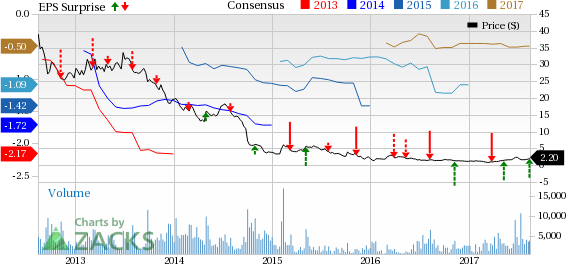

Westport Fuel Systems Inc.’s (NASDAQ:WPRT) second-quarter 2017 adjusted net loss from continuing operations came in at 12 cents per share, narrower than the Zacks Consensus Estimate of a loss of 15 cents. Adjusted net income per share came in at 4 cents in second-quarter 2016.

Total net loss from continuing operations amounted to $13.3 million. The reported net income for second-quarter 2016 was $3.4 million.

Westport Fuel Systems logged consolidated revenues of $62.1 million in the reported quarter, up 66.9% year over year. The growth was primarily driven by the addition of Fuel Systems’ revenues. Also, the top line surpassed the Zacks Consensus Estimate of $55 million.

Consolidated gross margin increased to $15.8 million (25.4% of sales) in the reported quarter from $8.2 million (21.9% of sales) recorded in the year-ago quarter. The improvement in gross margin came on the back of addition of Fuel Systems’ gross margin as a result of the merger.

Consolidated adjusted EBITDA amounted to a negative $5.3 million, compared with a negative $11.5 million in the prior-year quarter.

Segment Details

Automotive Business Unit recorded a 68% increase in revenues to $60.9 million in the quarter due to the acquisition of Fuel Systems.

Corporate and Technology Investments Business Unit revenues were $1.2 million in the quarter, compared with $0.9 million in the year-ago period.

The CWI segment recorded an 8% increase in revenues to $79.5 million, mainly on account of the rise in parts revenue attributed to the increase in the natural gas engine population in service.

Financial Position

Westport Fuel Systems had cash and cash equivalents of $87.4 million as of Jun 30, 2017, up from $60.1 million as of Dec 31, 2016

The company expects 2017 Automotive segment revenues to be in the range of $200-230 million. It is in process of the launching commercial components of HPDI 2.0.

Westport Fuel Systems currently carries a Zacks Rank #2 (Buy).

Few other top-ranked automobile stocks are Fox Factory Holding Corp. (NASDAQ:FOXF) , Cummins Inc. (NYSE:CMI) and Ferrari N.V. (NYSE:RACE) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fox Factory has a long-term growth rate of 16%.

Cummins has an expected long-term earnings growth rate of 12%.

Ferrari has an expected earnings growth rate of 14.1% in the long run.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Westport Fuel Systems Inc (WPRT): Free Stock Analysis Report

Original post

Zacks Investment Research