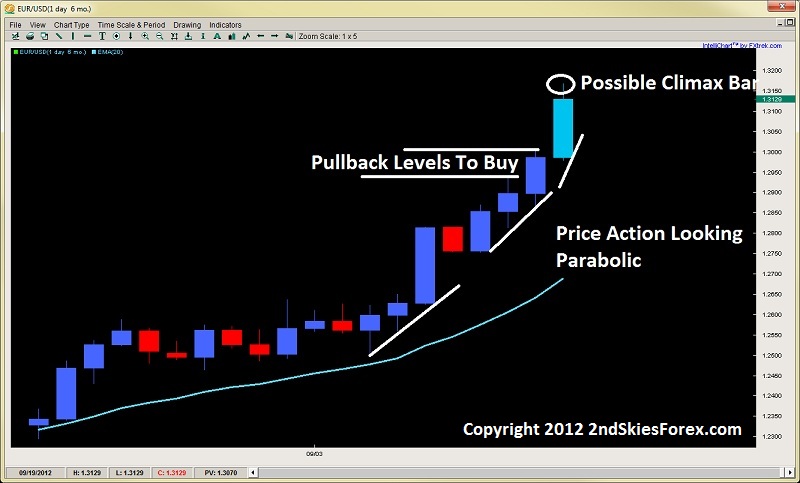

Gaining for 7 of the last 8 weeks and 7 for the last 8 days, the euro has looked impressive as its been given the green light from both Bernanke and the German Court (for now). Being that the trend is so strong, I’m only really looking for longs, but the price action is feeling a bit parabolic and climactic at this point.

Usually climactic price action means consolidation or pullback before the next leg up, so I’ll wait for pullbacks to get into this trend. My preferred levels for getting long are 1.300 and 1.2933 (or a really deep pullback to 1.2820). Bears can look for possible shorts on weakness heading into the weekly highs at 1.3167.

GBP/USD

After starting the week with an inside bar strategy last week, the pair broke higher with trend gaining 4 days in a row. As mentioned with the EUR/USD, I think the cable is turning parabolic and likely hitting a climax soon, thus time for some consolidation or pullback soon.

What I like about this pair is the upcoming major resistance and yearly high at 1.6300 coming up. Thus, bears have a great level to short the pair coming up, so watch for price action patterns off this level. Bulls can meanwhile to 1.6081 and 1.6000 before considering longs so plays on both sides.

AUD/USD

Also gaining 4 of its last 5 days last week, the Aussie ended a little weak forming a pin bar pattern off the 1.0600 swing highs. Looking at the nature of this pin bar, I’m suspecting there will still be a second push into the daily pin bar highs near 1.0600. I’ll look for pullbacks on the 4hr/1hr time frames for weakness looking to take an intraday short off this level. Meanwhile, bulls can look for a pullback towards 1.0533 or 1.0472 to rejoin the uptrend.

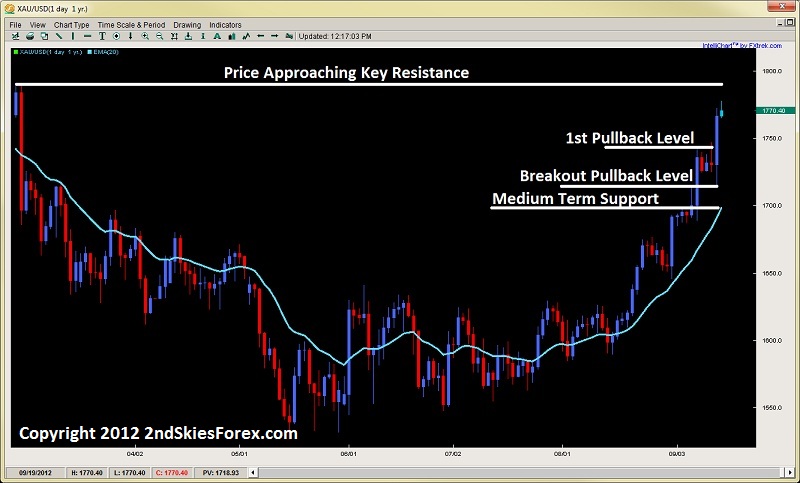

Gold

Forming three large with trend engulfing bars in the last few weeks, I’m expecting a pullback in the precious metal soon. Don’t get me wrong, i’m long physical and paper gold, but usually a pullback is coming after three ultra strong trend moves with only minor pullbacks. The shiny metal is approaching a key resistance at $1790 so bears have a possible area to sell. Bulls will have to look for pullbacks towards $1743, $1715 and $1696 to add longs so look for price action setups there.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Price Action Outlook

Published 09/19/2012, 06:50 AM

Updated 05/14/2017, 06:45 AM

Weekly Price Action Outlook

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.