CHF/JPY: Long

Position has been opened on May 6. The pair has a rank of 3, meaning it's at the top of the Ranking and Rating list. The CHF has a currency score of 7 and the JPY a score of 1. The Weekly chart is looking strong but the Daily and 4 Hour chart are showing some consolidation. However, the currency score difference is 6 and the CHF is showing strength against almost all pairs except the GBP. Also, the JPY is the weakest currency at the moment, so the current long position will remain open.

Possible positions for this week

The EUR/GBP looks like an opportunity and has a rank of 5. The GBP is the strongest currency at the moment with a score of 8. The EUR has a score of 3 being one of the weakest currencies after the NZD(2) and the JPY(1). The Weekly and Daily chart are looking strong for going short but the 4 Hour chart shows some signs of a possible pullback in the coming period.

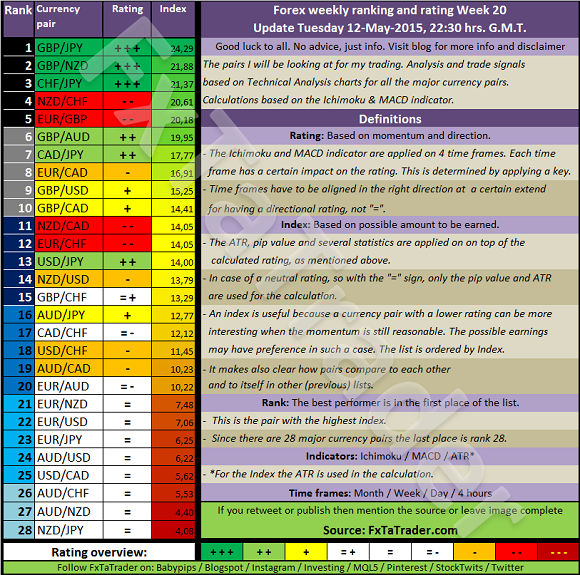

FxTaTrader Forex weekly ranking and rating Week 20 / Update Tuesday 12-May-2015

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every week the Forex ranking rating list will be prepared in the weekend. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.

There will be 2 updates during the week on Tuesday and Wednesday. The Daily and 4 Hour chart will then be analyzed and updated. This makes that there will be no more than 48 trading hours between each update. This is a reasonable period when considering that the smallest time frame used is the 4 hours, meaning 12 price bars/candlesticks.

The Forex ranking and rating list is meaningful data for my FxTaTrader strategy. Besides this list, I also use the Currency Score, which is also available once a week on my blog at FxTaTrader.com together with my weekly analysis on my Strategy.

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments.