You may like to drink something, but this does not mean it should be in your portfolio. Monster Beverage Corp (NASDAQ:MNST). stock did not have the best year end possible. It has been declining from its all-time high of $55.50 per share since August and is currently trading roughly $10 lower. Judging from the company’s continuously increasing profits, investors are probably wondering if this the “buy the dip” opportunity they have been praying for. Unfortunately, we believe they have been asking the wrong question. The right question, in our opinion, sounds more like this: “Is the dip over or is it going to extend ever further to the downside?” To find out, we rely on the Elliott Wave Principle.

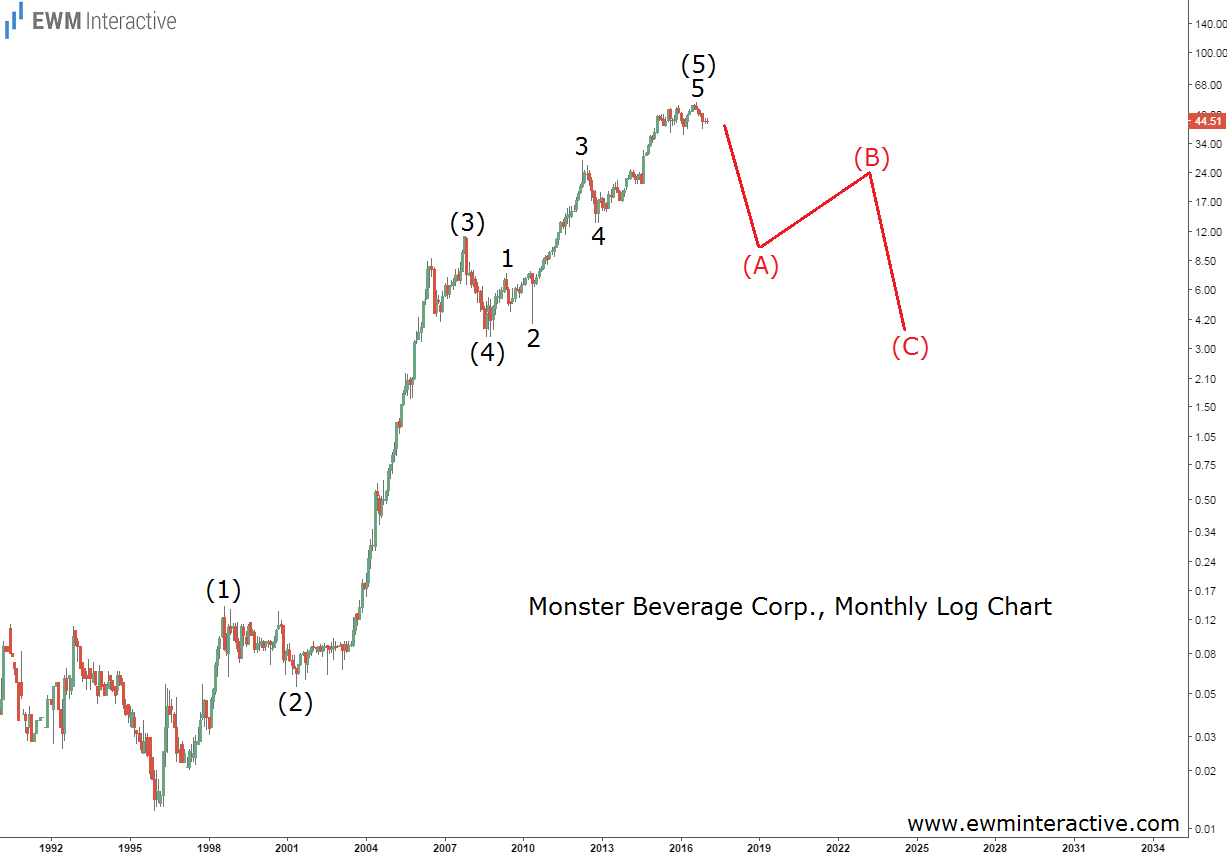

This chart is a scary monster. It shows that in split-adjusted prices, Monster Beverage’s uptrend began from as low as 1 cent a share in 1995. But what is even more important is the wave structure of this impressive growth, which looks strikingly similar to a five-wave impulse. The sub-waves of wave (5) are also clearly visible. According to the theory, every impulse is followed by a three-wave correction in the opposite direction. Usually, the retracement drags the price down to the support area near the fourth wave of the impulsive sequence. Here, wave (4) bottomed out at $3.42 in October, 2008, so if this is the correct count, we should expect Monster stock to revisit the single-digit territory below $10 a share from now on. In other words, the company might lose roughly 80% of its market value in the next few years, erasing most of the post-crisis gains. So this is a No, you should not be buying the dip. The bears seem to be just getting warmed up.