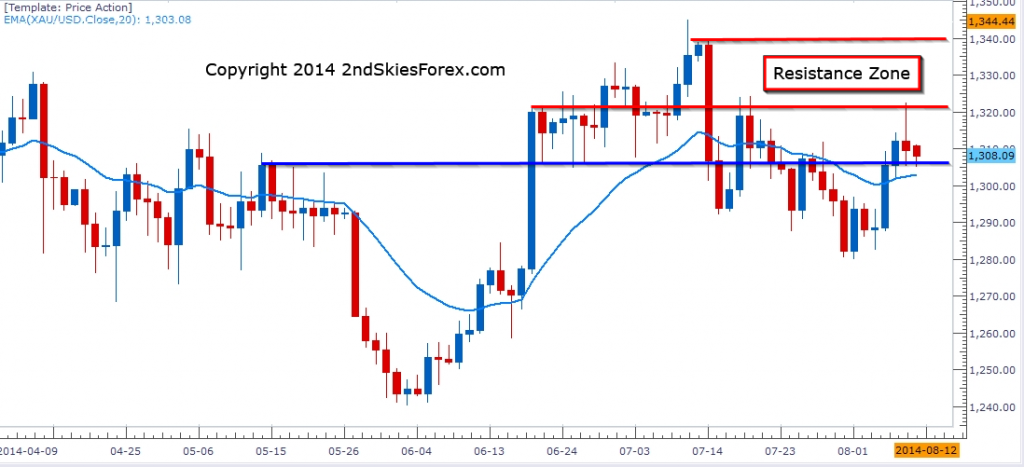

Gold – Intra-day Correction In Place, Watch for Break Short Term

In the members commentary last Thursday, we talked about the key resistance short term for gold being the 1324 area, and that if the precious metal rejects from here, expect a round trip back down towards 1306.

As we can see, the PM fell lower from a high of 1323 last week, heading right back down to 1306, so congrats to the members who profited from this trade setup.

For now, intra-day we have to watch the 1303/00 and 1313 levels to watch for the next major direction. While long term we are still in a down-trend, medium term we are in a range with some bullish under-pinning. If 1324 folds, then the 1331 and 1341 levels will be tested.

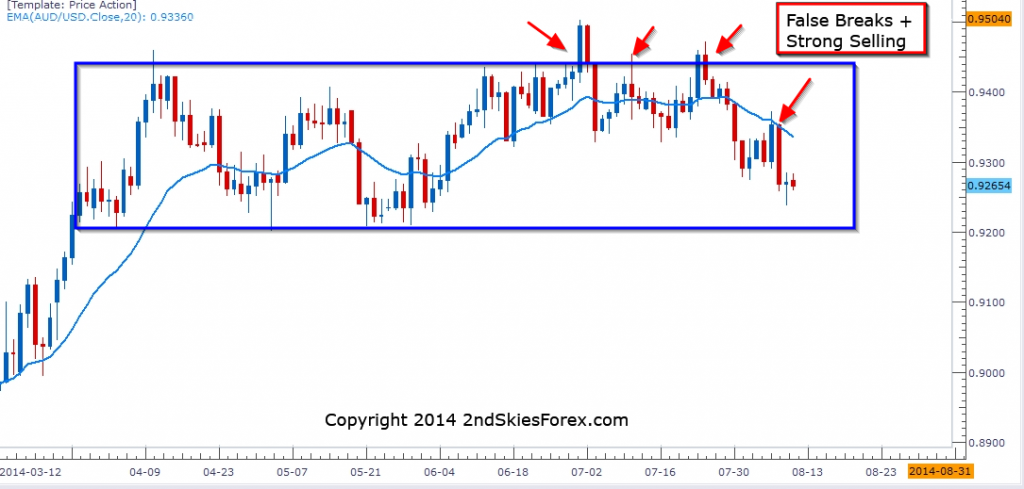

AUDUSD – Large Range in Play, Heading Towards Range Support

Since April this year, the Aussie has been largely contained within a +230 pip range between 9200 and 9435. The pair attempted to head north outside of the range, but had three false break setups, all leading to lower prices.

You’ll notice the general tendency after the false breaks is not consolidation, but of strong selling, further cementing the 2-way market, but also the presence of sellers willing to cap the upside.

For now, the pair seems like it wants to head for the 9200 key range support before buyers step in, and sellers cover their shorts. Bulls can look to play the range buying at the support, while sellers will want a daily close below this, or a weak rally to the top of the range before selling again.

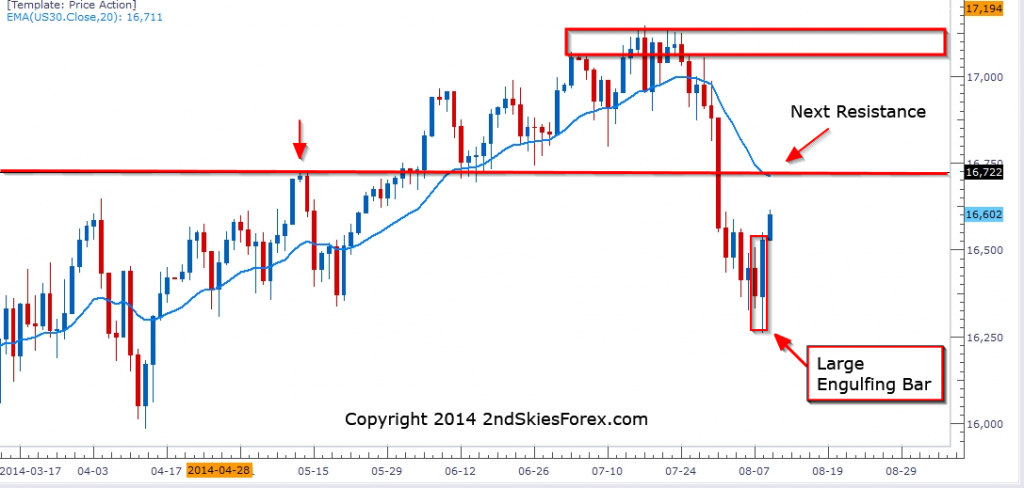

Dow Jones – Engulfing Bar Followed Up By Strong Buying

As we opined in our daily members commentary to end last week, we felt the price action of the major US indices hinting at bottoming and should bounce from here, likely closing green on Friday. We even tweeted about before the US open on Friday (see below):

Live Tweet Global Indices Will Bounce

As we can see, the Dow Jones did just that, forming a large bullish engulfing bar on Friday. Today the Dow has literally opened and climbed from the get-go, up +75 points on the day. The next major resistance comes in at 16722.

If the bounce forms a V-bottom with several bull closes taking out 16722, then expect a retest of 17000 and perhaps the yearly highs as bears will likely capitulate after 16722 and wait for the yearly highs before re-entering.