S&P 500 earnings update

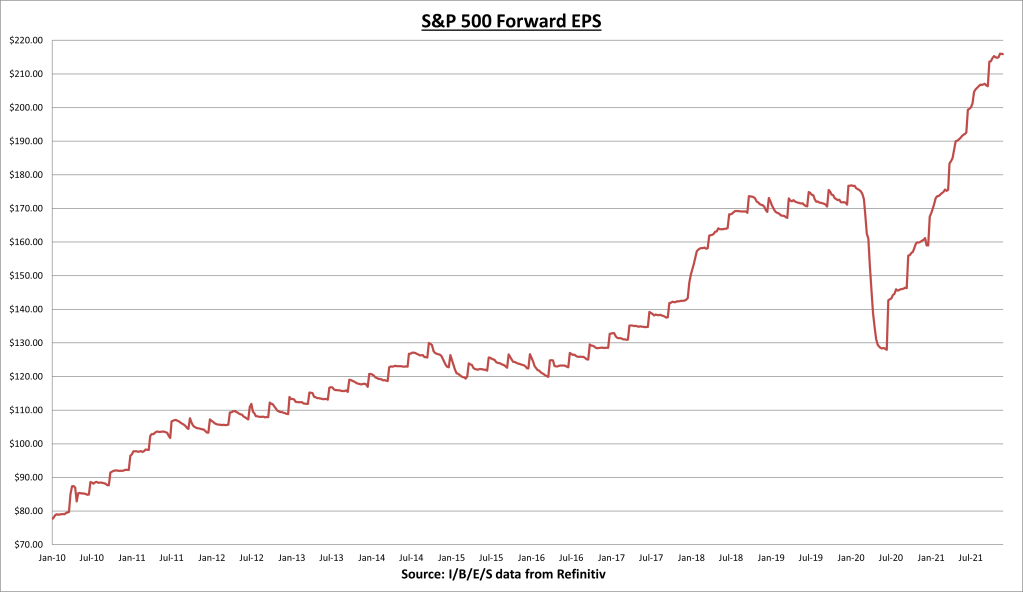

S&P 500 earnings per share (EPS) showed a modest decline for the week, from $215.97 to $215.87.

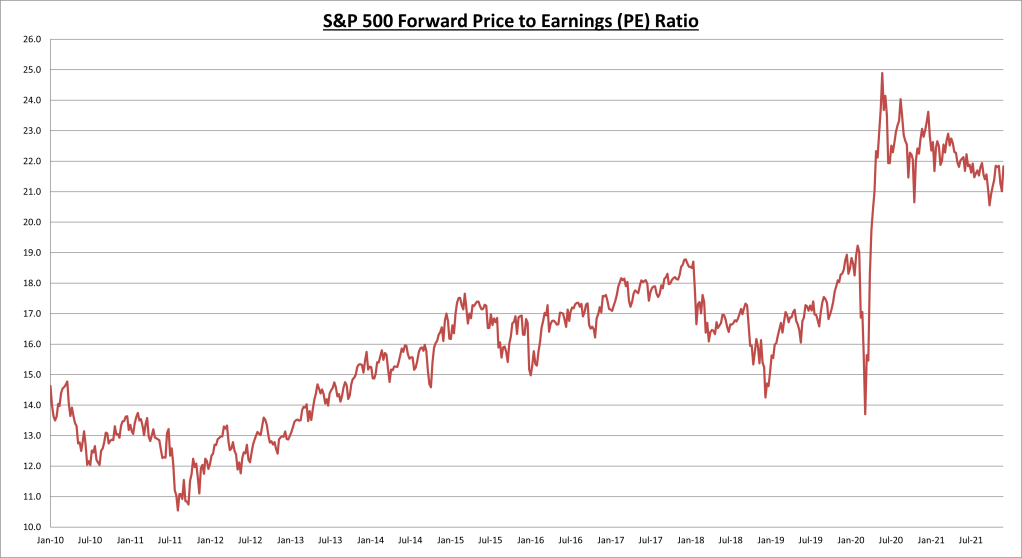

S&P 500 price to earnings (PE) ratio increased to 21.8, as the index increased +3.8% this week.

