Friday’s Western relief rally lifted Asian markets on Monday, following an agreement for stricter budgets amongst euro zone countries. The Nikkei advanced 1.4% to 8654, the Kospi climbed 1.3%, and the ASX 200 rose 1.2%. China’s Shanghai Composite bucked the uptrend, sliding 1%, and the Hang Seng closed down fractionally.

Friday’s gains were short-lived for European stocks, as a steep selloff hit the continent. Germany’s DAX tumbled 3.4% to 5785, the CAC40 dropped 2.6%, and the FTSE fell 1.8%. Despite Friday’s summit treaty, little progress has been made in improving the European debt crisis.

Germany's DAX Slumps 3.4%

US markets dropped as well, but ended well off their lows. The Dow dropped 163 points to 12021, the Nasdaq declined 1.3%, and the S&P 500 dropped 1.5%. Banking shares were hit hardest, as Citigroup plunged 5.4% and Bank of America dropped 4.7%.

Currencies

The Dollar surged as investors flocked to safety. The Euro and Swiss Franc both tumbled 1.5% to 1.3186 and 1.0672 respectively. The Australian Dollar shed 1.4% to 1.0078, and the Canadian Dollar lost 1% to 1.0258. The Yen fared better than its pears, easing .3% to 77.90.

Economic Outlook

The Fed will issue its rate statement on Tuesday, and is not expected to lift rates from .25%. Also due are retail sales, business inventories, and the TIPP economic optimism report.

Retail Stocks Drop on Weak Data

Equities

Asian markets traded lower as disappointment over Friday’s European Summit set in. The Nukkei dropped 1.2% to 8553, the Kospi slumped 1.9%, and the ASX 200 declined by 1.6%. The Shanghai Composite fell 1.9% to 2249, its lowest level since March 2009, and the Hang Seng eased .7%.

European markets closed mixed following Monday’s slide. The CAC40 fell .4%, and the DAX slipped .2%, while the FTSE rallied 1.2%, lifted by the energy sector. Investors digested news that German chancellor, Angela Merkel, opposes an increase in Europe’s bailout fund.

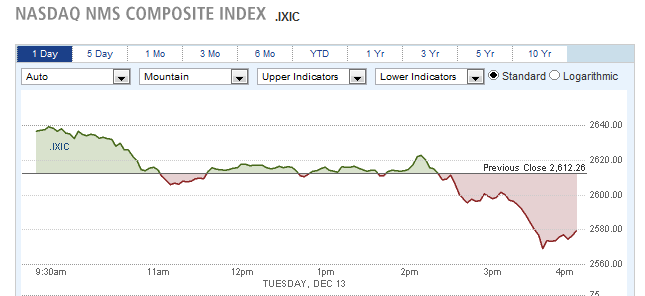

US stocks dropped in the late afternoon, following the Fed’s statement, which failed to entice investors. The Dow closed down 66 points to 11955, the S&P 500 dropped .9%, and the Nasdaq fell 1.3%

Nasdaq Loses 1.3% in Afternoon Selloff

Currencies

The Euro extended its losses from Monday, dropping 1.1% to 1.3031. The Pound and Canadian Dollar both lost .7%, and the Australian Dollar fell .5% to 1.0005. The Yen settled at 77.99, down fractionally, and the Swiss Franc slumped .8% to 1.0571.

Economic Outlook

Tuesday’s economic data was disappointing. Retails sales rose by.2% in November, significantly less than the .6% forecast. Business inventories rose by .8%, slightly more than expected.

Currencies

The Euro extended its losses from Monday, dropping 1.1% to 1.3031. The Pound and Canadian Dollar both lost .7%, and the Australian Dollar fell .5% to 1.0005. The Yen settled at 77.99, down fractionally, and the Swiss Franc slumped .8% to 1.0571.

Economic Outlook

Tuesday’s economic data was disappointing. Retails sales rose by.2% in November, significantly less than the .6% forecast. Business inventories rose by .8%, slightly more than expected.

Weekly Jobless Claims Drop to 3.5 Year Low

Equities

Asian markets fell on Thursday, as fear over Europe’s debt crisis intensified. In Japan, the Nikkei fell 1.7% to 8377. Scandal-hit Olympus shares tumbled more than 20% after restating earnings, as the company revealed a $1.1 billion loss. Korea’s Kospi dropped 2.1%, and the ASX 200 fell 1.2%. PMI data for China showed a slowdown in factory activity, sending the Shanghai Composite down 2.1% to 2181, and the Hang Seng down 1.8%.

