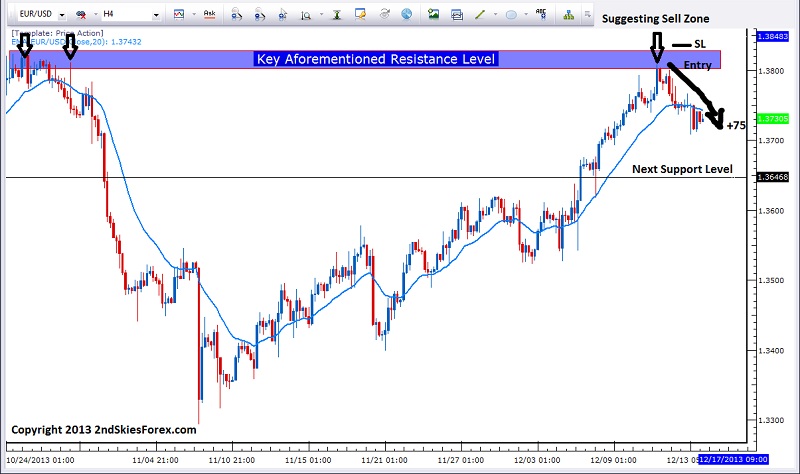

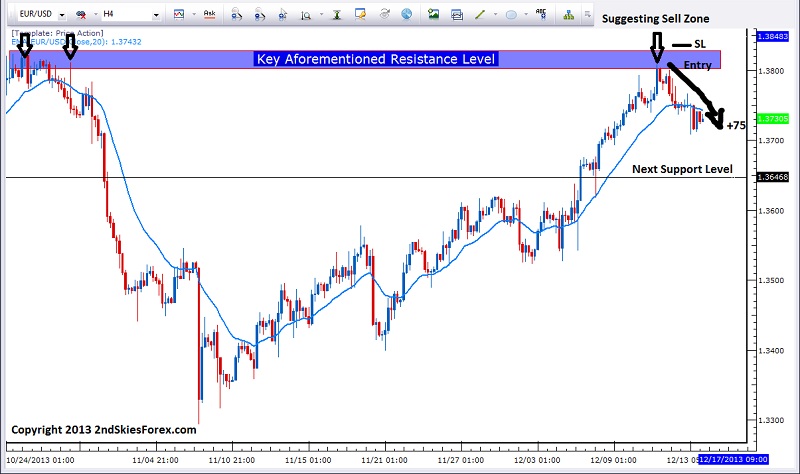

EURUSD – Sell Trade Recommendation @ Resistance Holds

Last week we suggested selling the EURUSD at the key resistance level of 1.3800/20 zone. After forming a double touch off this level over 20hrs, the pair sold off and has yet to return. Price action traders that sold off this level with a 25 pip stop are up handsomely with at least a 3R profit. The next key support is 1.3645 which will be the first test for the current bears. Bulls can look for intra-day price action setups there on corrective weakness heading into the level.

