Back from a quiet, holiday-shortened week, market participants face an avalanche of data and plenty of FedSpeak. This is an irresistible combination for pundits, who will parse each economic report with emphasis on what it might mean for the Fed. In light of many Fed promises, they will all be asking:

Will the Fed really be data dependent?

Prior Theme Recap

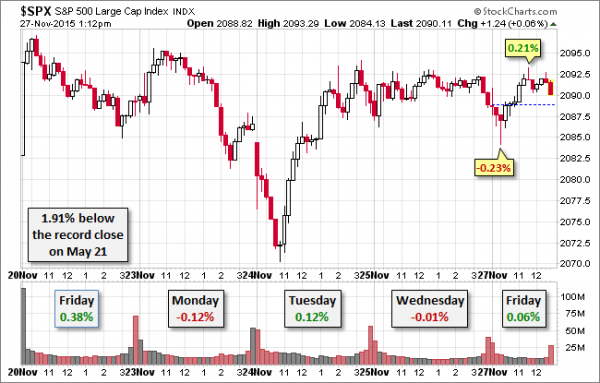

In my last WTWA I predicted that the market stories for the week would emphasize individual stocks and include some rarely-seen faces doing TV interviews. This was fairly accurate, with CNBC featuring stock pick segments all week. I also suggested that the low volume of trading could lead to some volatility until data were released on Wednesday morning. The only volatility came intra-day on Tuesday in what proved to be one of the quietest weeks of the year. To get the full story, let us look at Doug Short’s weekly chart. Doug’s full post shows the various relevant moving averages in a very negative week for stocks. (With the ever-increasing effects from foreign markets, you should also add Doug’s World Markets Weekend Update to your reading list).

Doug’s update also provides multi-year context. See his full post for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

The economic calendar brings together all of the most important economic reports. We also have the Fed’s Beige Book (used as a qualitative addition to the economic statistics at the next FOMC meeting). We will have plenty of FedSpeak, including Chair Yellen in front of the Congressional Joint Economic Committee.

The punditry loves to opine about the Fed and invite every guest or column source to do the same. The calendar combination will prove irresistible. If you are tired of hearing and reading about this topic, I understand. I could not agree more.

But my job here is to consider what will be the weekly focus, not what should be.

People will be asking:

Will the Fed (as promised) be data dependent in hiking rates?

There are several key viewpoints:

- Data will show weakness, and the Fed will not hike rates. (Some still expect more QE).

- Data will show some weakness, but the Fed will not be deterred.

- Mixed data allows the Fed to hike as planned.

- Strong data will emphasize the need for higher rates, reviving the “Fed behind the curve” arguments.

Most observers believe that Friday’s employment data will be the most important influence. Here are some ideas that most will not discuss or will get wrong:

- People will speculate that Yellen “has the numbers” before her Congressional testimony on Thursday. This is an interesting idea, since the Fed gets some information a bit early to prepare some of their own reports. Theoretically, the overall report goes to the Fed Chair and the President the afternoon before the announcement. Many will expect Yellen’s commentary to reflect special knowledge, but it probably does not.

- Nearly everyone will forget that the payroll employment number is based on a survey with a confidence interval of +/- 110K or so. This is just “sampling error” so it does not reflect any revisions due to more responses, changes in seasonal adjustments, or aligning with benchmarks.

- Some will regard Thursday’s initial jobless claims as a relevant signal. It is not, since it covers a different period from the monthly employment report.

Expect to see plenty of support for each of these various positions, since every expert has an opinion about the Fed.

But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

There was a little good news, but most results were in line with expectations.

- Change in policy from Saudi Arabia. This is an important story, but a confusing one. There are two parts.

- Would higher oil prices be good? In general, lower oil prices seem to be positive for most countries, lowering the consumption “tax” for consuming nations. Despite this, stocks have been positively correlated with oil prices.

- Is this really a policy change? The FT carried the story this week, and it was treated as fresh news by many observers. Others noted that similar statements were made several days earlier. (Bloomberg)

- Personal income showed solid growth. The gain was 0.4% month-over-month and 5.3% over last year, the best gain since May.

