It is a short week without much new data. Even FedSpeak is on holiday. The big story will continue to be the Trump transition. I expect the punditry to be asking a dual question:

How much economic stimulus and how to pay?

Last Week

Once again, last week’s economic news was nearly all good, but not the focus of discussion.

Theme Recap

In my last WTWA, I predicted that it would be “all Trump, all of the time”. And so it was. Speculation about the effect of Trump policies is rampant, usually wrong, and revised daily. This is profitable for media sources and the punditry, so we can expect it to continue.

The Story in One Chart

I always start my personal review of the week by looking at this great chart from Doug Short. He captures the continuing rally as well as the late-week weakness (despite options expiration).

Doug has a special knack for pulling together all the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis grounded in data and several more charts providing long-term perspective.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something very positive. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

This week’s news was quite good. If I missed something for the “bad” list, please feel free to suggest it in the comments.

The Good

- Jobless claims decreased to 235K, the lowest since 1973 despite a larger labor force. Amazingly, some are looking for any modest uptick in this series to be some sign of disaster.

- Heavy truck sales slump over?

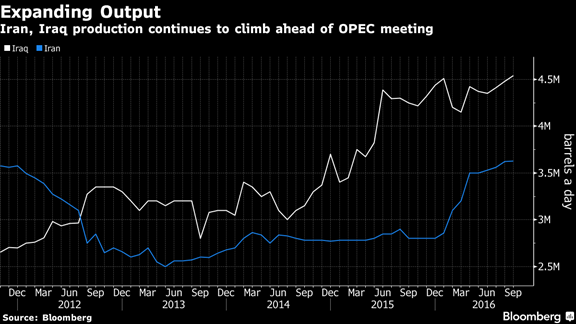

- OPEC might be on track for a deal on production limits. The market is skeptical, so this would be a real plus for oil prices. (See also OPEC news below under “bad”)

- Earnings continued to show the strength we have been reporting for several weeks. The earnings recession is over.

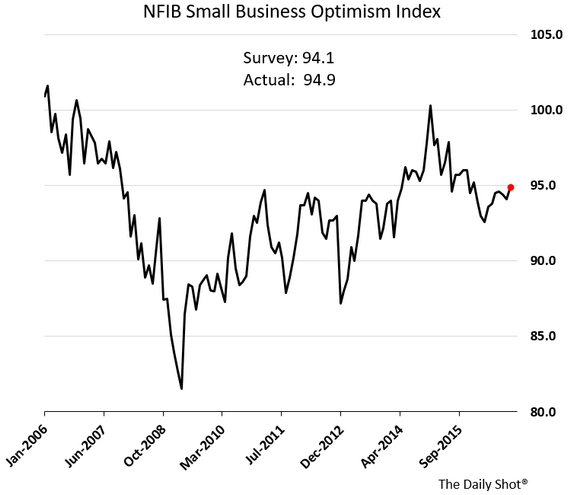

- Small business optimism is higher. Since uncertainty and weak confidence has been cited as a drag on business investment, it will be interesting if this indicator starts to show more strength.

- Housing starts beat expectations with a shift from multi-family to single-family. Calculated Risk has been right on target with this trend, as well as the overall growth rate.

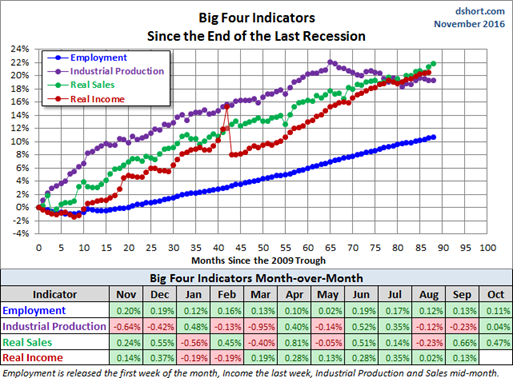

- Retail sales were strong up 0.8% on top of upward revisions for the prior month. The reports handily beat expectations. See Doug Short’s Big Four update in the Quant Corner.

