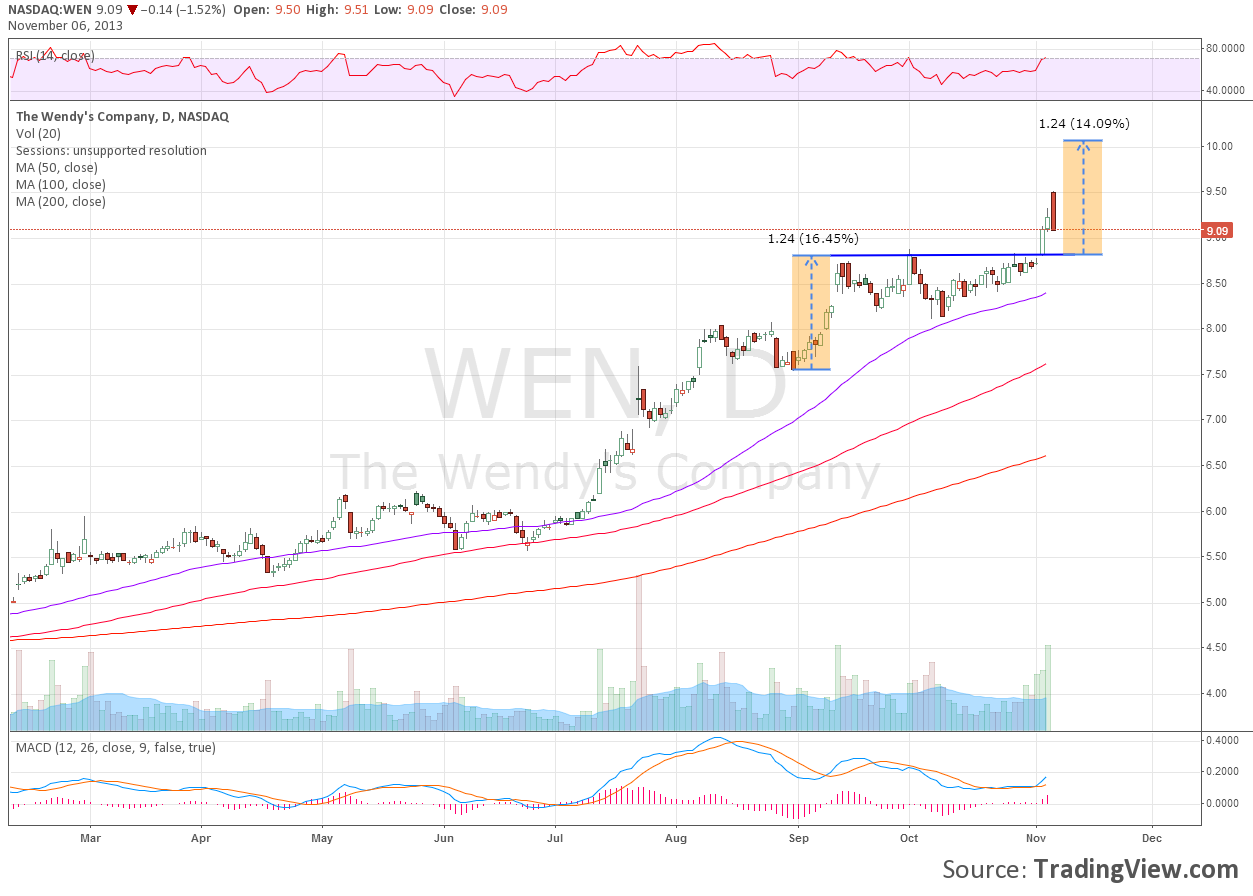

The Wendy's Company, (WEN), showed up in my weekend work as a stock that could take off to the tune of a 5-10% move in a short period. From the chart below the blue resistance line was being tested again and the Relative Strength Index (RSI) was holding in bullish territory. The MACD was flat but the whole scenario supports a a push higher.

The only problem was that it was scheduled to report earnings Thursday morning before the open.

You can see that it did break out on Monday and ran higher on a follow through day Tuesday before capping out at 9.50 on the open Wednesday, up 7.8%, and then reversing lower. I guess it could have been on the watchlist after all.

Ahead of earnings, with the stock falling, the options market saw buyers of Calls and Call Spreads, in November, December and February. This smells of stock replacement, or taking gains in the stock but continuing to express a positive view through options.

If this is the case then the sell off Wednesday maybe nothing more than a shift of assets, and a pause in the run up. There is nearly 10% short interest so expect that traders and talking heads will attribute a pop in the stock to a short squeeze, and in a way that may be true. But in any regard you should be ready if it does start higher to jump on board. Does Wendy’s serve breakfast?

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post