EURUSD – Line of Least Resistance

As we’ve been stating in our members commentary, with the Euro selling off all but one day for the last 5 (now 6), and with the consolidation, plus the dynamic resistance and daily 20 ema above, we feel the line of least resistance is down until we get a daily close above 1.3675. So maintain a bearish bias till the daily can close above the short term resistance level. If 1.3500 folds, then 1.3465 and 1.3300 will be targeted.

WTI Crude Oil – Buyer on Pullbacks

With the geo-political tensions in the Middle-East on the rise, it is no surprise Oil gained heavily on the week. We expect this bullish momentum to continue for the coming week, although we are anticipating a pullback.

Our Trade Idea: For now, we remain buyers on pullbacks into the 104.75-105.21 range, targeting the 106.75 and 108.30 levels. Only a daily close below 104.30 will invalidate our bullish bias.

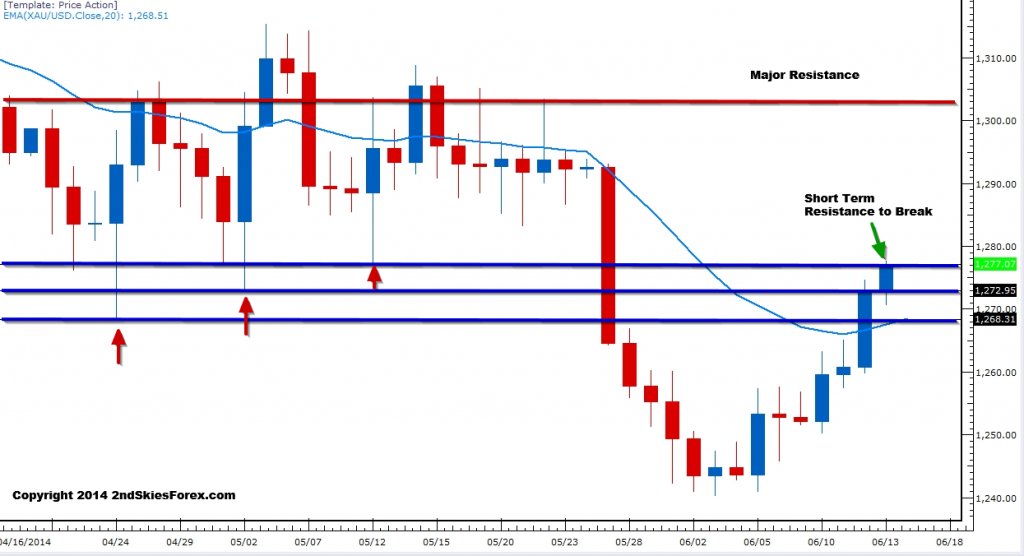

Gold – Bullish Momentum Continues

Closing now 6 out of 9 days bullish, the shiny metal is trying to work through some key resistance levels, after climbing on renewed fears of Middle-Eastern tensions. Thus far, the PM has cleared through 2 of the 4 key resistance levels, taking out 1267 and 1272. If it can get past 1277 and 1285, then we’ll likely see 1300+ in this coming week.

Our Trade Idea: Maintain a bullish bias while above 1268 and 1257. Weak corrective pullbacks towards the 1267 support zone and daily 20 ema could be good opportunities to get long targeting the aforementioned resistance levels. A daily close below 1257 means a more complex price action range structure will likely persist till the end of June.