A stagecoach and some horses pulling it across the plains. Nothing but sunshine and blue skies and fresh air. It does not get much better than this rendition of Wells Fargo & Company (NYSE:WFC) from the mid-to-late 19th century. A lot has changed in the world since then. But the trend higher in the stock price seems to date back to that time and shows no signs of changing.

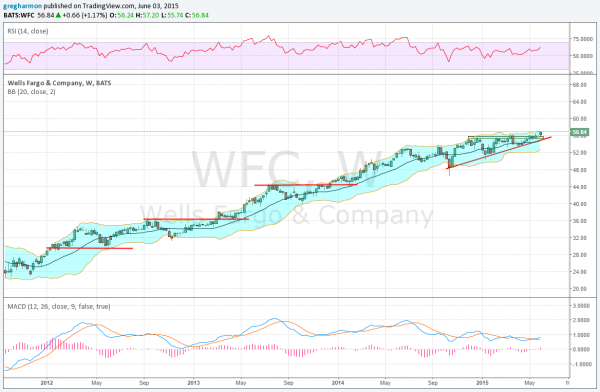

The chart above of weekly prices going back to 2012 shows part of that trend. If you look closely, there have been areas to get into an investment in the stock against a low-risk level of downside price movement. May 2012 was one. So was March 2013 and January 2014. And now this week. In fact, the latest price movement gives two reasons to get into the stock with a very low downside risk level.

The first is the break over resistance that has been in place since December 2014, shown by the yellow bar. The second is the proximity of the rising trend support line that has merged into the 20-week SMA. The 20 week has been a good spot for support over this run. This allows you to get into the stock on the show of strength with a stop only $2 below. If you have a bigger risk tolerance, then the lower Bollinger® Band has mopped up the liquidity whenever the 20-week SMA has not held. And that is only $4 below.