The Bad

- Industrial production continues to lag with a flat report instead of the small expected increase.

- Pre-OPEC actions. The market still seems to appreciate higher oil prices. Iran and Iraq continue to increase production in front of the meeting. (But see OPEC above).

The Ugly

Fake News – and the reaction. The bogus news sites had more traffic than legitimate ones during the election campaign. This led Google (NASDAQ:GOOGL) and Facebook (NASDAQ:FB) to change policies, prohibiting sites that traffic in lies to make money.

Do we need social media sites as editors, deciding what is fake and what is not? Izabella Kaminska explains the consequences:

The rot at the core of media has little to do with the propagation of fake news on the fringes. Alternative news sites and underground press with questionable journalistic practices have been a phenomenon since forever. In free societies, the public sphere tolerates single-issue publishers, special interest groups or anti-establishment newsletters, because we know that for every outlet which propagates nonsense there’s another that might be ahead of the curve on a topic of great cultural, commercial or political significance.

Accepting the fringes — which includes fake news — is what liberty and a free press is about. It’s our greatest strength, especially when positioned within the constructs of a fair and reasonable slander, libel and defamation framework. Suppressing marginal views is not the answer.

Tyler Cowen observes that this is little different from misleading forwarded emails.

There is no easy answer, but we must start by asking whether it is really a problem. We expect consumers of information to discriminate.

The investment world has seen an avalanche of lies and deceptive information from the most popular sites. The lesson from losing money does not seem to have much effect. This is a bad omen for issues where there are less direct financial consequences.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. No award this week. Nominations are welcome.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a normal week for economic data, with most of the reports concentrated on two days before the holiday.

The “A” List

- New home sales (W). Important sector for improved economic growth.

- Michigan sentiment (W). Strength continuing after the election?

- FOMC minutes (W). Probably no surprise. Confirmation of a tilt to a hike in December?

- Initial claims (Th). The best concurrent indicator for employment trends.

The “B” List

- Existing home sales (T). Not as important as new homes, but still a good read on the market.

- Durable goods (W). Volatile series. Any signs of strength in a sluggish sector?

- Crude inventories (W). Recently showing even more impact on oil prices. Rightly or wrongly, that spills over to stocks.

Earnings season is ending. The limited Fedspeak is early in the week.

Next Week’s Theme

This should be a very quiet week. There is little data. Most of the A-Teamers will be taking some time off. (Not me. A competitor used to suggest “Talk to Chuck.” He must have been hard to get on the line, but you can still “Talk to Jeff.”) We can expect more Trump speculation from the B-Team. It can’t be worse than we have already seen.

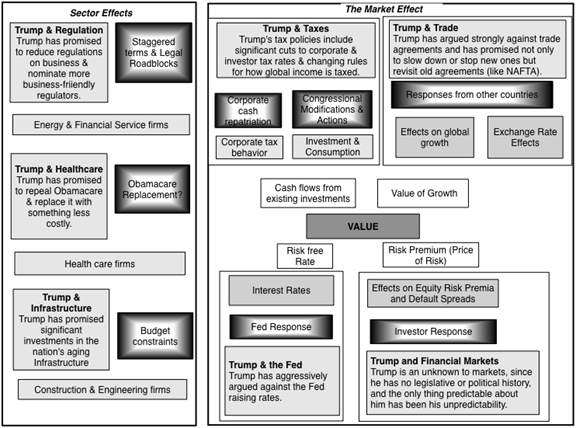

Analyzing the Trump effects requires a good analytic framework and a non-political approach. I hope these concepts will be familiar to regular readers. I was delighted to read a great piece from Prof. Aswath Damodaran, covering both themes. He produces this excellent diagram:

That is a lot on the plate for the punditry. It is all requiring some digestion. (Sorry, I can’t help it. At least I took it out of the title!)

I expect the initial focus to be on taxing and spending.

How large will the stimulus be, and how will it be financed?

