It was another disappointing week for dollar bulls with the disappointment from non-farm payroll report. However, it wasn't exactly the best kind of week for dollar bear neither. Weakness in the greenback was relatively limited after job report announcement, except versus Canadian dollar. Major dollars were indeed stuck in familiar range and the greenback closed the week just mildly down. Also, sterling was the weakest one over the week, registering losses against all other major currencies. The near term outlook in forex markets remain generally neutral in the early part of this week and we'll wait to see how traders make up their mind. Meanwhile, in other markets, stocks staged an impressive rebound on Friday which means that recent consolidations are going to continue. Gold rebounded too but stayed in recently established range. Crude oil also struggled to find the needed momentum for breakout.

The weak September job report, with lower than expected headline growth number, downward revision in prior month's figure and zero wage growth, should have dented some expectations of rate hike by Fed in December. Based on latest futures data, markets are pricing in 33% chance of December hike. That was quite a drastic decline comparing to Thursday's pricing of 42%. And, the 33% odds didn't look too bad when it's compared with last month's pricing of 35.8%. Also, overall, Fed officials who spoke after the last FOMC meeting, including chair Janet Yellen, were also firm on a rate hike this year. Another reason for the lack of follow through selling in dollar is that there are talks that other central banks, including ECB and BoJ, would possibly adopt further easing to push down their currencies if Fed doesn't hike.

The development in dollar index was also a bit puzzling. The initial post NFP dip argues that rebound from 92.62 has completed at 96.70 already and the index is heading back to this support. However, subsequent recovery dampened this bearish case. And considering major dollar pairs are generally bounded inside recent ranges, we'll turn neutral in dollar index first. But break of 96.70 resistance is needed to confirm rebound resumption to 98.33 resistance. Otherwise, another fall through 94.06 is mildly in favor. In that case, strong support should be seen fro 38.2% retracement of 78.90 to 100.39 at 92.18 to contain downside and bring rebound to extend the consolidation from 100.39.

The spotlight would turn away from US for this week to UK, Japan and Australia. RBA will announce rate decision on Tuesday, BoJ on Wednesday, BoE on Friday. All are expected to keep policies unchanged but there are chances of some dovish languages from the announcements. There are speculations that RBA would cut rate by as much as 50bps next year and markets will look into the RBA statement to see if there is any sense of pessimism in the economic outlook. BoJ's view on recent drop in CPI core into negative territory would be scrutinized. Meanwhile, MPC rate vote will be watched to see if Ian McCafferty would continue to vote for a hike.

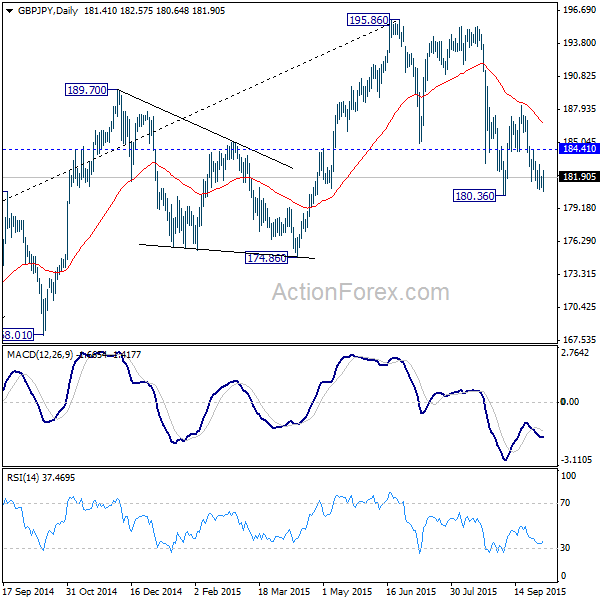

Comparing the three currencies, yen is having an advantage over both. Aussie looks a bit weaker than Sterling but there is risk of reverse in strength between them. GBP/JPY showed some weakness last week but lost momentum ahead of 180.36. Initial bias is neutral this week first. A break above 184.41 minor resistance will extend the consolidation from 180.36 with another rise. However, break of 180.36 will extend the fall from 195.86 to 174.86 key support level next.

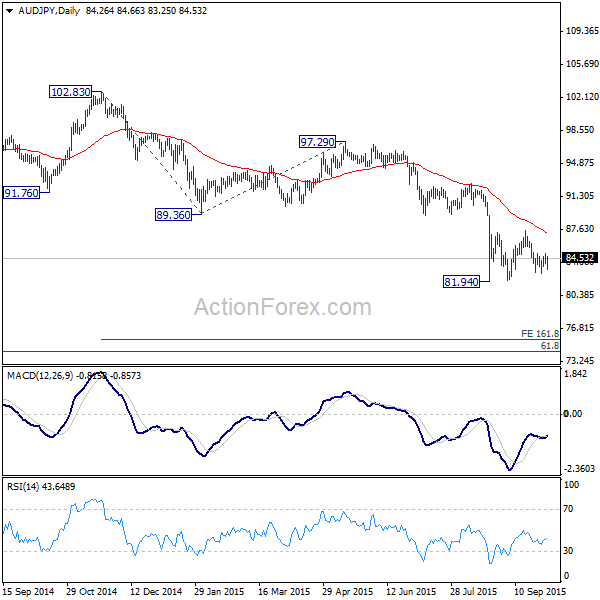

AUD/JPY turned sideway after hitting 81.94 and the corrective structure suggests that recent decline isn't over yet. While some more consolidation might be seen, a downside break out is expected later. Break of 81.94 will extend the whole fall from 102.83, which is part of the down trend from 2013 high of 105.42, to 161.8% projection of 102.83 to 89.36 from 97.29 at 75.49.

GBP/AUD turned sideway after hitting bother the medium term upper channel line as well as 100% projection of 1.4382 to 1.9185 from 1.7215 at 2.2019. A short term top was formed at 2.2397. So far the price actions from 2.2397 look like it's forming a sideway pattern. And the cross is also supported above 55 days EMA (now at 2.1410). Hence further rally remains mildly in favor. However, sustained break of the 55 days EMA would possibly drag the cross back to channel support (now at 1.92).

Regarding trading strategies, USD/CAD reached 1.3456 but missed our target of fibonacci level at 1.3469. The long position was closed on subsequent sharp reversal. USD/CHF long also hit our stop and was closed as there was no follow through buying after it hit 0.9842. EUR/GBP long was enter on break of 0.7421 resistance and we'll keep a stop at 0.7300. Meanwhile, we'll look at selling AUD/JPY on break of 81.94 support this week.