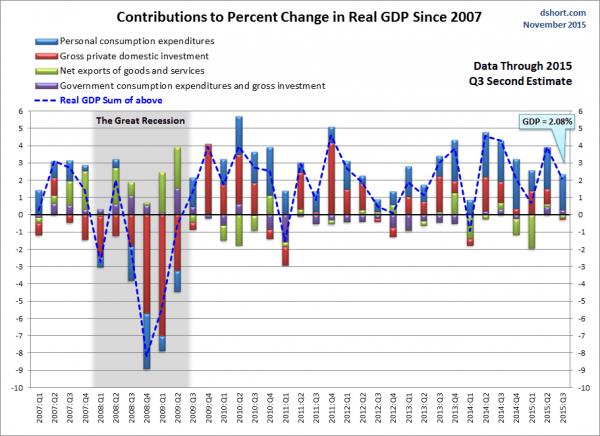

- GDP for Q3 was revised higher. The adjustment was in line with expectations, but it does provide a higher base. Much of the gain was due to inventory adjustments (Diane Swonk). Doug Short has a great method for illustrating the components of GDP change over time, and also a post with plenty of other interesting comparisons.

- Hedge fund oil shorts peak. This is good news if you are a contrarian investor and have noted that hedge funds have underperformed in the last two years. (The FT)

- Fewer homeowners are “underwater” than they believe. Only 8.7% are actually underwater, but 27% believe they are. (MarketWatch).

- Durable goods orders beat expectations. The gain was 0.5% month-over-month, about 0.2% better than expected.

The Bad

Some of the economic data was disappointing.

- Rail traffic is still declining. Steven Hansen (GEI) gets beyond the noise of the weekly data and reveals the trend. Read the full post for helpful tables and charts.

- Existing home sales declined. Steven Hansen has multiple looks at the data, including those without seasonal adjustments. Calculated Risk also has some comments about the surprising effect on inventory.

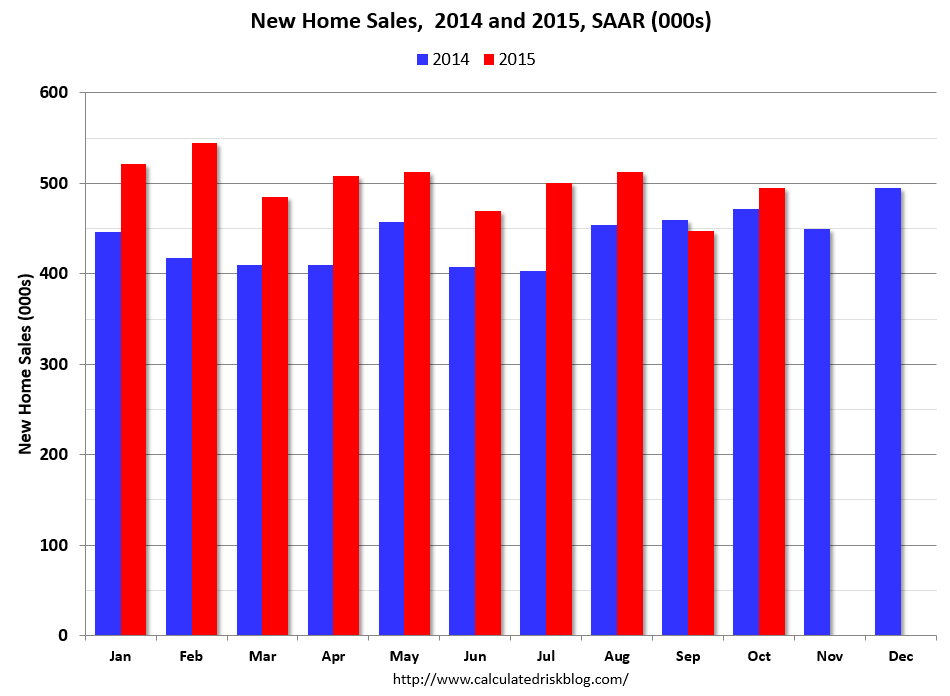

- New home sales also disappointed, a slight miss on the current month and downward revisions to past months. Calculated Risk has the full story, also noting that year-over-year comparisons are still solid.