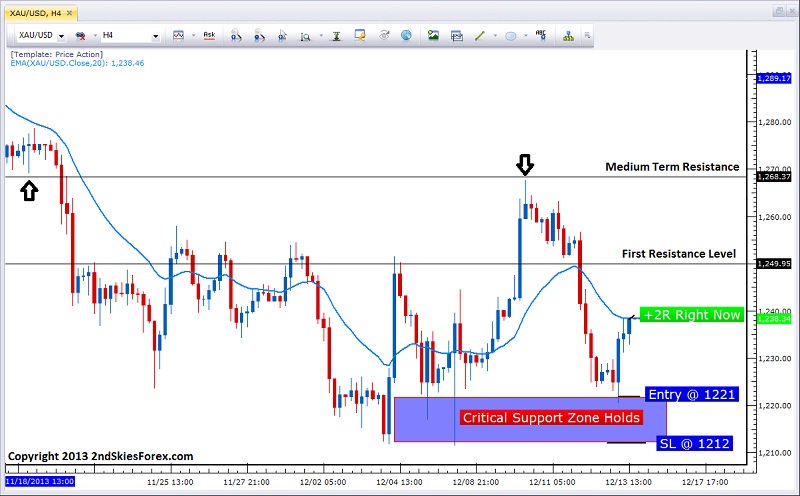

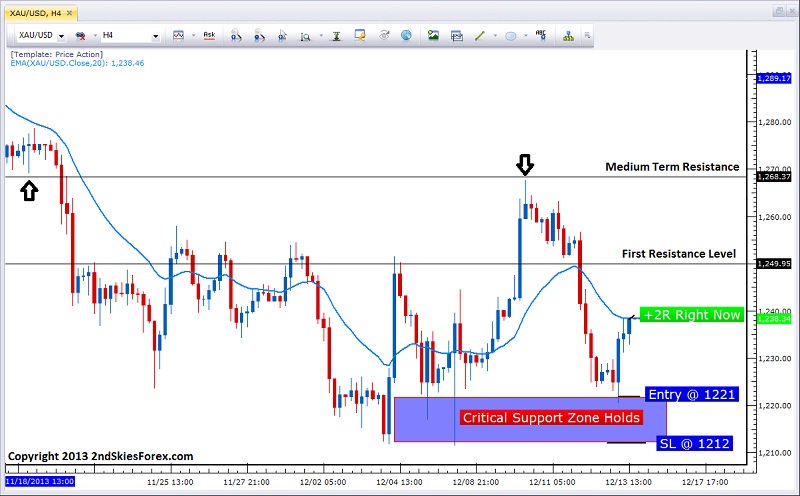

Spot Gold – Buy Recommendation @ Support Zone Also Profits

On Tuesday last week we recommended buying Gold at the support zone from 1221 to 1213 as we noticed some buying interest and some price action cues bids has stepped in that area – thus were likely to do it again. This played out exactly as planned with the precious metal barely going below the 1220 level, then launching higher. Currently that trade reco is up over +2R, so those wanting to close it can walk away with a handsome profit. For those wanting to hold a little longer, we feel that support zone should hold, and can target 1249 which is the next resistance level, and potentially 1267 with the first level offer another +1.5R, and the latter offering +4R. For now, we remain bullish while 1212 holds on a daily closing basis.

AUDUSD – Approaching Critical Support Zone

Down over +750 pips since late October, the impulsive downtrend has now formed four legs with this last one being the strongest two-day move (possible exhaustion selling). I suspect sellers will be covering heading into the major support zone and yearly lows between 8897 and 8842. I am open to taking a small long half the normal position size with stops just below the bottom of the zone. Bulls can look to target 8990, 9150 and 9275. Bears can meanwhile look for pullbacks towards 9100 or 9200 to trade with the trend and re-attack the yearly lows.

Original post

Last week we suggested selling the EURUSD at the key resistance level of 1.3800/20 zone. After forming a double touch off this level over 20hrs, the pair sold off and has yet to return. Price action traders that sold off this level with a 25 pip stop are up handsomely with at least a 3R profit. The next key support is 1.3645 which will be the first test for the current bears. Bulls can look for intra-day price action setups there on corrective weakness heading into the level.

Spot Gold – Buy Recommendation @ Support Zone Also Profits

On Tuesday last week we recommended buying Gold at the support zone from 1221 to 1213 as we noticed some buying interest and some price action cues bids has stepped in that area – thus were likely to do it again. This played out exactly as planned with the precious metal barely going below the 1220 level, then launching higher. Currently that trade reco is up over +2R, so those wanting to close it can walk away with a handsome profit. For those wanting to hold a little longer, we feel that support zone should hold, and can target 1249 which is the next resistance level, and potentially 1267 with the first level offer another +1.5R, and the latter offering +4R. For now, we remain bullish while 1212 holds on a daily closing basis.

AUDUSD – Approaching Critical Support Zone

Down over +750 pips since late October, the impulsive downtrend has now formed four legs with this last one being the strongest two-day move (possible exhaustion selling). I suspect sellers will be covering heading into the major support zone and yearly lows between 8897 and 8842. I am open to taking a small long half the normal position size with stops just below the bottom of the zone. Bulls can look to target 8990, 9150 and 9275. Bears can meanwhile look for pullbacks towards 9100 or 9200 to trade with the trend and re-attack the yearly lows.

Original post