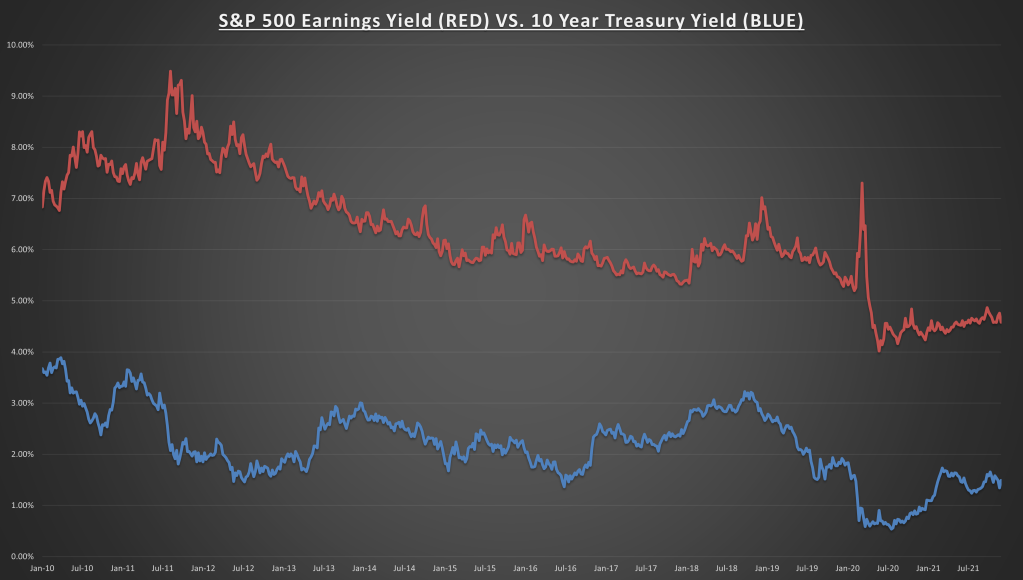

S&P 500 earnings yield is now 4.58%, still well above the 10-year Treasury bond rate currently at 1.49%.

Economic data review

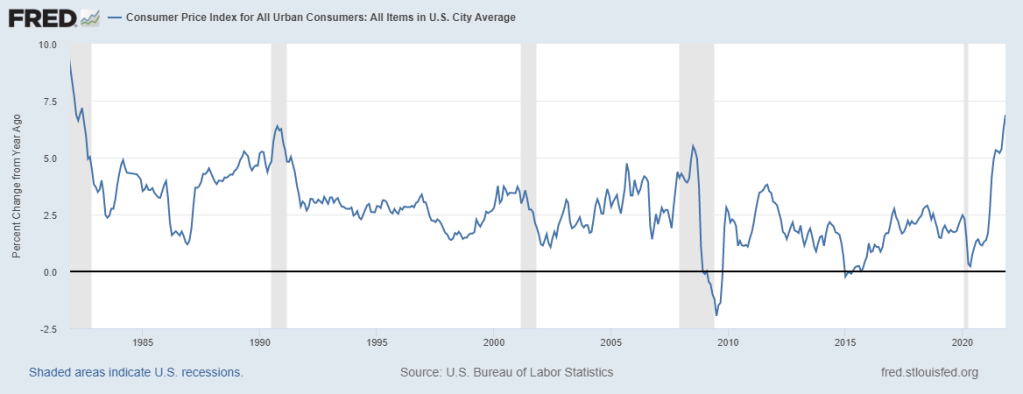

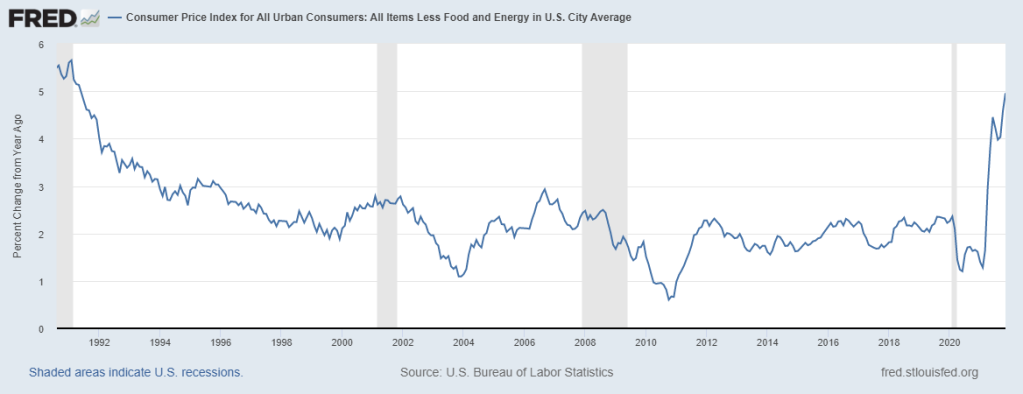

Consumer Price Index (CPI) increased +0.8% in November, now +6.9% over the last 12 months (up from +6.2% last month).

Consumer Price Index minus food and energy (Core CPI) increased +0.5% in November, now +4.95% over the last 12 months (up from +4.6% last month).