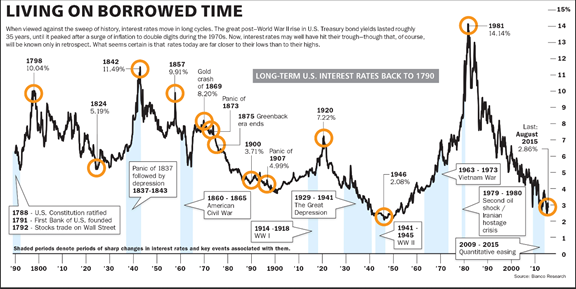

I am always delighted when a theme I am working on is delivered to me in Barron’s on Saturday morning. Their cover story is Taming Federal Debt: The Case for 100-Year Bonds. The argument is very good and this chart is especially helpful:

Barry Ritholtz joins in, suggesting what he calls “The Last Best Chance for Fixing Roads and Refinancing Debt.” He offers many points supporting the desirability and probability of a major debt refinancing.

There is a lot of complexity facing investors. Right now, the stimulus plan is probably the most important. As usual, I’ll have a few ideas of my own in today’s “Final Thoughts”.

Quant Corner

We follow some regular great sources and the best insights from each week.

Risk Analysis

Whether you are a trader or an investor, you need to understand risk. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

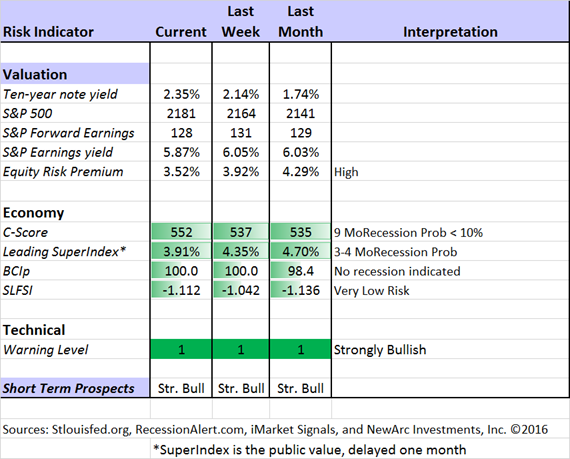

The Indicator Snapshot

The increased yield on the 10-Year note has lowered the risk premium a bit. I suspect much more to come. By this I mean that the relative attractiveness of stocks and bonds will continue to narrow.

The Featured Sources:

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his site for an array of interesting methods. Georg regularly analyzes Bob Dieli’s enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has several interesting approaches to asset allocation. Try out his new public Twitter Feed. His most recent research update suggests some “mixed signals” from labor markets.

Doug Short: The World Markets Weekend Update (and much more). It is time for another look at Doug’s Big Four, the most important indicators for recession dating. The NBER looks for a significant drop from a peak. All but one are still rising, with industrial production the laggard.

New Deal Democrat provides more reassurance. His long-leading indicators have now filtered into the shorter-term measures, especially the most recent housing results. Like our other sources, he now sees no recession for 9-12 months.

How to Use WTWA (especially important for new readers)

In this series, I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. Most readers can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide several free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk – what we all should know.

- Income investing – better yield than the standard dividend portfolio, and less risk.

- Holmes and friends – the top artificial intelligence techniques in action.

- Why it is a great time to own for Value Stocks – finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions on this subject. What scares you now?)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and the top sources we follow.

Felix and Holmes

We continue with a strongly bullish market forecast. Felix is fully invested. Oscar holds several aggressive sectors. The more cautious Holmes also remains fully invested, but has done a lot of profit-taking and position switching. Now joined by Athena, the group has a regular Thursday night discussion which they call the “Stock Exchange.” This week’s question was about how to spot a good chart. You might be surprised at the answer. You can see that discussion as well as the most recent ideas for consideration – and you can ask questions!

Top Trading Advice

Brett Steenbarger is on the verge of retiring our award for best trading advice. Every trader should be reading him daily, as well as his books. Readers will not agree with every conclusion, but it will get them thinking about the right issues. It is a challenge to pick the best post each week, but I’ll try once again.

