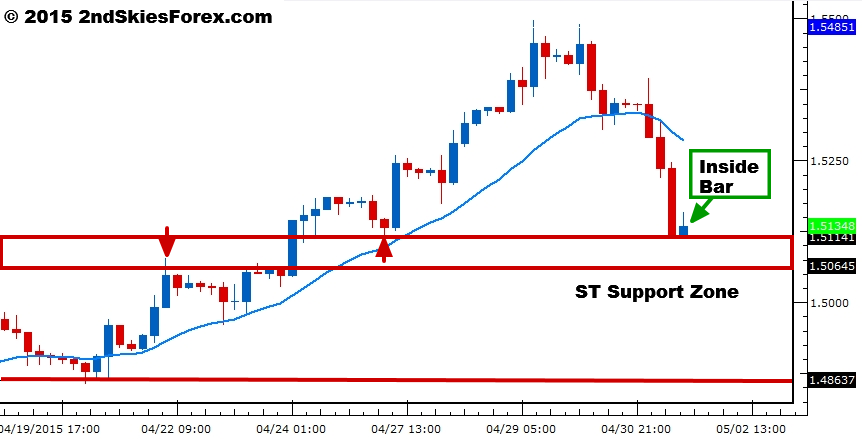

GBP/USD – Inside Bar At Key Support Zone (4hr chart)

Forming a double top and failing at the ‘big figure‘ of 1.55 last week, the Cable got murdered to end the week, dropping 4 handles in a couple of days.

The pair then formed and inside bar at a key support zone, suggesting some mild profit taking to end the week, but no real presence of strength by the bulls.

The key support zone for the pair ST comes in at 1.5115 – 1.5065. A break below this zone opens an attack on 1.4863 so lots of potential upside remains.

Unless that large bar at the end of the move was exhaustion price action selling, then I’m suspecting another leg down after a small pullback. Only a strong impulsive bounce here changes my ST bearish bias.

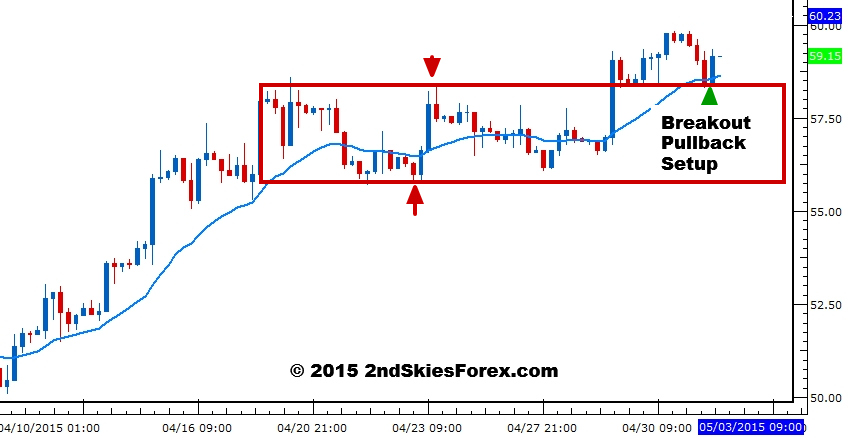

WTI Oil – Bullish Breakout Holding (4hr chart)

Last week we talked about the ST corrective phase in WTI between 58.20 and 55.75 as being a bullish sign with a likely breakout and breakout pullback on the cards.

As you an see from the chart below, this is exactly what happened with an upside breakout pulling right back to the 58.20 level before bouncing higher.

Some members profited from this so congrats to those who did. For now, ST & MT we have a bullish bias while above 58.20 and 55.75 on a daily closing basis. Beyond 60, I’m not seeing much resistance till about 64 and 73.