These are the highest annualized inflation numbers in almost 40 years (1982). The monthly gains were led by energy (+3.5% – gasoline +6.1%), used cars and trucks (+2.5%), apparel (+1.3%), & new vehicles (+1.1%).

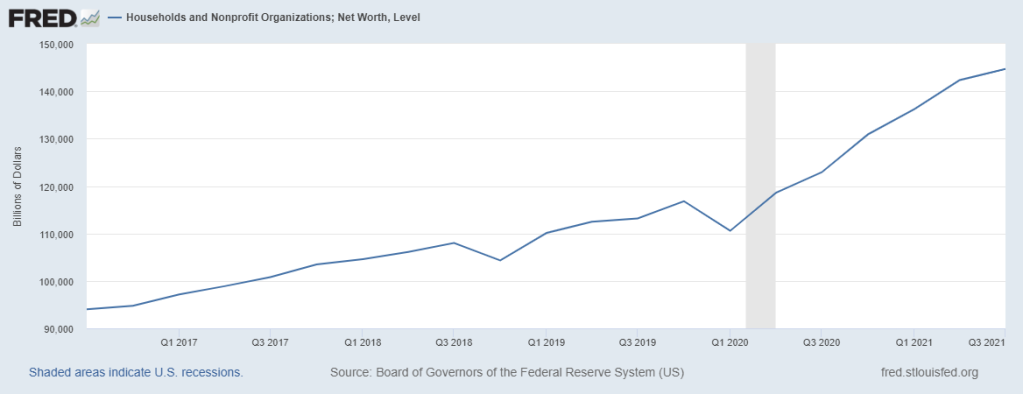

Household net worth rose to another record high, now $144.7 trillion, +1.7% for the quarter, and +17.7% higher than at this time last year.

In Q3, total assets grew 1.88% (from $160 trillion to $163 trillion), while total liabilities increased 1.7% (from $17.7 trillion to $18 trillion).

Over the last 15 years, total liabilities have increased only 34% (2% per year), while total assets have grown 103% during that same timeframe (4.8% per year).

Summary

In a slow week for earnings and data, it was all about inflation. Annualized CPI only got worse, but some downward pressure could be coming from the recent drop in oil prices.

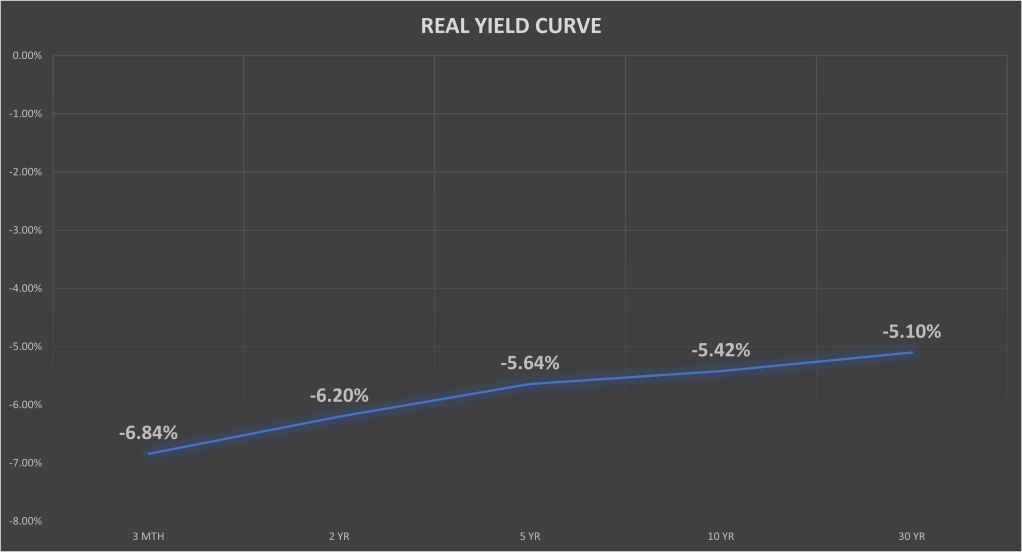

Real yields are calculated by taking the nominal interest rate and subtracting the rate of inflation. As you can see in the chart above, real yields (as calculated by using total CPI) are staggeringly negative across the entire curve.

This entire botched monetary experiment hurts consumers (the inflation tax we all face everyday now) and savers. The only one that benefits from this is the Federal government, as they are able to borrow at low rates and pay back those debt obligations with much cheaper dollars in the future.