European markets bounced moderately, lifted by upbeat US data. The DAX climbed 1%, the CAC40 gained .8%, and the FTSE rose .6%. The European insurance index rallied 2.3% on news that Old Mutual was selling part of its business for $3.2 billion. Fitch cut the debt rating on Credit Agricole, sending the bank’s shares down 4.4%.

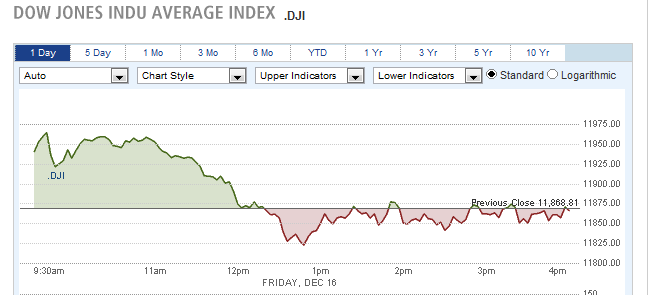

US stocks opened sharply higher, but surrendered most of their gains as the day dragged on. The Dow rose 45 points to 11869, the S&P 500 edged up .3%, and the Nasdaq ended up fractionally.

Dow Gains but Closes well off Lows

Fedex shares surged 8% after reporting earnings which were stronger than expected.

Currencies

The Swiss Franc surged 1.3% to 1.0634, while the Dollar eased modestly against other currencies. The Euro rose .2% to 1.3014, the Pound gained .3% to 1.5510, and the Canadian Dollar advanced .4% to 1.0354.

Economic Outlook

Weekly jobless claims fell to 366K, far better than the 389K forecast, its lowest level in years. The Empire State Manufacturing Index jumped to 9.5, showing a sharp rise in factory activity.

Global Equities Trade Mixed, Metals Advance

Equities

Asian markets rose moderately thanks to Thursday’s upbeat US data. The Nikkei rose .3% to 8402, the Kospi jumped 1.2%, and the ASX 200 rose by .5%. China’s markets surged on hopes for central bank easing in the mainland. The Shanghai Composite rallied 2% to 2225, and the Hang Seng advanced 1.4%.

European markets closed lower, as concerns over possible debt downgrades intensified. The CAC40 slumped .9%, the DAC dropped .5%, and the FTSE lost .3%. Bucking the downtrend, miners rallied, lifted by a bounce in metal prices. Nokia shares declined more than 3% after Research in Motion’s weak earnings weighed on the mobile sector.

In the US, the major indexes closed mixed. The Nasdaq gained .6%, the S&P 500 rose .3%, while the Dow slipped fractionally. The Dow had opened sharply higher, but those gains evaporated by the afternoon.

Dow Ends Flat, Surrendering Early Gains

Adobe shares climbed 6.6% after reporting solid earnings, while Research in Motion tumbled 11.2% after weak profits and a dismal outlook.

Currencies

The Dollar traded mostly lower on Friday, easing slightly after a strong week. The Euro and Pound both rose .2% to 1.3042 and 1.5546 respectively. The Australian Dollar and Swiss Franc rallied .4%. The Yen edged up .2% to 77.74, while the Canadian Dollar lagged behind, dropping .4% to 1.0384.

China’s yuan reached a record high of 6.3294, which was attributed to intervention by the central bank, in an effort to challenge short sellers.

Economic Outlook

Friday’s CPI data was mixed, as core CPI, which excludes food and energy, rose more than expected, while the broader CPI, remained flat. A drop off in inflation could potentially pave the way for additional easing from the Fed.

US Stocks Drop on ECB Disappointment

Equities

News that North Korea’s leader, Kim Jong il, had died, weighed on Asian markets amid concern for the region’s stability. South Korean shares tumbled, with the Kospi closing down 3.4%, after dropping as much as 4.9%. The Nikkei lost 1.3% to 8296, the ASX 200 dropped 2.4%, and the Hang Seng shed 1.2%. China’s Shanghai Composite outperformed, easing a mere .3%, as it erased an earlier drop of 2.6%.

European markets traded mixed, following a speech by ECB president, Mario Draghi, in which he offered no new stability plans. The DAX fell .5%, and the FTSE lost .4%, while the CAC40 inched up fractionally.

US stocks opened higher, but closed significantly lower. The Dow fell 100 points to 11766, the Nasdaq dropped 1.3%, and the S&P 500 declined 1.2%.

Currencies

The Dollar traded modestly higher against world currencies, in a light session. The Euro dropped .4% to 1.2996, the Pound declined .3% to 1.5498, and the Yen fell .4% to 78.04. The Australian Dollar sank .8% to .9888.

Economic Outlook

The NAHB housing market index rose from 19 to 21 last month, in line with expectations, posted its 3rd straight gain. Additional housing data is due on Tuesday, when the government will release reports on housing starts and building permits.