It has been about a month since the last earnings report for Weyerhaeuser Company (NYSE:WY) . Shares have lost about 4.3% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Second-Quarter 2017 Highlights

Weyerhaeuser reported better-than-expected bottom-line results for second-quarter 2017.

Earnings from continuing operations before special items came in at $0.28 per share, topping the Zacks Consensus Estimate of $0.27 by 3.7%. Also, the bottom line surged 64.7% from the year-ago quarter’s tally of $0.17.

Net sales were $1,808 million, increasing 9.2% year over year. However, the top line lagged the Zacks Consensus Estimate of $1.82 billion by 0.7%.

Segmental Details: Weyerhaeuser operates through three business segments, results of which are detailed below:

Timberlands: The segment's revenues (excluding intersegment sales) totaled $469 million, down 0.4% year over year. It accounted for 25.9% of net sales.

Real Estate, Energy and Natural Resources: The segment's revenues, accounting for 2.5% of net sales, were $46 million, up 21.1% from the year-ago tally.

Wood Products: The segment generated revenues (excluding intersegment sales) of $1,293 million, accounting for 71.5% of net sales. Compared with the year-ago quarter, the figure was up 12.8%.

Margins: Weyerhaeuser's gross margin in the quarter improved on the back of impressive net sales growth, partially offset by 5.1% year-over-year increase in costs of sales. As a percentage of net sales, cost of sales represented 73.9% versus 76.8% in the year-ago quarter. Gross margin grew 290 basis points (bps) to 26.1%.

Selling, general and administrative expenses comprised 5.4% of net sales, down from 7% in the year-ago quarter. Research and development expenses were flat at $4 million.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) increased 22.5% year over year to $506 million. Adjusted EBITDA margin was roughly 28% versus 25% in the year-ago quarter.

Balance Sheet & Cash Flow: Exiting the second quarter, Weyerhaeuser's cash and cash equivalents improved to $701 million from $455 million in the preceding quarter. Long-term debt dipped 5.2% sequentially to $5,936 million.

In the quarter, the company generated net cash of $489 million from its operating activities, down 0.6% year over year. Capital spending totaled $74 million, down from $83 million in the year-ago quarter.

During the quarter, the company paid dividends worth $233 million.

Outlook: For third-quarter 2017, Weyerhaeuser anticipates Timberlands segment's earnings and adjusted EBITDA to be slightly below the previous quarter. While results in the West will be influenced by sequentially higher realizations, lower fee harvest volume and higher road spending, sequentially higher silviculture expenses, higher fee harvest volumes and flat log sales realization will impact results in the South.

For Real Estate, Energy and Natural Resources segment, the company anticipates sequentially higher earnings and adjusted EBITDA in the third quarter. It predicts adjusted EBITDA to exceed $250 million in 2017.

For the Wood Products segment, the company predicts sequentially comparable earnings and adjusted EBITDA. Average sales realizations and increased lumber sales volume will be comparable sequentially while higher sales realizations and lower volumes will influence oriented strand board businesses.

For the full year, the company anticipates capital expenditure to be approximately $435 million, including $300 million for the Wood Products segment and $135 million for Timberlands segment. Tax rate will be in the 15-17% range.

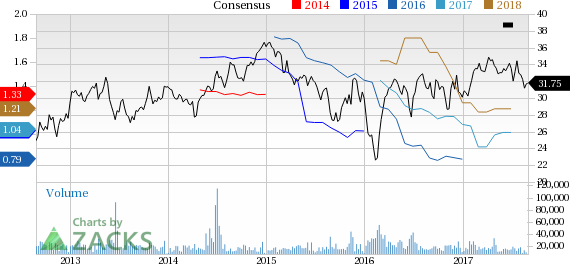

How Have Estimates Been Moving Since Then?

Analysts were quiet during the past month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Weyerhaeuser's stock has an average Growth Score of C, a grade with the same score on the momentum front. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is suitable for momentum and growth investors.

Outlook

The stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Weyerhaeuser Company (WY): Free Stock Analysis Report

Original post

Zacks Investment Research