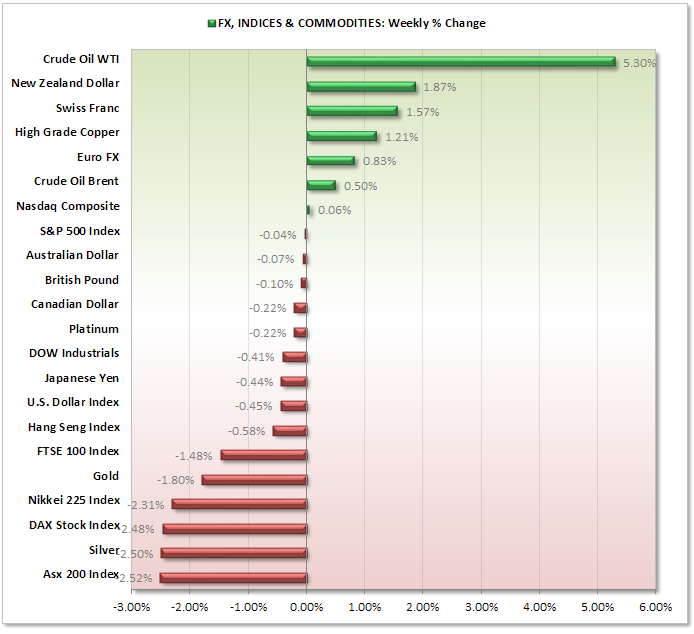

By reviewing and comparing market percent performance we can gain a quick and convenient insight into where money is flowing to (and from) to help us refine our trading watchlist for the days or weeks ahead...

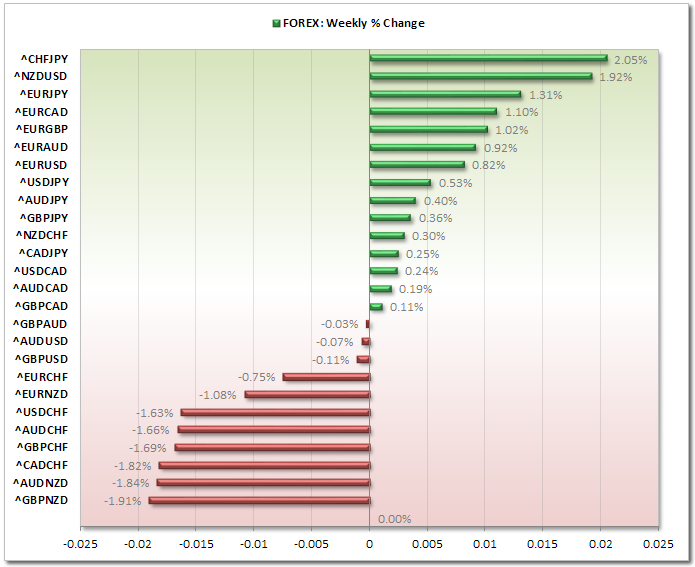

FOREX:

AUD: AUD/JPY clawed back the week's losses on Friday to reject the downside breakout below 92.20, however it did not do so well against the Kiwi as the AUD/NZD pair continues to trade at 5 year lows, closing the week below 1.10.

CAD: Canadian futures continue to trend down and remain one of the weakest currencies amongst the majors, along with JPY and AUD.

CHF: The Swiss futures accelerated back near their October highs, closing the week above 1.20. The most bullish FX pair we follow was CHF/JPY and was also last week's biggest mover.

EUR: Bullish momentum increased across all majors excluding the Kiwi. The ECB decided to keep interest rates at record lows, fuelling speculation that they will have to add additional monetary easing action some time next year.

JPY: Sold off heavily on Friday back in line with the bearish trend, wiping off all of the week's corrective gains.

GBP: The British pound futures retraced from its highs and produced a Spinning Top Doji after 4 consecutive bullish weeks. The trend still remains bullish and current price action appears more corrective before a resumption of the uptrend. However GBPCHF has raised questions after a 360 pip sell-off from the November highs.

NZD: The Kiwi had a very bullish week however the weekly futures charts are not so clear and still appear to be in a bearish correction in line with a longer-term bullish trend. Additionally there are divergences amongst the pairs, so whilst Kiwi finished up against AUD and was also the 2nd largest gainer last week against USD, it finished down against GBP and was last week's biggest mover.

USD: The USD finished the week back below 80.50 support to signal further downside. Technically this could still be a bearish correction but the next level of support is around 8.0 and 79.50.

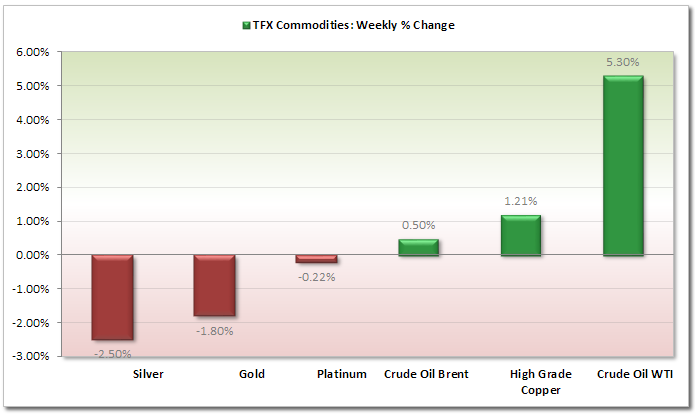

COMMODITIES:

OIL: WTI finally broke above the 95.60 swing high to close with week with a Bullish Engulfing candle. This adds further weight to the suggestion that WTI and Brent have both formed moult-week cycle lows as highlighted in our video last week.

METALS: Gold and Silver still remain technically bearish and trade within bearish channels; however both markets produced 'spike' bottoms to suggest a correction may be approaching.

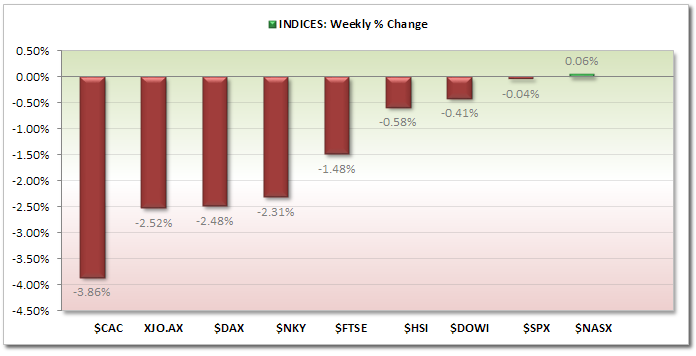

INDICIES:

US Equities produced long-shadow Hanging Man patterns, but still hover around their record highs after a bullish close following Friday's positive NFP figures. AUS200 accelerate the sell-off and broke out side of a suspected 'corrective' channel.

JPN225 had a positive week with a Bullish Engulfing Pattern to put it back on track with USDJPY.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market.

If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Wrap: Bullish Momentum Increased Across All Majors Except Kiwi

Published 12/09/2013, 01:42 AM

Updated 08/22/2024, 06:01 PM

Weekly Wrap: Bullish Momentum Increased Across All Majors Except Kiwi

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.