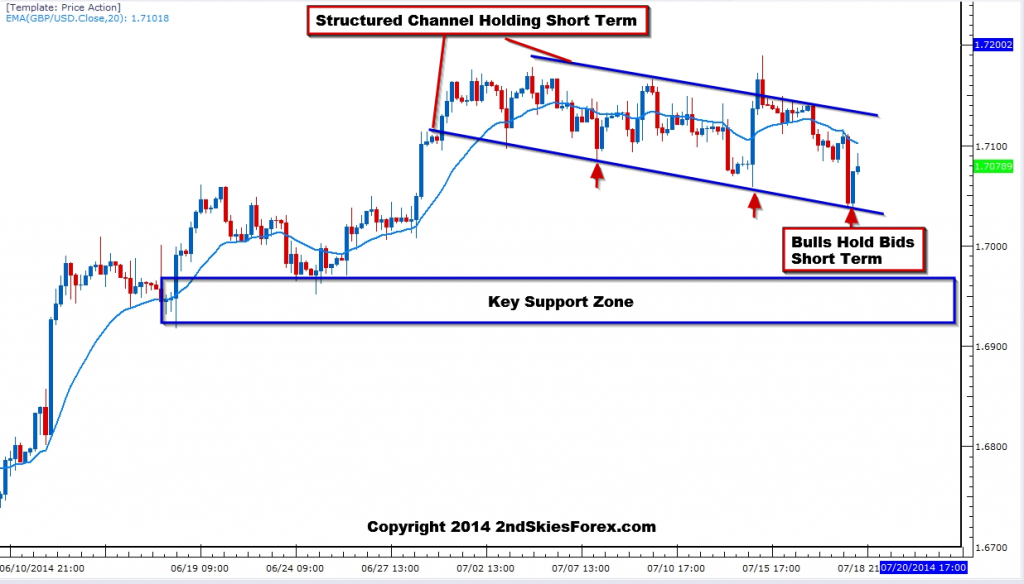

GBPUSD – Channel Still Dominates, Slightly Bearish ST

For most of July, the cable has been in a corrective price action phase, mostly holding inside a structured channel that we’ve been talking about in the prior member commentaries. The pair is attempting to find a base between 1.7050, and may need to go all the way to 1.6960/75 before finding bulls to support the price action.

For now, the medium term outlook is still bullish while above 1.6950. Short term the channel dominates so look to play the channel until it creates a more forceful directional move. Note how the last sell-off / 4hr bar was large and closed on the lows, yet immediately reversed, showing some bulls are interested in buying on dips.

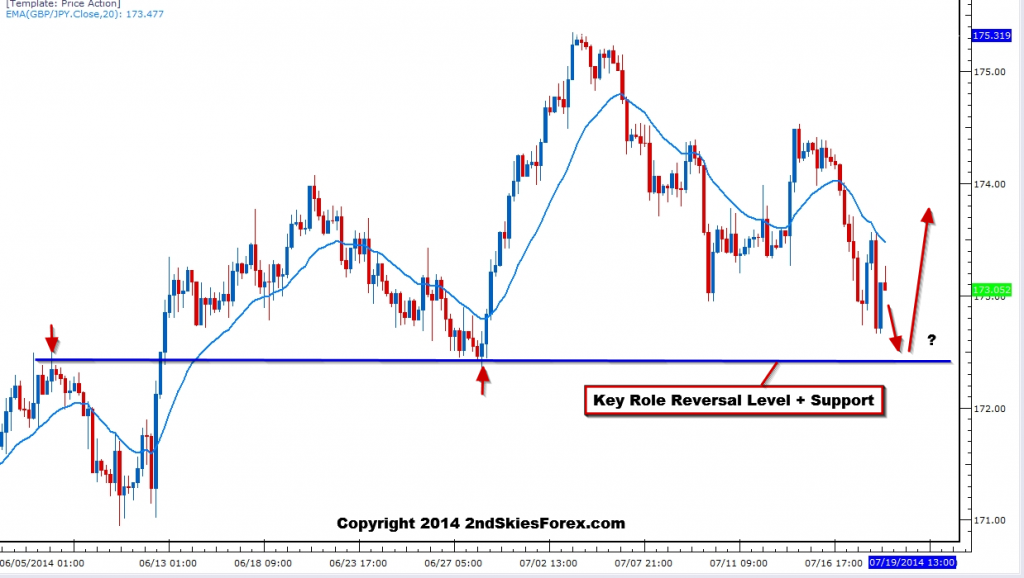

GBPJPY – Still Under Pressure Due to Event Risks Short Term (4hr chart)

As we talked about last week in the daily market commentary, we opined how the GBPJPY was attempting to stabilize above 172.75/60 area, after being hammered due to the event risks in Gaza and Ukraine.

For now, JPY pairs should be under pressure until those geo-political events stabilize, so watch the key support level around 172.50 below. If this folds, then we could see more bearish pressure resume, with a possible test of 171 near term.

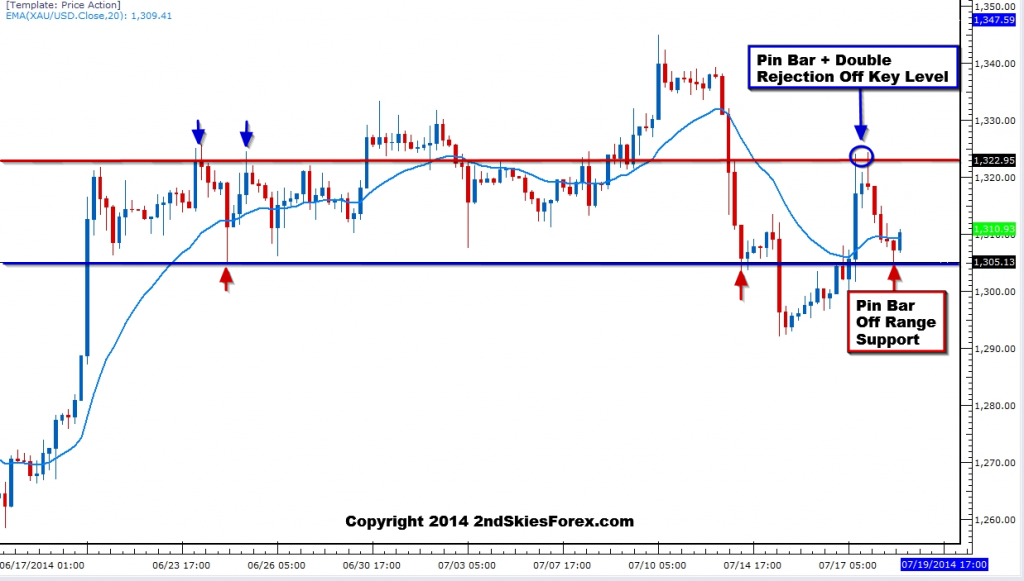

Gold – Dual Pin Bars Off Range Barriers

After bouncing heavy last week on the risk off events, you’ll notice how gold formed a double top off the key 1324 level we talked about recently. In the process of attempting to break through these barriers, it formed a pin bar signal, and then sold off heavy after, ironically at the range support and 1306 that we profited from in prior commentaries, also forming a pin bar rejection.

For now, the range dominates between 1306 and 1324. If 1324 holds the upside, then look to sell and play the range. If 1306 folds, then watch 1292 carefully. If this folds, we could see a larger unwinding towards 1267 and 1257. If 1324 gets broken to the upside, then 1333 and 1341 will be under pressure.