This article reviews the latest weekly sentiment survey we conduct over on Twitter. The survey measures respondents' equity and bond positioning/view – differentiating between whether the view is bullish or bearish for technical or fundamental reasoning.

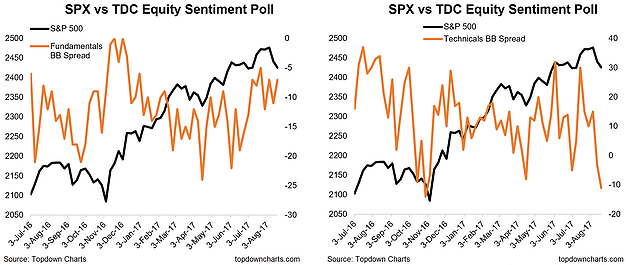

The results show a slight further rise in bearishness overall, adding to the sharp lurch down the previous week. Technicals sentiment has been the biggest mover, and the "technicals" net bulls or bulls minus bears spread has fallen close to the lows it got to around the US election. Notably though, fundamentals sentiment is holding up at relatively high levels.

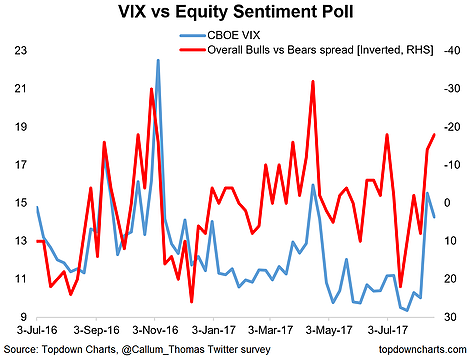

Looking elsewhere among the charts, there are two other standouts. First is the overall net-bulls vs the VIX. There remains a slight gap between sentiment and the level of the VIX, but it is informative that both the VIX and the surveyed sentiment are seeing a strong reaction. It shows that fear has moved into the market.

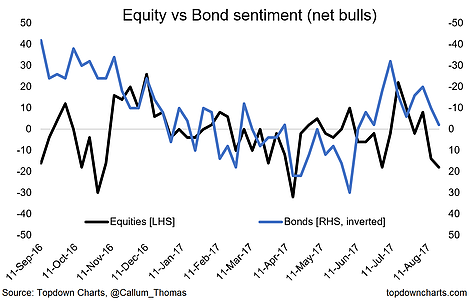

On a similar note, the other graph worth highlighting is the chart of net-bulls for equities and bonds. It shows a fairly synchronized move in both: i.e. bond sentiment more bullish and equity sentiment more bearish. This is consistent or what you would expect (equities go down, bonds go up). Although I would note, that the Jackson Hole central banking symposium this week has the potential to stir both markets up, and this time next week we might be talking more about equity and bond bears!

Fundamentals sentiment is holding up while technicals sentiment has taken a sharp dive.

Equity sentiment has moved slightly beyond the VIX, but overall the movement in both indicates that fear has moved into the market.

Seeing an internally consistent move in bond (more bullish) and equity (more bearish) sentiment.