- Personal spending lagged expectations, growing only 0.1% over the prior month.

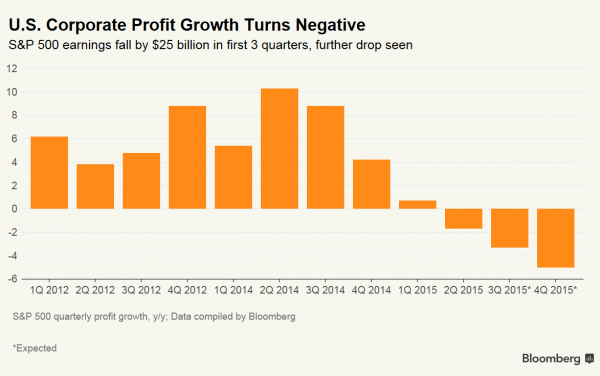

- Corporate profits have turned negative. Bloomberg notes the pattern of declines (chart below), but also mentions the impact of the energy sector – which might not continue. Brian Gilmartin makes a similar point, and is a bit more optimistic about 2016.

- Consumer confidence was disappointing, both from the Conference Board and the University of Michigan. Doug Short has his typical great charts and analysis on both series.

The Ugly

Continuing terrorism – now including Turkey shooting down a Russian plane. There are various accusations and sanctions, but the actions are edging closer to a direct disagreement between major powers.

Noteworthy

Take the global financial literacy test. Would you be surprised to learn that many cannot do simple percentage calculations?

The Silver Bullet

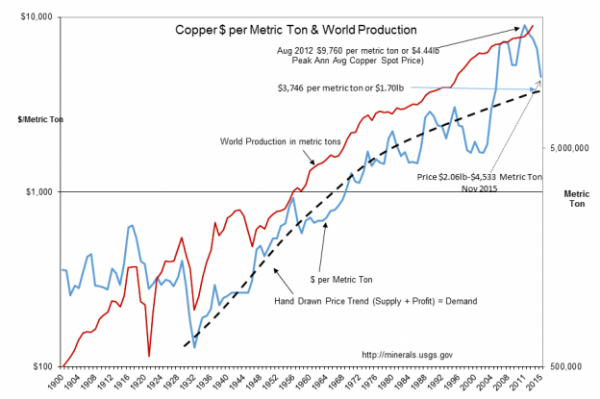

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. This week’s award goes to “Davidson” (brought to us once again by Todd Sullivan). He takes on the popular notion of the economic forecasting powers of “Dr. Copper.” Here is a key paragraph, supported by the chart below.

What holds as teaching in business schools are concepts like Dr. Copper and oil as economic indicators. They are simply fallacies of the worse kind. Because they have been taught by those society has deemed ‘smart’, ‘intelligent’ and the ‘best minds of our time’ we take these concepts to be truths tested by time. They are not!! These concepts fall apart when examined rationally but the consensus rather than thinking independently accepts the misperceptions of a few.

Quant Corner

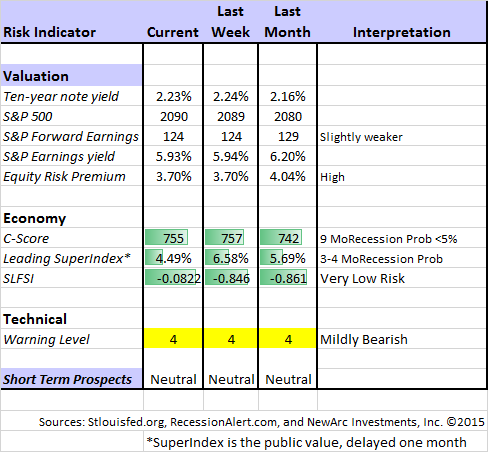

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. Beginning last week I made some changes in our regular table, separating three different ways of considering risk. For valuation I report the equity risk premium. This is the difference between what we expect stocks to earn in the next twelve months and the return from the 10-year Treasury note. I have found this approach to be an effective method for measuring market perception of stock risk. This is now easier to monitor because of the excellent work of Brian Gilmartin, whose analysis of the Thomson-Reuters data is our principal source for forward earnings.

