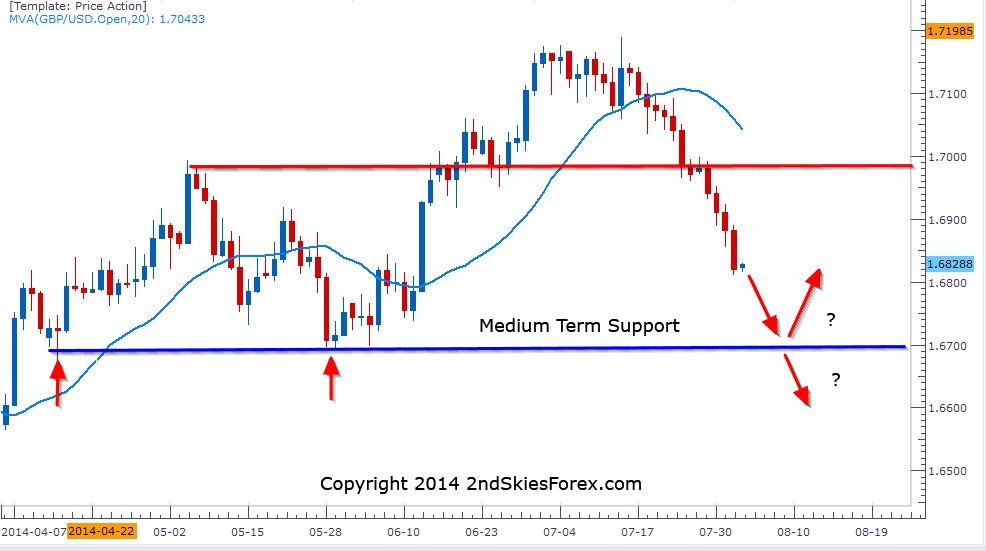

GBPUSD – Approaching Key Support Levels

Selling off for 12 of the last 13 days, the Cable has now broken below the 1.6900 support level, and appears to be picking up momentum. In regards to this last point, notice how the candles are getting larger, having larger bodies with only small wicks to the downside.

For now, bulls will have to wait till 1.6700 before bringing in longs, while bears will target this level. Watch the 4hr chart to see if the structure of the trend turns from mildly balanced to heavily balanced. If it does, then we could see some stalling or a potential reversal. But if the structure remains the same, then look to get short on pullbacks targeting 1.6700 where bulls will likely cover their shorts.

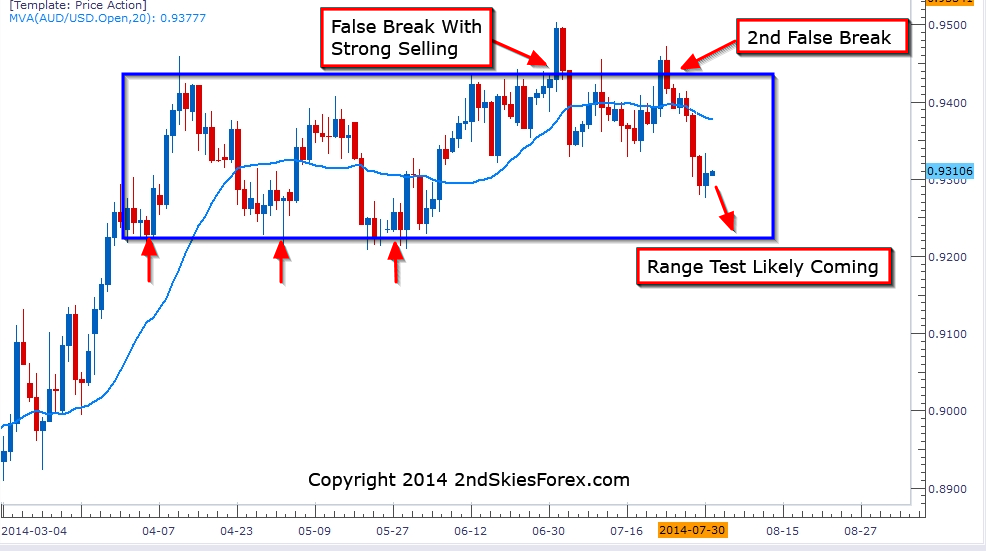

AUDUSD – Likely Range Test Coming Up

Stuck between the 9210 and 9450 range, the Aussie appeared to be forming an upside breakout, consistently building a higher base. Instead, the pair produced two false breaks with the first one running into heavy selling, and a second attempt failing, pushing the pair back in the range.

The more logical scenario from here is a range test of the floor around 9200 before bulls decide to enter the frey. Those wanting to get long can look for intra-day price action signals, or a corrective basing near the range support. If this level holds, then a retest of 9350 and 9450 would be in order. If the 9200 floor fails, then we’d see further unwinding as this would mean the false breaks were intimating a re-distribution phase of price action, and likely institutional profit taking.

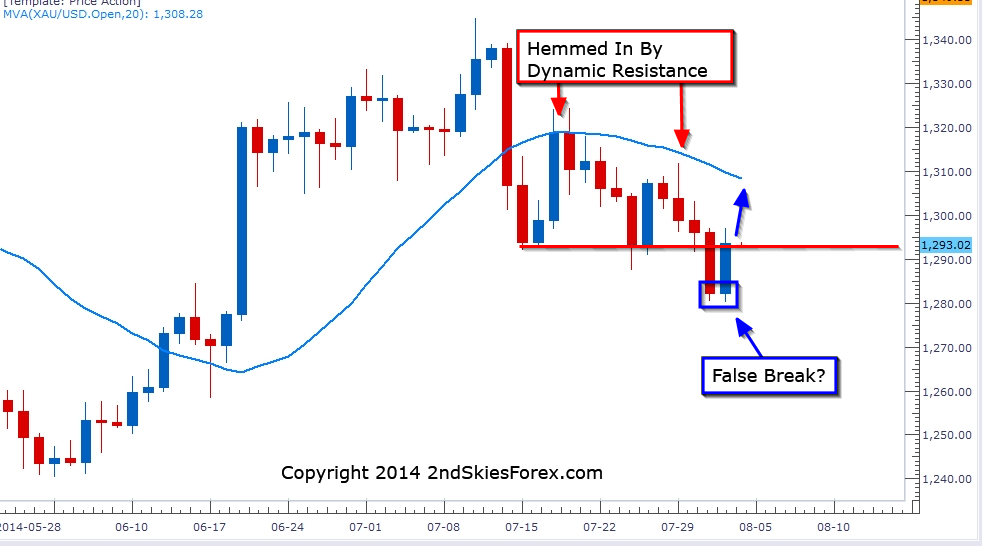

Gold – False Break, But Hemmed In

Since July 14th, Gold has been hemmed in by the 20 ema and dynamic resistance. Each solid upside thrust has met the line and fallen lower. Since this time, strong bullish closes have been met by at best one more day of buying before printing new lows.

The precious metal did though bounce strongly from the NFP numbers, creating a potential false break setup. Right now, the PM is just below 1293, which was support two times before failing, thus potentially acting as a role reversal level. Bulls will first need to clear this level to inspire more buyers. After that, it will have to take out the 20 ema.

If either of these levels hold the line, then the 1280 lows will be re-attacked, and mean the bear trend is continuing.