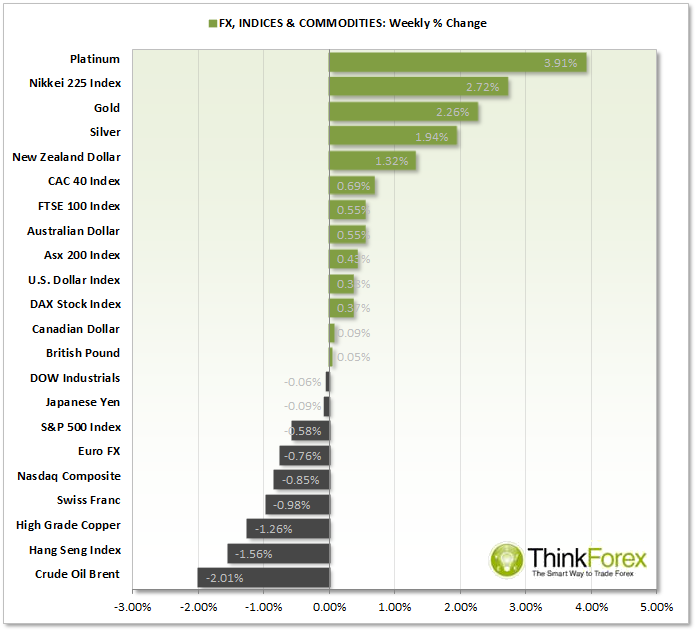

By reviewing and comparing market % performance we can gain a quick and convenient insight into where money is flowing to (and from) to help us refine our trading watchlist for the days or weeks ahead:

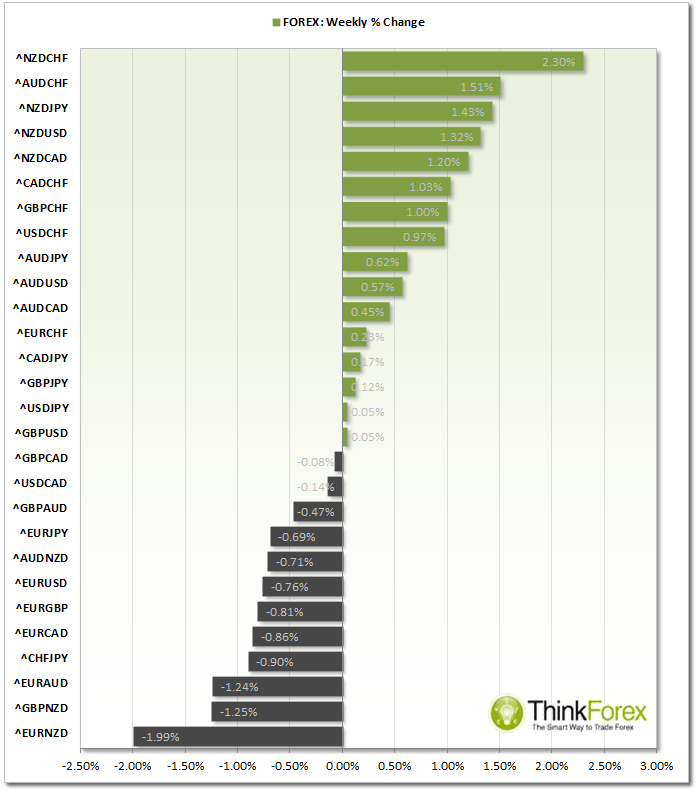

FOREX:

AUD: With a promising start to the short trading week and rejecting previous lows, AUD finished by showing of signs of weakness against CAD, NZD and USD. Trend remains technically bearish on the daily timeframe. AUD/CAD short highlighted in our daily report has now generated a sell signal.

