WellCare Health Plans, Inc. (NYSE:WCG) reported second-quarter 2017 adjusted operating earnings of $2.52 per share that surpassed the Zacks Consensus Estimate of $2.23 by 13%. Earnings per share also grew 13% year over year. The year-over-year improvement was primarily backed by strong results across its all three business lines.

Adjusted net income for the second quarter was $113.4 million, up 14% over the year-ago quarter. The upside was primarily driven by the premium revenue growth in the company's Medicaid Health Plans and Medicare Health Plans segments and continued operational execution.

Operational Update

Adjusted total premium revenues of $4.3 billion for the second quarter increased 21.6% year over year due to strong organic growth across its three lines of business and the company's acquisition of Universal American and Care1st Arizona. Revenues also surpassed the Zacks Consensus Estimate by 8%.

Adjusted selling, general & administrative (SG&A) expenses were $336.7 million, up 25% year over year. The adjusted SG&A expense ratio was 7.9%, down 20 basis points (bps). The deterioration stemmed primarily from the company's acquisitions of Universal American and Care1st Arizona as well as staffing and infrastructure costs to support organic growth.

Quarterly Segment Update

Medicaid Health Plans:

The segment’s membership increased 17% to 2.8 million from the last-year quarter.

Adjusted Medicaid Health Plans premium revenues were $2.7 billion, up 18.7% year over year, primarily due to membership growth.

Adjusted Medicaid Health Plans’ Medical Benefit Ratio (MBR) was 87.7%, up 100 bps from the last-year quarter.

Medicare Health Plans Segment Results:

Medicare Health Plans membership was 0.484 million, up 46.2% year over year due to the company's acquisition of Universal American, 2017 bid positioning and continued execution on sales and retention initiatives.

Medicare Health Plans premium revenues increased 33.3% on a year-over-year basis to $1.3 billion. This was primarily due to the company's acquisition of Universal American and year-over-year organic membership growth.

The segment’s MBR was 86.4%, up 220 bps due to continued operational execution as well as the company's 2017 bid strategy.

Medicare Prescription Drug Plans (PDP) Segment Results

Medicare PDP membership was 1.1 million, increasing 10.3% year over year primarily as a result of the company's 2017 bid positioning.

Medicare PDP premium revenues were $225.6 million, flat year over year.

The Medicare PDP segment’s MBR was 86.5%, up 1140 bps. This was due to improved operational execution and the company's 2017 bid positioning.

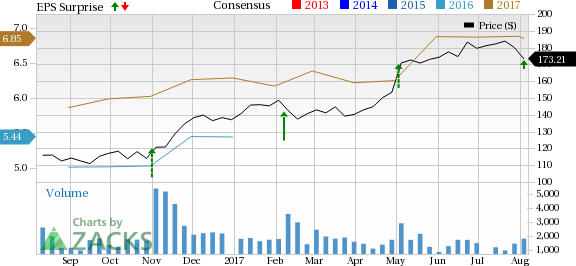

WellCare Health Plans, Inc. Price, Consensus and EPS Surprise

Financial Update

Net cash provided by operating activities was $335 million against net cash of $60.2 million used by operating activities in the prior-year quarter. As of Jun 30, 2017, cash and cash equivalents of $4 billion inched up 2% from year-end 2016,

As of Jun 30, 2017, long term debt of $1.2 billion increased 18% from year-end 2016,

Guidance for 2017 Raised

The company expects adjusted earnings per diluted share in the range of $6.75–$6.95, up from previous guidance of $6.55 to $6.80.

Total adjusted premium revenues are expected in the band of $16.45–$16.85 billion, same as its previous guidance.

Investment & other income is anticipated to be $40–$45 million, same as the previous guidance.

Adjusted SG&A ratio is expected between 8.0% and 8.25%, up from the previous guided range of 7.95% to 8.20%.

Zacks Rank and Performance of Other Insurers

WellCare presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among the other firms in the medical sector that have reported second-quarter earnings so far, the bottom line at Centene Corp. (NYSE:CNC) , Aetna Inc (NYSE:AET) and UnitedHealth Group Inc. (NYSE:UNH) beat their respective Zacks Consensus Estimate.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Aetna Inc. (AET): Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

WellCare Health Plans, Inc. (WCG): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post

Zacks Investment Research