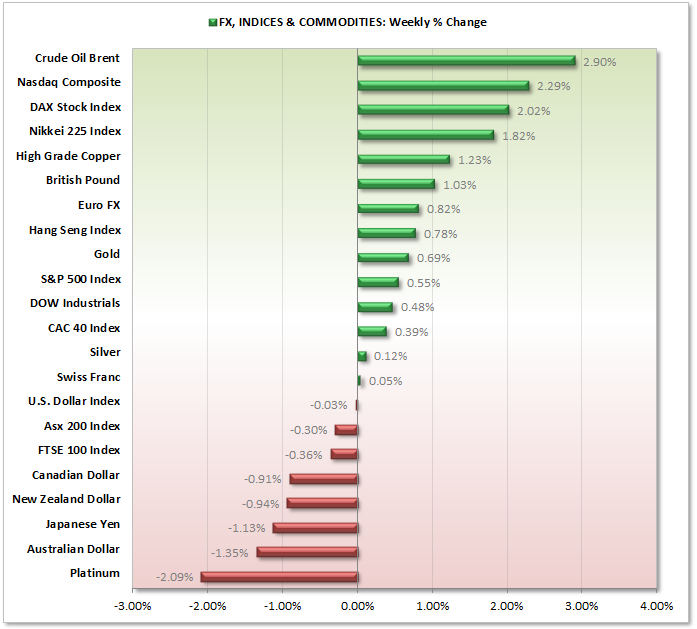

By reviewing and comparing market % performance we can gain a quick and convenient insight into where money is flowing to (and from) to help us refine our trading watchlist for the days or weeks ahead...

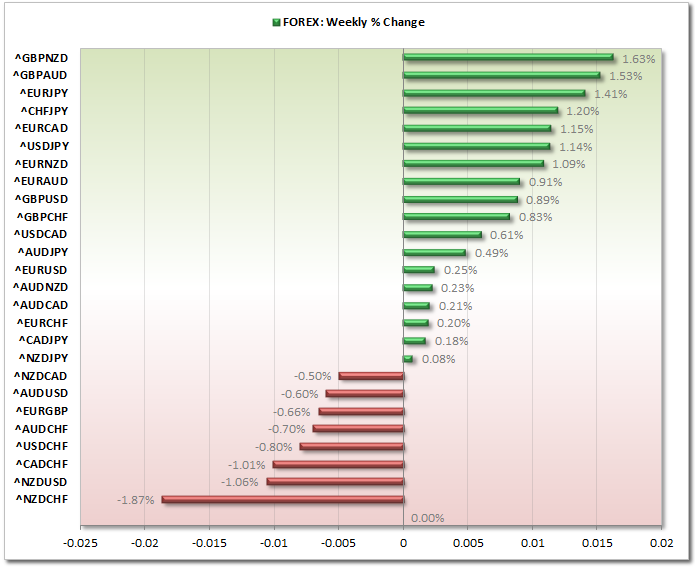

FOREX:

AUD: Whilst news was relatively light for the AUD last week, most of the numbers came out positive. Wednesday saw construction work done at 2.7% versus 0.6% expected, followed by Private Capital Expenditure QoQ on Thursday come in better than expected which resulted in a short-term rally across the AUD pairs. The futures charts are still clearly bearish

CAD: Remains technically bearish, closing the week -0.91% down. Current accounts came in less than expected at -15.5bn versus -14.3bn expected, however Friday's GDO MoM came in better than expected at +0.3% versus +0.1% expected.

CHF: Futures continues to grind higher but only just closed the week higher at +0.05%. GDP QoQ remains fixed at 0.5%, whilst the KOF Economic Barometer came in positive at +1.85

EUR: It was a busy news week for the Euro with lots of mixed results. German unemployment is up, yet the Eurozone unemployment rate also came in positive. Perhaps the most interesting observation is how EURUSD closed the day down despite positive news, which also coincides with the 61.% retracement. Technically the bullish run from the 1.329 lows appears to be corrective so keep an eye on this potential swing high.

JPY: Futures remain bearish with increased bearish momentum. JPY pairs still very much the better trending currencies to be monitoring going forward. The bullish trend on USDJPY remains to be strong and there is talk of the next target being around 103.60

GBP: Futures remain technically bullish and buying could clearly been seen across the GBP pairs last week. This remains the view for this week, with GBPUSD, GBPAUD and GBPJPY offering some of the better opportunities for bullish traders.

NZD: With the Trade Balance and ANZ business confidence coming in better than expected the Kiwi would have expected a better weak. Regardless the Futures finished down. AUDNZD is trading near 5yr lows with increasing bearish momentum.

USD: The USD Index continued to trade above 80.60 and technically appears to be forming a basing pattern to suggest pending strength. Indeed this is also reflected on EURUSD and USDCHF charts so are charts to monitor this week for swing trades. Unemployment claims and building permits came in positive, whilst pending home sales, CB Consumer confidence and Core Durable Goods orders MoM came in less than expected.

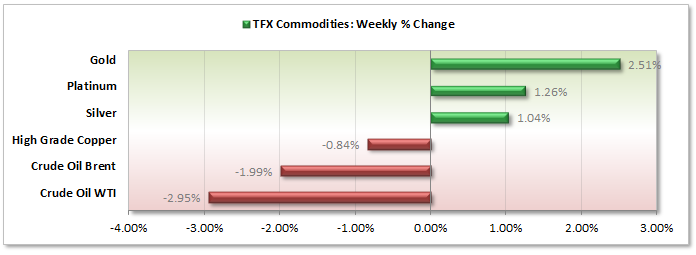

COMMODITIES:

METALS: Silver managed to stay above the 19.58 support level and is technically not trending. A break above 20.11 swing high suggests continued buying whilst a break below 19.58 suggests continuation of bearish trend. Gold did not manage to trade lower than previous week low of 1227 and like silver, appears to be correcting, however trends remain down on both.

OIL: Brent and WTI continue to diverge and increase their spread. WTI broke out of the sideways consolidation to hit the 91.70 target, closing the week down. Brent traded sideways for the week compared to the previous week but closed the week bullish and holding above key support levels.

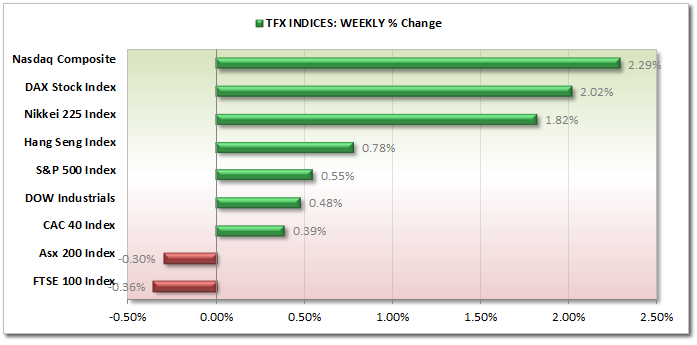

INDICIES:

US Equities continue to trade at record high and grind higher. Volatility has reduced on JI and SP500 however NASDAQ had the larger gains of the three finishing the week at the highs. AUS200 continues to retrace from the 5460 highs with today's trading testing the 50%. FTSE100 also appears to be amidst a bearish correction however DAX is leading the way and continues to trade at record highs.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market.

If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Wrap: Leaders And Laggards

Published 12/02/2013, 01:19 AM

Updated 08/22/2024, 06:01 PM

Weekly Wrap: Leaders And Laggards

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.