Our economic risk indicators have not changed.

In our monitoring of market technical risk, I am using our “new” Oscar model. I put “new” in quotes because Oscar is in the same tradition as Felix and the product of extensive testing. We have found that the overall market indication is more helpful for those investing or trading individual stocks. The score ranges from 1 to 5, with 5 representing a high warning level. The 2-4 range is acceptable for stock trading, with various levels of caution.

Oscar improves trading results by taking some profits during good times and getting out of the market when technical risk is high. This is not market timing as we normally think of it, since it is not an effort to pick tops and bottoms and it does not go short. Instead, Oscar identifies and limits risk. (More to come about Oscar).

I considered continuing to report the Felix updates, but I already have a distinction between long and short-term methods. I want to minimize confusion. Those who want this information can subscribe to our weekly Felix updates.

For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

Georg Vrba: An array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. He gets a similar result from the Business Cycle Indicator, updated this week.

Doug Short: Provides an array of important economic updates including the best charts around. One of these is monitoring the ECRI’s business cycle analysis, as his associate Jill Mislinski does in this week’s update. The ECRI story is becoming repetitive and even more unhelpful. It seems too related to commodity prices, and only slightly changed from their failed recession forecast. It would be refreshing to see them do a complete reset and adopt a fresh approach.

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting systems. These include approaches helpful in both economic and market timing. He has been very accurate in helping people to stay on the right side of the market.

The Week Ahead

There is a very big week for economic data, featuring many of the most important reports. While I highlight the most important items, you can get an excellent comprehensive listing at Investing.com. You can filter for country, type of report, and other factors.

The “A List” includes the following:

- Employment report (F). Will last month’s strength be matched?

- ISM index (T). Only 50.1 last month, so close to a manufacturing contraction.

- Auto sales (T). Good economic read based on private data. Sales of light trucks are especially interesting.

- Beige book (W). Anecdotal evidence from each Fed district helps to inform the next FOMC decision.

- ISM services index (Th). Important companion to the manufacturing survey. Recent strength to continue?

- ADP private employment (W). Good independent read on employment growth.

- Initial claims (Th). Fastest and most accurate update on job losses. Not included in Friday’s employment report.

The “B List” includes the following:

- Construction spending (T). Key economic sector. October data.

- Factory orders (Th). Volatile series. Also October data.

- Pending home sales (M). October data provides a read on the overall market, but not as important as new home sales or starts.

- Trade balance (F). October data relevant for Q4 GDP.

- Crude oil inventories (W). Focus on oil prices keeps this report in the spotlight.

There is plenty of FedSpeak including two appearances by Chair Yellen and another by Vice-Chair Fischer. Yellen will appear before the Congressional Joint Economic Committee, which could lead to some interesting questions.

The OPEC ministers meet on Friday. Given the recent link between stocks and oil prices, any policy change would be significant.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Oscar continues Felix’s neutral market forecast, but he is fully invested. There are often plenty of good investments, even in an expected flat market. For more information, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix and Oscar’s weekly ratings updates via email to etf at newarc dot com. They appear almost every day at Scutify (follow here).

There is plenty of advice telling traders what they should do. Brett Steenbarger tells you how to do it.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a page (just updated!) summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking. Pick a topic and give it a try.

Other Advice

Here is our collection of great investor advice for this week.

If I had to pick a single most important article, it would be David Van Knapp’s excellent discussion of knowing your investment philosophy. I could not agree more! Those who lack consistency between philosophy and method will eventually have a problem. Read the entire article, but I love the comparison of these two quotes:

Yogi Berra: “If you don’t know where you are going, you’ll end up someplace else.”

Warren Buffett: “Risk comes from not knowing what you are doing.”

