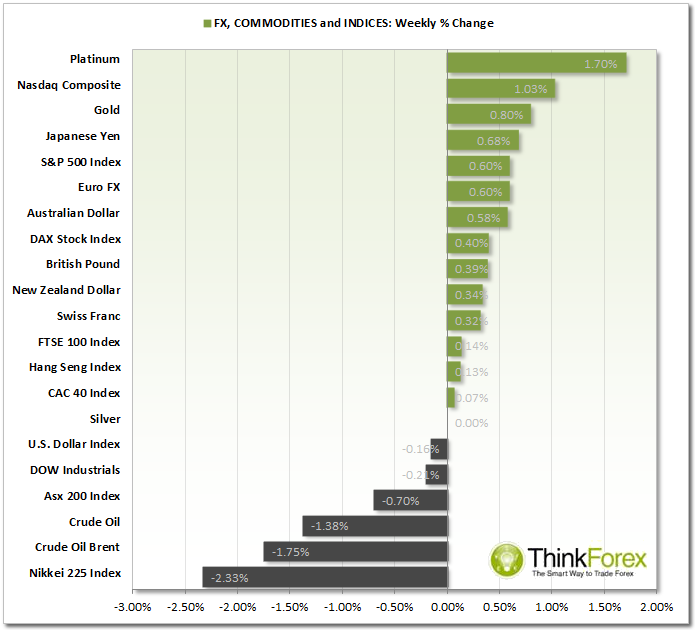

By reviewing and comparing market % performance we can gain a quick and convenient insight into where money is flowing to (and from) to help us refine our trading watchlist for the days or weeks ahead...

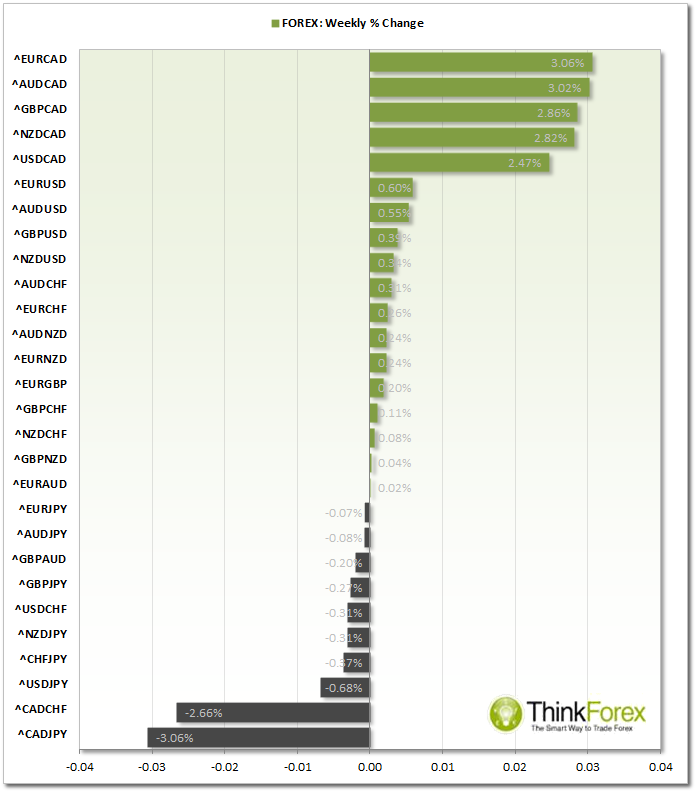

FOREX:

AUD: AUD enjoyed a much more bullish week and broke bearish trendline against CAD, CHF and USD. Finding support around 1.073 against Kiwi there is potential for a basing pattern to form.

CAD: By far the weakest single currency this year and selling off against all majors. Technically weak with fundamentals to match there is little reason to change this view in the foreseeable future.

CHF: A more bullish to the end of the weak fuelled by 'flight to safety' however the single currency is still technically bearish.

EUR: Mixed bag for Euro: Record highs against CAD but selling off against AUD and JPY.

JPY: Had a much more bullish week last week and recovering losses against most Majors together than AUD.

GBP: Topping patterns appearing across three majors with a potential H&S reversal on GBPAUD, Double to on GBPJPY; lacking momentum against USD

NZD: The Kiwi has been the safe haven of the majors so far this year and currently trading at record highs against CAD and JPY. Still looks technically strong with increasingly bullish momentum.

USD: A mixed picture at the start of the week after reducing trade deficit to its lowest in 4 yrs whilst PMI came in less than expected. Friday was the final blow with NFP coming in much less than expected to -122k. USD sold off heavily from its highs against most majors with only GBP and CAD failing to capitalise from the weakness of the Greenback.

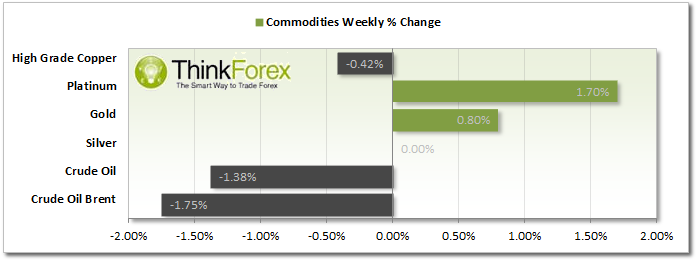

COMMODITIES:

METALS: Gold and Silver finished the week on a high after Friday's NFP but Silver remains within a technical correction and below resistance. Gold has begun to form higher highs and lows on the daily but has failed to stay above 1250. Platinum is looking increasingly bullish with a potential 'breakaway' gap at the start of this year

OIL: WTI and Brent have managed to trade from their recent lows but too sooner to speculate if this is merely corrective against the bearish momentum or the start of something more significant.

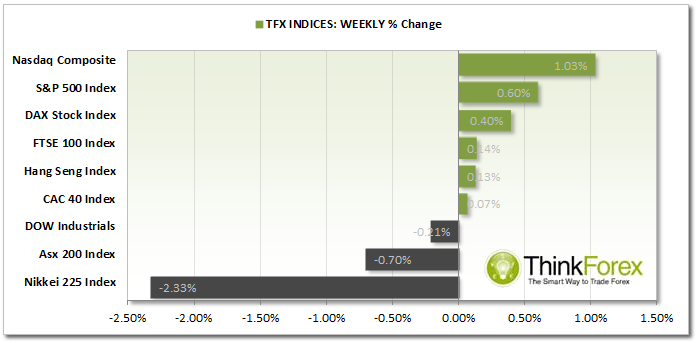

INDICIES:

US Equities are still trading sideways however a slight divergence has formed across the Europeans. DAX has failed to recover losses from the start of the year and trades within a narrow range whilst FTSE and CAC have recovered recent losses and back near their recent highs.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market.

If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Wrap: Mixed Bag For Euro, Bullish Week For AUD

Published 01/13/2014, 01:21 AM

Updated 08/22/2024, 06:01 PM

Weekly Wrap: Mixed Bag For Euro, Bullish Week For AUD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.