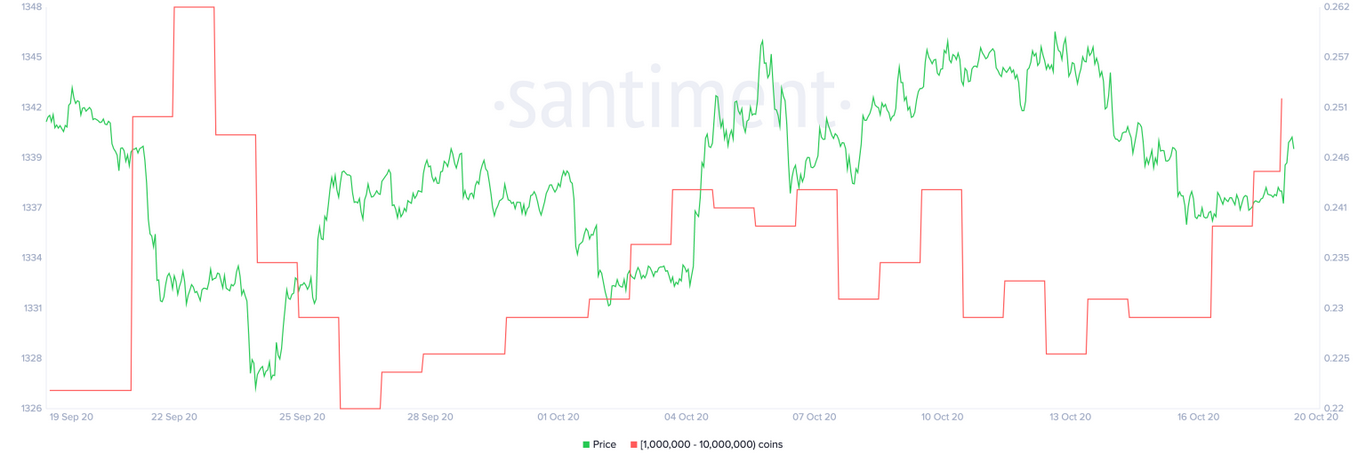

Santiment’s holder distribution index adds credence to the bullish outlook. The behavior analytics firm recorded a considerable increase in the number of addresses holding 1 million to 10 million XRP.

Roughly 14 new whales have joined the network since Oct. 13, while prices were declining.

This sort of bullish divergence between prices and the number of XRP whales on the network is an uplifting sign for investors. The increased buying pressure may soon be reflected in prices and lead to a breakout of the previously mentioned descending parallel channel.

Even though data seems to be hinting that XRP’s downtrend is coming to an end, investors must pay close attention to the 50-day and 100-day moving averages. Failing to turn these resistance hurdles into support might be followed by a significant correction.

If this were to happen, the international settlements token would likely retrace towards the 200-day moving average at $0.225 or the parallel channel’s lower boundary at $0.20.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.