Stock Ideas

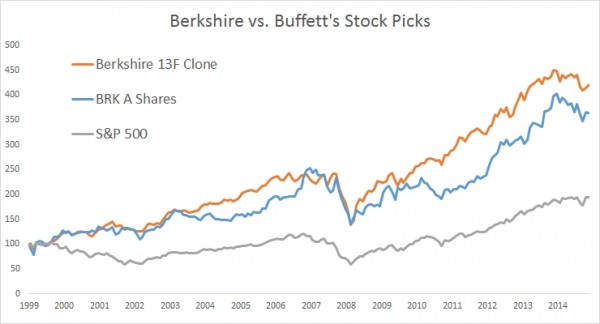

Should you follow Buffett’s picks or buy his stock? Meb Faber shows that both work in the long run. Please also note that neither has beaten the market in the last couple of years, reflecting the lag of “value” approaches.

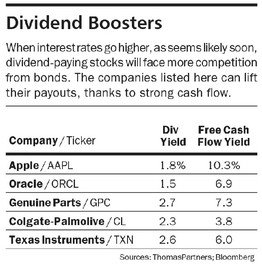

Dividend-paying stocks that can raise the payout are especially attractive when interest rates may be moving higher. Lawrence C. Strauss (Barron’s) analyzes a range of candidates, including those in the table below. Many investors hold the “classic” yield stocks that may not be similarly prepared.

Time for FedEx (N:FDX) to catch up? (Barron’s)

Some values for bargain hunters from John Dorfman. These hit the themes in my conclusion and we hold one choice (Emerson (N:EMR) versus short calls).

Dana Lyons compares FANG stocks to the leaders from 1995-2000.

Strategy

Barron’s highlights the attractiveness of covered call strategies in markets like the current one. They mention a couple of funds as examples. I agree that the approach fits the times, but as the article shows, implementation can be tricky. Some funds choose very volatile stocks and get stock-like performance with only a little hedging effect. We prefer to choose stocks and calls that give more of a bond-like performance.

Watch out for….

Obamacare effects follow up. Last week I wrote about the UnitedHealth Group (N:UNH) story:

United Health Group downgraded earnings expectations, blaming the ACA. The health insurance group plummeted and the selling pressure rippled to hospitals and even to biotechs. The next day the other big insurers all stated that participation, fees, and revenues were on track. This has been a popular and important market sector, so the story deserves careful monitoring.

As I suggested, this is one to follow carefully. This Brookings article, by leading expert Henry J. Aaron, explains why this might be a one-off problem for United, which chose to enter the market later than competitors. This changed the mix of participants. It is wise to be especially careful when investing in this market.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for ten year. The average investor should make time (even if not able to read every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition. There are several great links, but I especially liked The 10 Investing Commandments by Charles Ellis and via Wade Sloame. Read the whole list, but this season especially note #3: “Don’t do anything in investing primarily for tax reasons.” #6 is in the Josh Brown tradition: “Don’t be confused about stockbrokers and mutual fund salespeople. They are usually very nice people, but their job is not to make money for you. Their job is to make money from you.”

And don’t miss this chance to hear from two of our favorite sources in one interview – Dr. Brett Steenbarger interviews Tadas Viskanta.

Final Thoughts

There is plenty of evidence that the Fed is ready for “liftoff” at the next meeting. Our go-to Fed expert, Tim Duy, has an excellent summary of the recent positions of various FOMC participants. He concludes that the Fed is ready to declare “mission accomplished” barring a dramatic change in the outlook. Tim sees another 100 bps of tightening over the next year, and perhaps a start on reducing the balance sheet.

As long as this is the pace, I see little impact on stocks (beyond a possible knee-jerk reaction). The Fed remains data dependent, but they have seen enough.

Personal Note

I expect to be taking off next weekend, so there will be no WTWA. I am comfortable with the recent themes we have recently covered for selecting good value stocks. If something changes dramatically next week, I might post an update.

Meanwhile, a rising rate environment will help financials (I especially like regional banks). It will not impede technology or homebuilders. Mid to late stage cyclicals are fine. The jury is still out on energy and materials, where there may be tax-loss selling.