GBPUSD – Short Term Bearish but Approaching Critical Support

After peaking at 1.7200 a few weeks ago, the Cable has now sold off for 8 days straight losing a few cents in the process. This puts the possibility into play the pair may be headed for a larger correction, and keeps the short term bias to the bear side.

For now, watch the key support zone between 1.6970 and 1.6912 for buyers to step in, or hold the line. If they fail to do so, and this collapses, then 1.6800 and 1.6700 will be put to test in the near term.

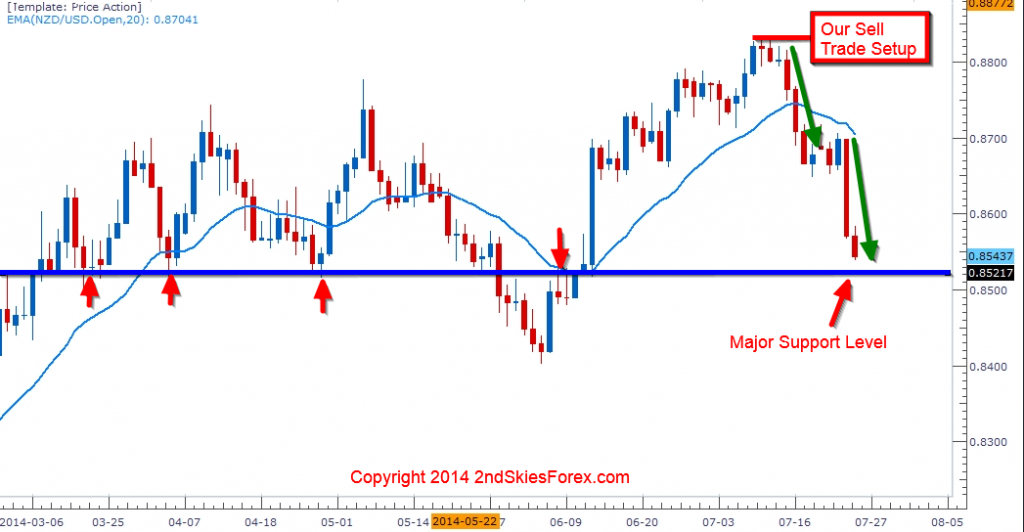

NZDUSD – Corrective Consolidation Leads to Bigger Losses

Back on our July 16th market commentary, we talked about the pair being bearish after our short trade just below 8842 profited heavily. We further opined how if the kiwi could take out the days lows, then we expect a deeper pullback towards 8575.

As you can see, the pair fell much lower from our sell trade setup below 8842, and after a few days of consolidation, hit the 8575 target.

For now, the pair is sitting just above the key support at 8520-8500. If this level holds, then the range should dominate, offering bulls a chance to get long and target 8657 for a good risk to reward setup. If however the level folds, then the 8408 June lows will be under threat.

Gold – Forms False Break of 1292 Support

After getting hammered on virtually every US or EU open for the last 6 days, Gold broke through a key low in 1292 which had held the precious metal up for over a month. However, after immediately closing below the level, the PM found some buyers who stepped in strong forming a false break setup, ramping heavy into the close (4hr chart below).

This changes the short term price action bias from bearish to bullish while above 1290 as it took out 1.5 days of gains in just over half a day. If the bulls maintain short term control, then the PM should push to challenge the 1324 level we’ve talked about in prior commentaries. This is the same level the pair double-topped at forming a pin bar rejection before selling off for 6 days.

If 1324 holds, then expect a ping-pong match between 1234 and 1290. If the bulls can push through here, then 1331 and 1341 will be tested next.