Dollar strengthened across the board last week as a number of Fed officials, including chair Janet Yellen, reiterated their view that there will be a rate hike by the end of the year. Nonetheless, traders seemed remain rather unconvinced by it yet. As of Friday, fed fund futures were only pricing in 39% chance of a rate hike in December, practically unchanged from a month ago. It's believed that there remains so much uncertainty from now till December. And a number of factors are needed to solidify the rate hike. That would include stability in the financial markets, a string of solid economic data, as well as no more shocks from other parts of the world, including Europe and China. And, the employment data to be released from US this week will be the first test for the greenback.

Technically, dollar's strength was a bit unconvincing too. The dollar index breached near term resistance of 96.61 to 96.70 before closing at 96.29. Momentum is seen as a bit weak. EUR/USD was held above 1.1086 support so far, in spite of speculation of expansion of stimulus by ECB. USD/JPY also stayed in familiar range of 118.58 to 121.62. AUD/USD was also held above 0.6905 support despite weak China data. Sterling, Swiss Franc and Loonie all breached recent support against the greenback. But there was no follow through selling after that.

Nonetheless, further rise will remain cautiously in favor in dollar index as long as 95.45 minor support holds. And the rebound from 92.62 would extend to 98.33/100.39 resistance zone. At this point, we don't see any strong momentum to push through 100.39 yet. And the sideway pattern from there might extend with another fall. Meanwhile, below 95.45 will possibly bring a test on 92.62 support instead.

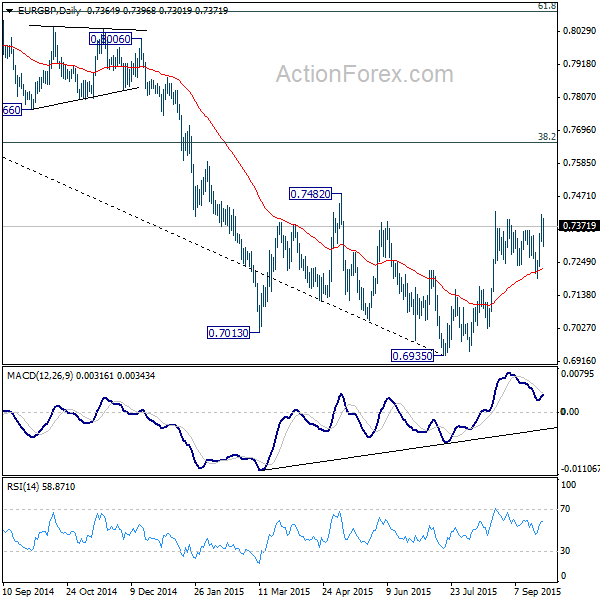

An interesting development to note is the weakness in Sterling. BoE is still expected to hike interest rate next year, after Fed. Thus, talk of Fed hike should also give support to sterling. However, the pound was indeed the second weakest major currency last week, next to Aussie, in spite of the FOMC talks. EUR/GBP also shrugged off speculation of ECB QE expansion and jumped to close at 0.7371. The path of Sterling down the road is worth some attention this week, in particular with PMI data scheduled to be released. A break of 0.7421 resistance would likely send EUR/GBP through 0.7482 resistance to medium term target of 38.2% retracement of 0.8806 to 0.6935 at 0.7650.

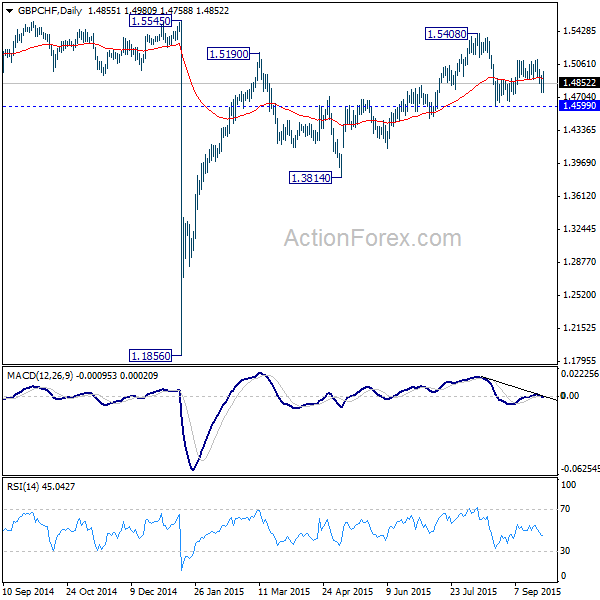

Meanwhile, GBP/CHF also showed much some weakness that last week. The development suggests that recovery from 1.4599 was merely a corrective pattern and fall from 1.5408 might be ready to resume soon. Break of 1.4599 support will firstly resume the decline from 1.5408. And more importantly, that should be treated as at least a correction to the rebound from January's low of 1.1856 support. And GBP/CHF would fall further to 1.3814 support in that case.

Regarding trading strategies, we entered long in USD/CAD on break of 1.3353 and USD/CHF and break of 0.9823 last week. While momentum was a bit unconvincing, we'll hold on to the positions first. Stop will be put at 1.3230 in USD/CAD and 0.9660 in USD/CHF. Initial targets are fibonacci level at 1.3469. in USD/CAD and 1.0127 in USD/CHF. We'll adjust the target and stops later. Meanwhile, to ride on the possibly weakness in sterling, we'll buy EUR/GBP on break of 0.7421 resistance this week.