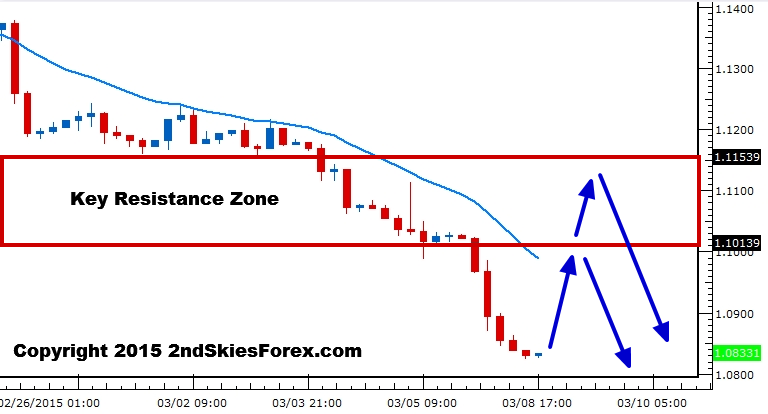

EUR/USD – Closes Below 1.10 ‘Big Figure’ with Short Trade Profiting, 1.05 Up Next (4hr chart)

As we talked about last week, we expected the EUR/USD to hit 1.0850 after taking out 1.10. The pair ended the week just below that hitting our target on our short live trade setup. We are now at over 12 year lows for the pair, so am expecting the bearish bias to continue.

I’m looking for a pullback to a resistance level to get short with my first being around 1.1012 and the next being 1.1154. Only a daily close above the latter changes the ST & MT bearish bias. Downside targets are the ‘big figure’ at 1.05, with parity looking increasingly more likely by the end of 2015, and likely sub-parity in 2016.

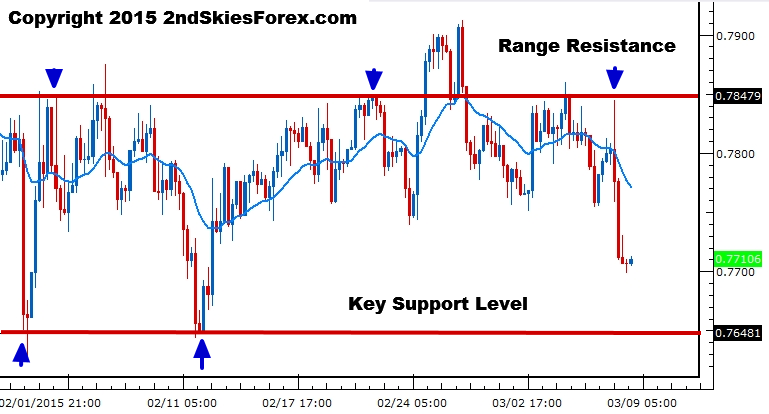

AUD/USD – Range Resistance Sell Setup Profits (4hr chart)

As we talked about last week, the two key resistance levels to sell for the Aussie were at 7900 and 7847. The lower level held before some impulsive price action selling ensued, sending the pair to a three week low just above 7700. The next support comes in at 7648 which is really the ‘line in the sand’ for the bulls.

If this breaks, then we should see some impulsive follow through as some medium term stops should be tripped and renewed selling interest entering. For now, the two aforesaid resistance levels are locations to sell while bulls can look at the 7650 for potential longs.

I’m remaining neutral to bearish while in this range and below 7900. Below the yearly lows puts 7500 on deck.

Also in our members commentary today, we cover the NZD/USD, USD/CAD, GBP/USD, EUR/GBP & USD/CHF.