We are initiating coverage on Western Potash Corp. (CCE) due to its attractive risk/reward profile. The company’s Milestone Project is one of the most attractive greenfield (in-development) potash projects in the western world. The complete 20-page research report is available in English and German, whereas the below represents only an excerpt of its key findings:

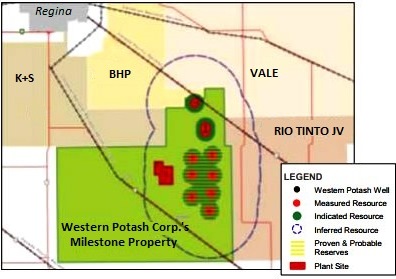

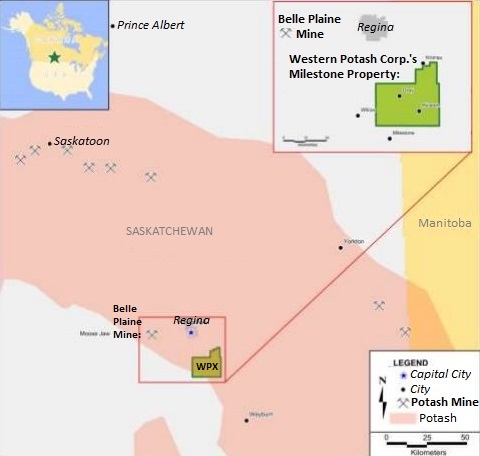

Western Potash Corp. is focused on building an environmentally-sustainable solution-extraction mine at its Milestone Potash Project, which is located in southern Saskatchewan. A prospectively world-class 2.8-million tonnes-a-year producer, Milestone has an anticipated mine life of at least 40 years. Among its peers, it hosts an unrivalled “proven and probable” reserve of 137 million tonnes of net recoverable high-grade potash (KCl). This makes it an unequivocally world-class asset – one that has an after-tax net present value (NPV) of $2.44 billion CAD.

Other key value drivers include the following catalysts for success:

- The project has been technically de-risked, which means that there are no meaningful impediments to the construction of a world-class potash mine at the heart of the world’s richest potash fields in Saskatchewan, Canada.

- The company has formed a strategic alliance with a Chinese government-owned fertilizer manufacturer, China BlueChemical Ltd. By leveraging this emerging business relationship, Western Potash is committed to seeking out the necessary project financing to build and commercialize the Milestone Project.

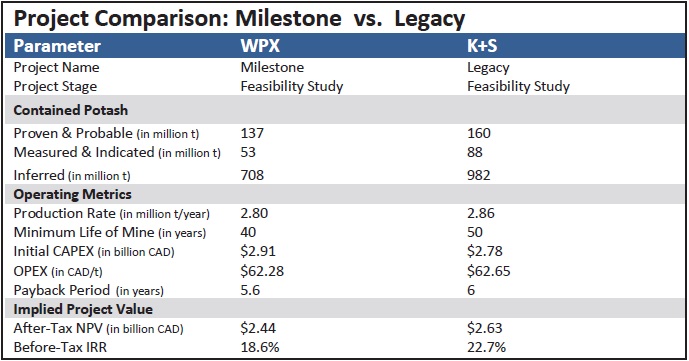

- Milestone compares very favourably with the nearby Legacy Potash Project, which is being developed into an environmentally-sustainable potash-extraction mine by the German fertilizer company, K+S. This reality bodes well for the realization of a commercially successful potash mine at Milestone, which promises to benefit from project metrics that are equally as attractive as those at Legacy.

Milestone vs. Legacy: How These Regional Peers Match-Up

Comparable industry transactions provide a useful valuation benchmark for junior potash developers. In particular, we believe that the $434 million CAD acquisition of the Legacy Potash Project by the German fertilizer manufacturer K+S in November 2010 offers the most relevant comparison. For context, Legacy and Milestone are geologically similar in size, grade, and amenability to solution-extraction mining. Most other logistical metrics, as well as the availability of necessary project infrastructure, are likewise similar. K+S is currently developing Legacy into a mine and is on schedule to start production in 2016. In order for WPX to gain up to a comparable market capitalization of $434 million CAD, its stock must rise to $1.95 CAD; an appreciation of 457% from its current share price of $0.35 CAD.

Investment Highlights/Value Drivers

- WPX has defined a world-class, high-grade deposit of at least 137 million tonnes of potash as proven and probable reserves at the heart of the world’s richest potash fields in Saskatchewan;

- The Milestone project is an advanced-stage project that is technically de-risked;

- A positive feasibility study (a detailed blueprint for a mine) for Milestone was completed in early 2013 demonstrating robust project economics for a solution-extraction mine;

- The study confirms that the reserves are of sufficient size and grade to support potash solution mining for at least 40 years at an ultimate production rate of 2.8 million tonnes of potash (KCl) per year. Current resources could add another 180 years of mine life;

- Measured, indicated and inferred resources add another 761 million tonnes of potash as KCl;

- After tax, the project is estimated to have a net present value of $2.44 billion CAD, with an 18.6% internal rate of return (IRR) and a payback of 5.6 years;

