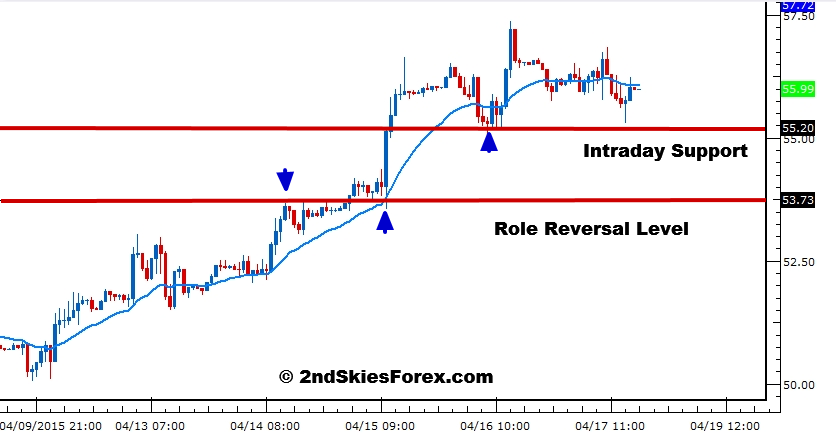

WTI – Corrective Price Action Structure Near Highs (1hr chart)

After breaking above the key resistance at 53.80, the breakout pullback setup we suggested has profited nicely. To end last week, WTI Oil has formed a corrective price action structure near the highs.

ST this helps with the bullish bias with intra-day support coming in around 55.20.

Below here we have the former resistance turned support at 53.75/80 where I’m suspecting some bulls will want to defend, thus another potential level to get long.

EUR/USD – ST Bullish, MT Bearish Below Key Resistance (4hr chart)

Continuing with our ST bullish bias, the Euro has continued to climb since we changed our bias last week. It has bounced off the role reversal level around 1.0715 and climbed higher both days.

MT we are in a bearish trend while below 1.1030 on a daily closing basis. Even ST we can see the structure is bullish, but the larger pullback is not dominantly bullish.

For now, we’ll look to sell at the key resistance level above.