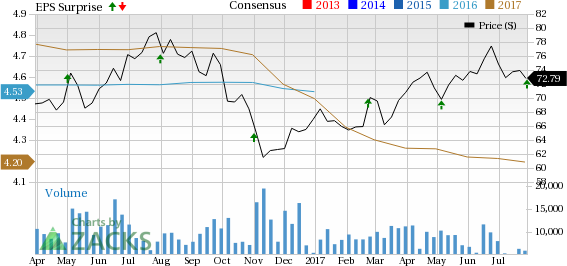

Welltower Inc. (NYSE:HCN) , a healthcare real estate investment trust (REIT), reported normalized funds from operations (“FFO”) per share of $1.06 for second-quarter 2017, beating the Zacks Consensus Estimate of $1.05. Further, the company posted revenues of $1.06 billion, which beat the Zacks Consensus Estimate of $1.04 billion.

The company experienced solid seniors housing operating performance in the first half of 2017.

However, on a year-over-year basis normalized FFO per share number declined 7.8% from $1.15. Also, revenues edged down 1.7% from the year-ago quarter.

Seniors housing operating same-store net operating income (SSNOI) grew 3.5% year over year. Moreover, same-store revenues per occupied room increased 3.9%.

Note: The EPS numbers presented in the above chart represent funds from operations (“FFO”) per share.

Quarter in Detail

Welltower accomplished $292 million of pro rata gross investments for the quarter. This included $110 million in acquisitions/joint ventures, $162 million in development funding as well as $20 million in loans. Notably, the company completed 92% of these investments with present relationships.

On the other hand, the company accomplished total dispositions of $160 million. This comprised loan payoffs of $43 million and property sales of $117 million.

The company exited second-quarter 2017 with $442.3 million of cash and cash equivalents, down from $466.6 million recorded at the end of the prior-year quarter. In addition, as of Jun 30, 2017, the company had $2.6 billion of available borrowing capacity under its primary unsecured credit facility. Further, at an average price of $72.56, the company generated around $192 million in proceeds under its ATM program.

2017 Outlook

Welltower reaffirmed its 2017 normalized FFO per share guidance and expects it to remain in the range of $4.15–$4.25. The Zacks Consensus Estimate for the same is currently pegged at $4.19.

Furthermore, the company has increased total SSNOI guidance to 2.25–3% from the prior outlook of 2–3%, mainly due to better-than-expected seniors housing operating performance in the first half of 2017.

Additionally, in sync with its strategic repositioning of its premier health care portfolio, the company continues to anticipate 2017 disposition proceeds to be around $2 billion.

Our Take

Welltower’s diversified portfolio and strategic investments have the capability to serve as growth drivers in the long run. Also, a rise in senior citizen spending for healthcare reasons promises scope for growth. However, any rate hike remains a concern for the company due to its high exposure to long-term leased assets. Further, intense competition with national and local healthcare operators, and earnings-dilutive effects of disposition add to its woes.

Currently, Welltower carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let us now look forward to the earnings releases of AvalonBay Communities, Inc. (NYSE:AVB) , Alexandria Real Estate Equities, Inc. (NYSE:ARE) and Extra Space Storage Inc. (NYSE:EXR) , all of which are expected to report quarterly figures in the next week.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AvalonBay Communities, Inc. (AVB): Free Stock Analysis Report

Welltower Inc. (HCN): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

Original post

Zacks Investment Research