His analysis is right on target for this week’s issues. He notes the short-term effect of the election as well as the long-term concerns. As a trader, he is aware, but flexible. You could also check out posts on how to react to a big winning day and how to align with market cycles.

Adam H. Grimes has a nice post on losses – not the normal expected losses, but the big ones. He suggests five reasons, which are worth your consideration. The one that I see most often is #3, taking trades of the wrong size.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Bill McBride’s cold-water splash in the face for those who have been spending too much time on the wrong sites: The Cupboard is Full. It is a nice, objective summary of overall conditions. His summary hits the high spots, citing the relevant data and providing his customary charts. Here is his conclusion:

Sure, there are problems. Not everyone has participated in the current expansion. Wealth and income inequality are record extremes. There is too much student debt. And climate change is posing a real threat to the economy in the future. I could offer proposals to address those issues without negatively impacting the current expansion, and we will see if those issues are addressed in the coming years.

However, the bottom line is the cupboard is full. The expansion should continue for some time. What could possibly go wrong?

Here is an example of the several helpful charts, how population will drive housing expansion:

Meanwhile, plenty of financial, cyclical, technology, and homebuilding stocks are trading at recession pricing.

Backing up this conclusion is (yet another) great entry by “Davidson” via Todd Sullivan. He emphasizes the significance of single-family housing for the overall economy. Here is a key quote:

Housing Starts and financing go hand-in-hand. The T-Bill/U.S. 10-Year Treas spread used by banks in mtg lending decisions narrowed to 1.2% in July 2016 indicating a potential slowing in housing which this data reflects. This morning this spread has widened rapidly since the election to 1.8% and the trend looks higher. 10yr rates should continue to rise faster than T-Bills and this will confound many forecasters.

The election of Trump has not yet been factored into housing. I would buy Toll Brothers Inc (NYSE:TOL) and Lennar Corporation (NYSE:LEN) at current levels with their excellent CEOs. Single-Family Housing starts should be higher by June 2017 after Trump strips away some of the impediments to mtg lending.

Stock Ideas

Time for energy investments? Brian Gilmartin makes the case with his objective, earnings-driven analysis. He also cautions:

What we hear from the new Administration will matter.

There is a lot of angst over the sector now, with the choppiness of crude trading, what the new Administration does with solar credits, etc.

Give it more time.

Our trading model, Holmes, has joined our other models in a weekly market discussion. Each one has a different “personality” and I get to be the human doing fundamental analysis. We have an enjoyable discussion every week, with four or five specific ideas that we are also buying. This week Holmes revisits a pick from about a month ago, DexCom Inc (NASDAQ:DXCM). On the last round Holmes stopped out for a small loss, avoiding a bigger decline. With a new bottom Holmes is trying again. Check out the post for my own reaction, and more information about the trading models.

While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas have worked well so far. My hope is that it will be a good starting point for your own research. Holmes may exit a position at any time. If you want more information about the exits, just sign up via holmes at newarc dot com. You will get an email update whenever we sell an announced position.

Time for biotech? Bret Jensen makes the case for several stocks, including one of our favorites, Cara Therapeutic (NASDAQ:CARA).

And an evaluation of the “bump from Trump” from VanEck.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. If you are a serious investor managing your own account, you should join us in adding this to your daily reading. Every investor should make time for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are always several great choices worth reading. My personal favorite this week is the very practical discussion of what burglars are looking for in finding a house to rob.

Stickers do not help much, but big dogs do. Your hiding places are not helpful. They know all of them. This surprised me the most:

“NRA sticker on car bumper = Lots of guns to steal,” wrote one burglar.

Seeking Alpha Editor Gil Weinreich’s Financial Advisors’ Daily Digest is a must-read for financial professionals. The topics are frequently important for active individual investors. That is especially true this week as he highlights key questions, among others, about what advisors do and their effect on performance. I especially his post with analysis and links you can use to see whether you would benefit from an advisor. Here is a key quote:

A true leader educates clients on what are the key principles that should define their financial decision-making: how does one invest, how one can increase his savings rate; spending restraint, etc. The best advisors do this. The worst follow the same trends as Johnny-come-lately investors. I still recall Wall Street Journal articles in the aftermath of the dot-bomb detailing how many brokers made it big promising the moon and stars to all-too-eager clients.

