Wells Fargo & Company (NYSE:WFC) was upgraded by Vetr from a "hold" rating to a "buy" rating in a research note issued to investors on Monday, MarketBeat.com reports. The firm presently has a $46.86 price target on the financial services provider's stock. Vetr's price objective points to a potential upside of 4.41% from the company's previous close.

A number of other equities research analysts have also weighed in on WFC. Nomura restated a "buy" rating on shares of Wells Fargo & Co. in a research report on Saturday, July 9th. Barclays PLC reaffirmed a "buy" rating on shares of Wells Fargo & Co. in a report on Saturday, July 9th. FBR & Co reaffirmed a "buy" rating and set a $63.00 target price on shares of Wells Fargo & Co. in a report on Wednesday, June 1st. Deutsche Bank AG reaffirmed a "buy" rating on shares of Wells Fargo & Co. in a report on Sunday, June 26th. Finally, Zacks Investment Research downgraded Wells Fargo & Co. from a "hold" rating to a "sell" rating in a report on Wednesday, June 15th. Six investment analysts have rated the stock with a sell rating, seven have assigned a hold rating and twenty have issued a buy rating to the company's stock. The stock currently has a consensus rating of "Hold" and a consensus target price of $50.96.

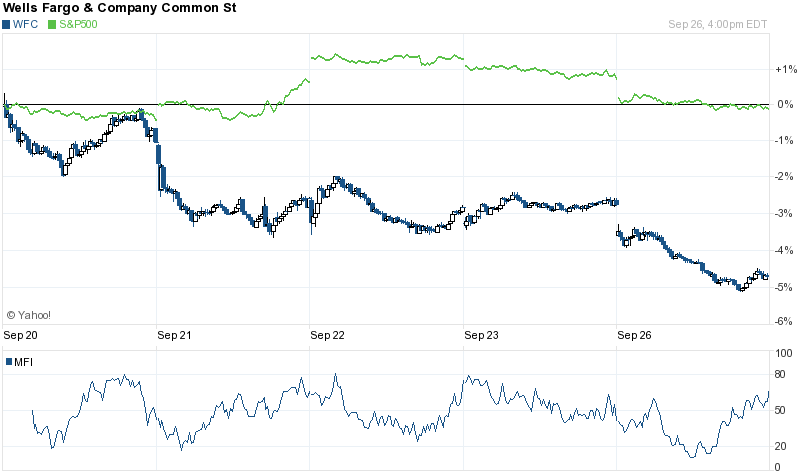

Wells Fargo & Co. (NYSE:WFC) traded down 1.88% on Monday, hitting $44.88. The company had a trading volume of 30,937,973 shares. The stock's 50-day moving average price is $48.17 and its 200 day moving average price is $48.53. The company has a market capitalization of $226.44 billion, a P/E ratio of 11.08 and a beta of 0.90. Wells Fargo & Co. has a one year low of $44.50 and a one year high of $56.34.

Wells Fargo & Co. (NYSE:WFC) last issued its quarterly earnings data on Friday, July 15th. The financial services provider reported $1.01 earnings per share for the quarter, hitting analysts' consensus estimates of $1.01. The business had revenue of $22.20 billion for the quarter. Wells Fargo & Co. had a return on equity of 12.95% and a net margin of 24.33%. The company's revenue was up 4.0% on a year-over-year basis. During the same quarter in the prior year, the firm earned $1.03 EPS. On average, analysts expect that Wells Fargo & Co. will post $4.02 EPS for the current fiscal year.

The business also recently announced a quarterly dividend, which was paid on Thursday, September 1st. Shareholders of record on Friday, August 5th were given a dividend of $0.38 per share. The ex-dividend date was Wednesday, August 3rd. This represents a $1.52 annualized dividend and a dividend yield of 3.39%. Wells Fargo & Co.'s dividend payout ratio is currently 37.25%.

In other Wells Fargo & Co. news, COO Timothy J. Sloan sold 20,500 shares of the stock in a transaction on Monday, August 8th. The stock was sold at an average price of $48.92, for a total transaction of $1,002,860.00. Following the sale, the chief operating officer now owns 650,815 shares in the company, valued at $31,837,869.80. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Company insiders own 0.29% of the company's stock.

Several large investors have recently bought and sold shares of the company. Berkshire Hathaway Inc increased its stake in Wells Fargo & Co. by 2.0% in the fourth quarter. Berkshire Hathaway Inc now owns 479,704,270 shares of the financial services provider's stock valued at $26,076,724,000 after buying an additional 9,411,911 shares in the last quarter. Vanguard Group Inc. increased its stake in Wells Fargo & Co. by 2.2% in the second quarter. Vanguard Group Inc. now owns 288,028,042 shares of the financial services provider's stock valued at $13,632,368,000 after buying an additional 6,247,583 shares in the last quarter. Wellington Management Group LLP increased its stake in Wells Fargo & Co. by 2.7% in the first quarter. Wellington Management Group LLP now owns 131,270,916 shares of the financial services provider's stock valued at $6,348,262,000 after buying an additional 3,450,553 shares in the last quarter. BlackRock Fund Advisors increased its stake in Wells Fargo & Co. by 8.8% in the first quarter. BlackRock Fund Advisors now owns 57,985,130 shares of the financial services provider's stock valued at $2,804,161,000 after buying an additional 4,695,036 shares in the last quarter. Finally, Norges Bank bought a new stake in Wells Fargo & Co. during the fourth quarter valued at about $2,695,119,000. Hedge funds and other institutional investors own 73.98% of the company's stock.

Wells Fargo & Co. Company Profile

Wells Fargo & Company (NYSE:WFC) is a bank holding company. The Company is a financial services company, which offers banking, insurance, trust and investments, mortgage banking, investment banking, retail banking, brokerage, and consumer and commercial finance. It has three operating segments: Community Banking, Wholesale Banking, and Wealth and Investment Management.