- With a projected operating cost of $62.28 CAD per tonne, Milestone enjoys one of the lowest projected operating costs among all the world’s potash developers;

- A major Chinese fertilizer company, China BlueChemical Ltd., has indirectly completed a $32 million CAD strategic investment in WPX;

- The financing arrangement includes an off-take agreement that allows China BlueChemical to purchase the lesser of 30% or 1 million tonnes of potash annually from WPX for a 20-year term;

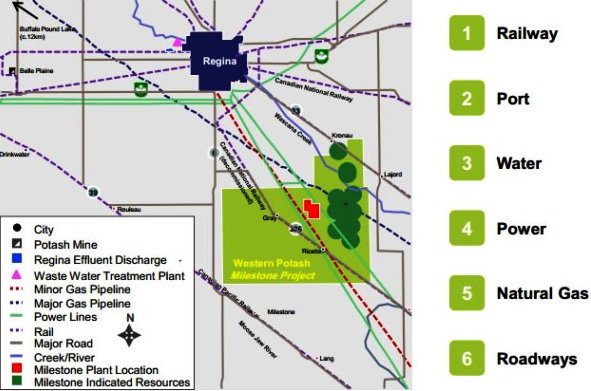

- Milestone offers an environmentally-sustainable business model that has received full governmental environmental approval;

- Milestone is located in a supportive, mining-friendly jurisdiction at the heart of the world’s most prolific potash mining territory. This makes it well-suited to support a large-scale mining operation;

- Solution-extraction mining has a variety of advantages, first and foremost reduced capital costs, shorter payback (higher IRR), faster timeline to production, well-established methodology, lower safety risks, and being environmentally-sustainable;

- Ideal geological conditions (a deep deposit and a desirable heat gradient) exist for what could prove to be one of the world’s most energy-efficient and therefore cost-efficient potash mines;

- WPX has a healthy cash-on-hand position ($26 million CAD) with sufficient working capital for 2-3 years.

The Key to Success: Strategic Partnering

In June, 2013, WPX received a strategic equity investment in the company by CBC (Canada) Holding Corp. totalling $31.98 million CAD, giving CBC a 19.9% ownership stake in WPX. The majority partner in CBC is China BlueChemical Ltd., one of China’s largest fertilizer manufacturers, with sales of approximately $12 billion USD per annum. China BlueChemical is also a majority owned subsidiary of China National Offshore Oil Corporation (“CNOOC”), the largest offshore oil and gas producer in China.

Further to taking an indirect equity stake in WPX, China BlueChemical is seeking project financing for Milestone in Southeast Asia. In the eventuality that China BlueChemical succeeds in this regard, it will be granted by WPX an off-take agreement for the lesser of 30% of production, or one million tonnes of potash per year, over a 20-year period.

This would guarantee China BlueChemical and other future partners certain quantities of potash each year at a predetermined “reasonable” price in exchange for assisting to finance mine construction costs at Milestone.

The significance of this business arrangement is summed up by WPX’s President, Patricio (Pat) Varas, as follows:

“Our strategic alliance with China Blue and Guoxin will provide Western with access to project financing, technical expertise in large-scale project construction and marketing channels for future potash sales.”

Exceptional Geology & Ideal Infrastructure are a Winning Combination

Saskatchewan hosts an estimated 46% of the world‘s potash reserves and is currently the world’s second largest potash producer with 10 operating potash mines. These mines account for about 33% of global output, translating into annual revenues averaging over $6 billion CAD per year.

The province’s ore beds exhibit optimal, uncomplicated geology (with excellent continuity and consistency of grade and thickness, as well as cost-effective accessibility), along with high grades ranging from 20% to 35% KCl.

Saskatchewan has all the necessary infrastructure in-place, as well as a skilled labour force, to support a new mine at Milestone. Proximal infrastructure to Milestone includes railways, paved roads, power and gas, industrial services, and other utilities, as well as potable water and ready access to treated effluent. The close proximity of both the Canadian National Railway and the Canadian Pacific Railway provides easy access to deep-water ports in both Canada and the U.S. for potash exports to China.

Compared to most of the world’s other well-established potash fields, Saskatchewan also offers an exceptionally low risk of civil unrest, war, and political interference (including a very low risk of expropriation of land).

The odds in favour of a potash mine being successful at Milestone are also supported by its close proximity to the largest solution-extraction potash operation in the world, the Belle Plaine Mine. It is situated approximately 50 kilometres to the northwest of Milestone. Owned by the potash giant, The Mosaic Company (MOS), it has been in business for over 40 years and is still highly productive with around 2.8 million tonnes of KCl output per annum. Milestone benefits from similar geological features to Belle Plaine and comparable regional infrastructure.

The above represents an excerpt of a research report which also includes a look into the fundamentals of the potash market and its rosy outlook.

Disclaimer

Neither Rockstone Research Ltd. nor the author was remunerated by Western Potash Corp. to produce or publish this content. However, the author holds shares of Western Potash Corp. (WPX) and may sell those any time without notice. Please read the full disclaimer on www.rockstone-research.com as none of this content is to be construed as an “investment advice”.