WellCare Health Plans, Inc. (NYSE:WCG) recently joined forces with Community Care of North Carolina, Inc. (“CCNC”) and Community Care Physicians Network, LLC (“CCPN”). The alliance is aimed at delivering quality healthcare to North Carolina's Medicaid beneficiaries enrolled under North Carolina's new Medicaid program, which is expected to be implemented in 2019.

CCNC has been providing healthcare services to nearly 1.7 million North Carolina Medicaid beneficiaries through regional healthcare networks in 100 counties of the state at a controlled cost. The company has formed collaborations with almost every hospital in the state, thousands of private practice physicians and health department of each country. This wide network works closely with North Carolina Medicaid enrollees in order to treat them in a better manner.

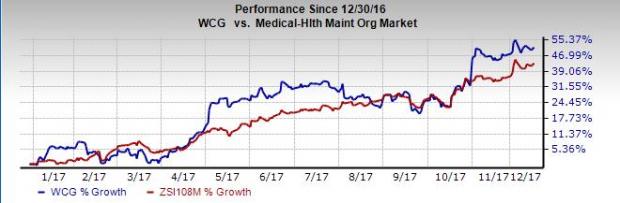

WellCare Health serves more than 2.7 million Medicaid beneficiaries across 11 states. The company has a leading position in providing government-sponsored healthcare programs. The company’s vision and commitment to health system transformation has boosted shareholders’ confidence in the stock. Year to date, its shares have gained 51.2%, outperforming the industry’s rally of 42%.

The company’s collaboration with CCNC is slated to work through joint development and management of population health programs, predictive analytics solutions and care management models for North Carolina Medicaid beneficiaries. The focus of the partnership remains confined to complex health problems. The partnership would bring managed care operational best practices, innovative payment models and comprehensive clinical supports in order to improve healthcare in North Carolina.

In addition, CCPN's robust network of primary care physicians is likely to help in providing high-quality healthcare to WellCare Health's members. CCPN would also provide infrastructural support to the partnership of Wellcare Health and CCNC.

Zacks Rank & Other Stocks to Consider

Wellcare Health sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Investors interested in the same space can also consider some other stocks like Triple-S Management Corporation (NYSE:GTS) , Centene Corporation (NYSE:CNC) and The Joint Corp. (NASDAQ:JYNT) . While Triple-S Management sports a Zacks Rank #1, the other two stocks carry a Zacks Rank #2 (Buy).

Triple-S Management delivered positive surprises in two of the last four quarters, with an average beat of 74%. The stock has gained 34.8%, slightly outpacing the industry.

Centene delivered positive surprises in all of the last four quarters with an average beat of 10.6%. Its shares have returned 66.2% year to date, beating the industry mark.

Joint Corp delivered positive surprises in three of the last four quarters, with an average beat of 5.5%. Its shares have rallied 102.6% year to date, outperforming the industry.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

WellCare Health Plans, Inc. (WCG): Free Stock Analysis Report

Triple-S Management Corporation (GTS): Free Stock Analysis Report

The Joint Corp. (JYNT): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post