CAD: The futures charts are seemingly within a bearish correction which explains the disparity seen across the CAD pairs. USD/CAD is within a particularly messy part of the cycle however NZD/CAD maybe setting up for another potential long position after a brief pullback following intraday bullish momentum. Long positions may be considered above 0.876

CHF: The Swiss futures have continued to sell off from their highs formed at the end of last year and is close to breaking an ascending trendline to highlight potential for further weakness.

EUR: Very similar to CHF (as they tend to track very closely) we have continued to sell off from last year's highs. However EUR/CHF is looking more bullish hinting at CHF to be the weaker of the two going into this week.

JPY: GBP/JPY may be setting up for another leg higher after producing a bullish hammer on Friday. Currently trading at 5yr highs it would be wiser to keep on the same side as the clearly bullish momentum. However a slight word of warning is the Spinning Top Doji formed on cast week's candle.

GBP: Bearish candles forming across the board on GBP: Bearish outside weeks on GBP/AUD and GBP/NZD to suggest interim tops or sideways trading; Dark Cloud Cover on GBP/CAD.

NZD: NZD/JPY in clearly defined uptrend within increasingly bullish momentum; largest gainer of the week against Swissy and Euro;

USD: Cable edges lower after forming Bearish outside day last week but approaching trendline support; Euro continues to look weak closing the week at the lows; USD/CHF breaks above 06/13 trendline resistance and continues to form bullish wedge; USD/JPY held above 104 but potential for swing high is present (remains bullish above 103.77; AUD/USD within bearish consolidation and formed potential hanging man reversal on Friday.

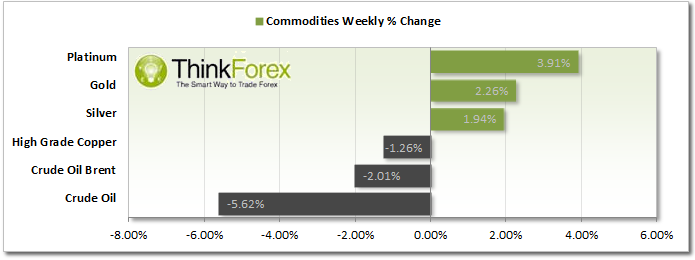

COMMODITIES:

METALS: Both Gold and Silver saw a temporary reprieve to their bearish trends by rejecting their lows formed at the end of last year. Whilst intraday momentum is bullish the trends technically remain down.

OIL: Brent hit out target of 94.00 on Friday and currently bringing into question my previous analysis, assuming we had seen a multi-week cycle low. A break below 91.45 invalidates this outlook but price is now resting above 94.00 with bearish momentum. Brent is looking equally weak going into this week so intraday bearish setups remain the preference.

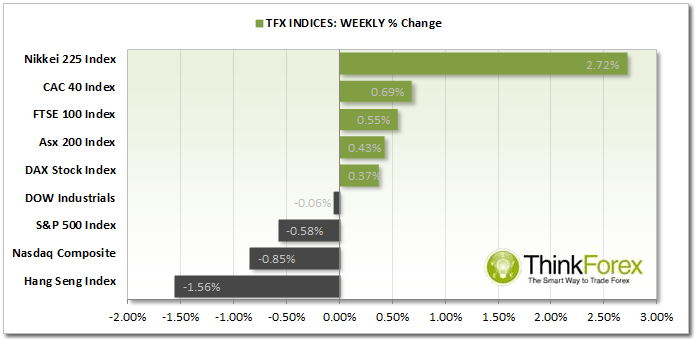

INDICIES:

Nikkei continues to gain after finishing 2013 as the biggest gainer we track. Bearish engulfing candle formed on DAX to suggest weakness at last year's highs. AUS200 trades within tight range but possible bullish correction is more likely. NASDAQ100 edges from highs but Dow and SP500 hover near last year's highs.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market.

If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Wrap: Trend Remains Down For Gold, Silver

Published 01/06/2014, 12:52 AM

Weekly Wrap: Trend Remains Down For Gold, Silver

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.