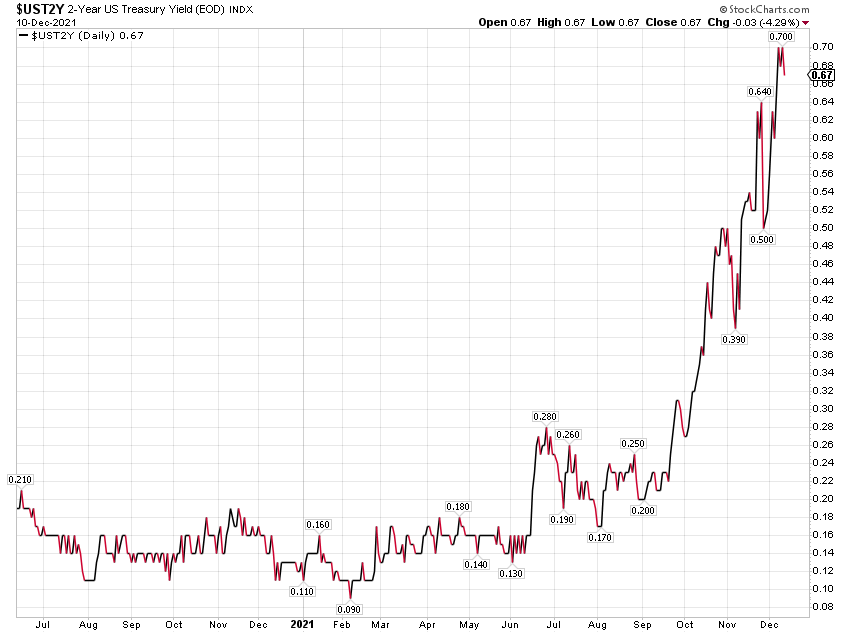

The 2-year Treasury bond rate (short end of the curve) has been rising steadily for the last 3 months in anticipation of the Fed having to raise rates in 2022.

But here is the conundrum. There isn’t much room to raise short term rates without it negatively affecting financial conditions. The 10 year treasury bond rate (long end of the curve) is 1.49%, while the 2 year rate is 0.67%, which means there is a spread of only 80 basis points or so.

The Fed may only have about three 25 basis point rate hikes of wiggle room before they are in danger of “inverting” the yield curve. Much like 2018. According to current market expectations, there is a better than 50% chance they raise rates 3 times by the end of 2022. Although right now my guess is it’ll be more like 2 rate hikes in 2022. Who knows.

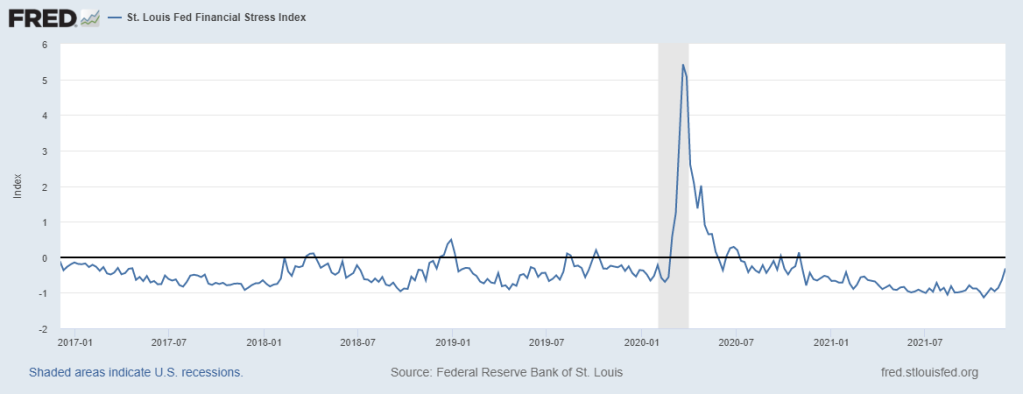

But we do know the anticipation is already having some negative impact on financial conditions. The St. Louis Fed financial stress index, although still very low, has been moving up in the last few weeks.

Bottom line, the Fed has lost credibility by refusing to believe that inflation wasn’t transitory. They’ve also fallen behind, and as a result the risk of a policy mistake has risen. This coming week will be the main event, as the Fed gives its statement and their economic projections on Wednesday. We should gain more clarity on the pace of tapering asset purchases and rate increases.

The fundamentals remain strong but there are some challenges ahead. Financial conditions can effect liquidity in the markets, and when liquidity drops then volatility can increase. I can’t stress enough how important it is for investors to remain well diversified and disciplined.

Next week: 6 S&P 500 companies will be reporting earnings. I’ll be paying attention to Adobe (NASDAQ:ADBE) on Thursday. For economic data, we have NFIB small business optimism index and the producer price index (PPI) on Tuesday, retail sales and the Fed statement along with economic projections on Wednesday, and Industrial production on Thursday.