Westlake Chemical (NYSE:WLK) recorded a net income of $152.8 million or $1.17 per share for the second quarter of 2017, up roughly 37.5% from $111.1 million or 85 cents per share a year ago. Net earnings improved mainly due to earnings contribution of Axiall, lower effective tax rate, higher sales price of major products and lower costs associated with turnarounds and unplanned outages.

Barring one-time items, earnings for the reported quarter were $1.21 per share, which topped the Zacks Consensus Estimate of $1.19.

Westlake Chemical reported net sales of $1,979.2 million, up around 82.2% year over year. Sales in the quarter benefited from higher sales contributed from Axiall and increased selling prices for major products. Revenues, however, trailed the Zacks Consensus Estimate of $2,083.6 million.

Segment Highlights

Sales from the Olefins segment fell roughly 1.1% year over year to $489.2 million in the reported quarter. However, operating income of the segment increased 1.9% year over year to $143.3 million, supported by higher sales prices all major products and higher production rates which resulted in higher olefins integrated product margins.

The Vinyls segment logged sales of $1,489.9 million, a roughly two-and-a-half-fold year-over-year surge. Operating income of the segment was $143.3 million, 174.5% year-over-year increase aided by Axiall and higher selling prices for PVC caustic soda and resin.

Financial Position

Westlake Chemical ended the quarter with cash and cash equivalents of roughly $395.8 million, down 48.7% year over year. Long-term debt was $3,489.9 million at the end of reported quarter.

Cash flow from operations was around $322.3 million for the second quarter, up 33.8% year over year.

Outlook

According to Westlake Chemical, second-quarter results benefited from strong global demand of its key products and increasing prices in Vinyls segment. The company is making notable progress in integrating, improving activities and achieving the expected synergies associated with the acquisition of Axiall business. Westlake Chemical believes that continued investment and acquisition will help to fully leverage the improving Vinyls market.

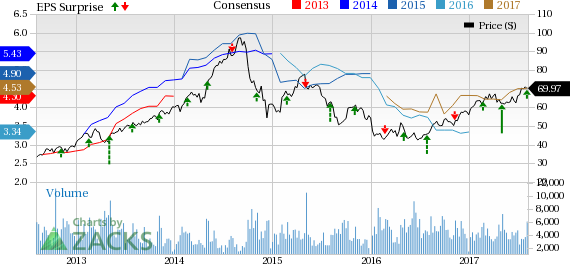

Price Performance

Shares of Westlake Chemical have gained 16.4% in last three months, significantly outperforming the industry’s 6.2% rally.

Zacks Rank & Other Stocks to Consider

Westlake Chemical currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Arkema S.A. (OTC:ARKAY) , Versum Materials Inc. (NYSE:VSM) and Kronos Worldwide Inc (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Arkema has expected long-term earnings growth rate of 12.7%.

Versum Materials has expected long-term earnings growth rate of 11%.

Kronos has expected long-term earnings growth rate of 5%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Versum Materials Inc. (VSM): Free Stock Analysis Report

Original post