This is very true. In my first interview with clients I try to align expectations with reality, especially in keeping risk under control. One woman had $2 million to invest and needed to turn it into $6 million in three years. I suppose she found someone who told her that he would do that.

Here is another test. If you can deal with the challenges in my latest paper, The Top Twelve Investor Pitfalls – and How to Avoid Them, you can fly solo. Readers of WTWA can get a free copy by sending an email to info at newarc dot com. We will not share your address with anyone.

Market Outlook

Plenty of sources, mostly of the permabear variety, cited low interest rates as bad news for stocks. Now that rates are moving higher, that is also supposed to be a negative. Scott Grannis effectively explains this relationship –A bond bear market is bullish for stocks.

I’ve been arguing for years that higher interest rates won’t be a problem, since they would be symptomatic of stronger growth. Higher rates won’t lead to an exploding deficit, because the stronger growth that pushes interest rates higher will also work to reduce the deficit by boosting tax revenues. Interest rates have been low because the market has had a very pessimistic view of the future growth potential of the U.S. economy.

I agree!

Watch out for…

“Cheap” put protection. The oft-cited advice to buy puts when markets are calm is misguided.

Mixing up your politics and your evaluation of the business cycle. (The Capital Spectator).

Coal stocks. The President-elect may not be able to deliver on this front as along as natural gas prices are so low. (MIT Technology Review)

Final Thoughts

The stimulus/infrastructure theme is getting a lot of attention. PBS had a pretty objective analysis of the needs, labor shortages, and implementation problems.

My conclusion is that something major on infrastructure needs will be approved. Here are three key reasons:

- Congress loves to spend money and point to the effects in specific districts.

- It is easy to imagine a bipartisan coalition. This week showed support from the GOP side via Barron’s and the Dem side via Barry Ritholtz. The philosophies are in alignment.

- It is the right thing to do. There are important needs. The exact term of new bonds is up for debate, but locking in low rates seems pretty obvious.

Time Frames encourage a wide range of conclusions. Many are predicting that Trump policies will all end badly – eventually.

Moody’s Mark Zandi has downgraded economic forecasts.

The firm’s “outlook for the U.S. and global economies has been shaken up by the shocking election of Donald Trump as president of the United States,” writes Zandi in the firm’s latest monthly economic outlook. “Based on our analysis to date, the economy under President Trump will likely perform a bit better in the near term but ultimately it will be diminished.”

Zandi is projecting that GDP growth under four years of President Trump will be less than 2% per year, below the 2.2% he had been forecasting before the election. “That is not a big difference in any given year, but it is meaningful over a four-year period,” writes Zandi.

Ed Yardeni, in a thoughtful analysis, asks, “Is Trumponomics Inflationary?” His analysis does not have an easy conclusion, but deserves some thought about each point.

David Rosenberg sees increasing inequality, paving the road to ruin. He sees skewed tax effects and a shortage of skilled tradespeople for proposed programs.

My own perspective for investors is about one year ahead. None of the key issues permit longer forecasts. The immediate stimulus effects will be positive. Investors should do a regular reassessment of progress.

Digestion. There is plenty to do. Here are the key issue areas in my planning for the Trump administration. Each requires study of political dynamics as well as overall impact. Most of the punditry is still reaching far beyond what they know, writing on deadline, driving too fast for the reach of their headlights.

I am starting with the most general and important themes. I welcome suggestions about interesting topics or themes I have omitted. In each case I am evaluating probabilities, impacts, and stocks affected.

- Stimulus

- Infrastructure

- Tax cuts

- Financing

- Sectors

- Health stocks – biotechs, pharma, insurance, hospitals — all different

- Energy

- Construction

- Trade policy

- Exporters

- Importers – corporate and consumers

- Immigration

- Law and Order

- Defense

And finally, Happy Thanksgiving to readers of WTWA. I hope that my work has given you a little more to be thankful and happy about.