EURUSD – Potentially Building for an upside Breakout

After rejecting 3x off the key 1.3815 resistance level, the pair sold off a few hundred pips, but has since entered a structured channel. What is interesting to note is the pairs inability to gun straight for the range bottom at 1.3320, which would have been more in keeping with the larger range.

Closing bullish 4 of the last 5 days after the false break suggests the bulls may be building up positions for an upside breakout. If they can take out the 1.37 swing highs, then the key resistance at 1.3815 will be under attack.

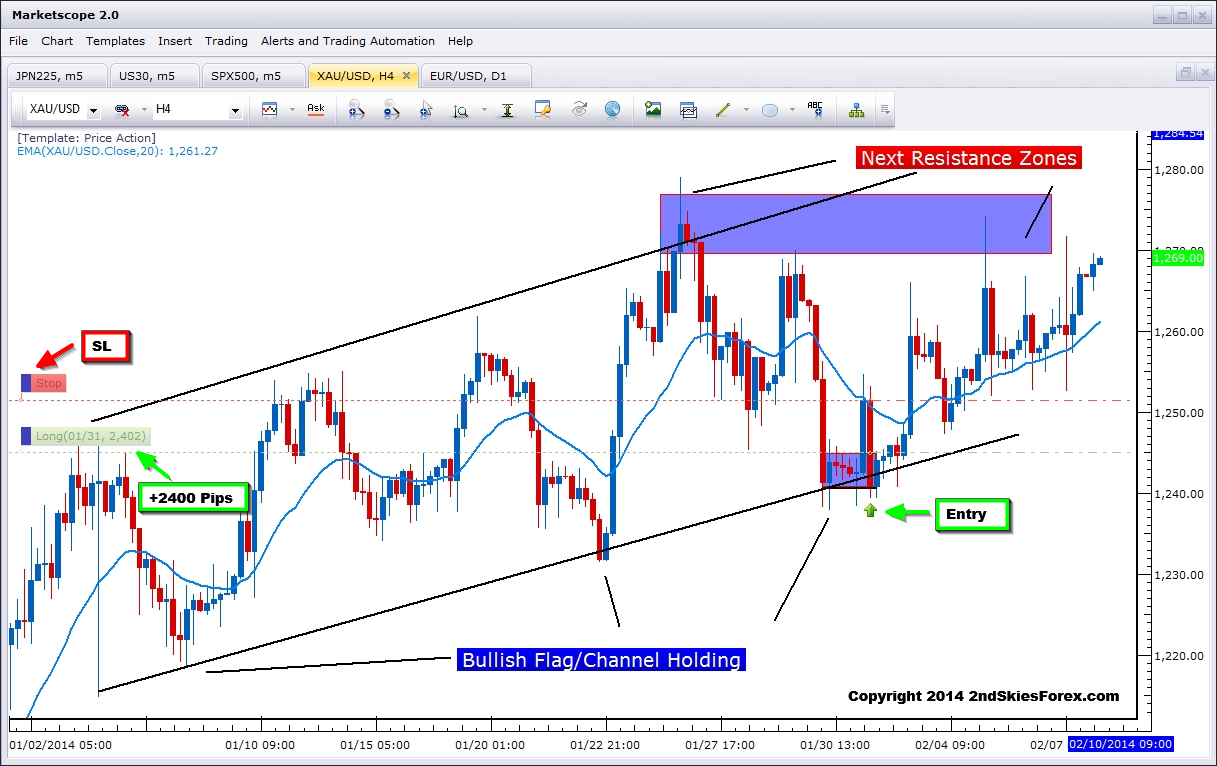

Spot Gold – Bullish Channel & Trade Progresses

Our bullish gold trade and bias has been working out quite nicely, with the key 1242 area holding, consistently building higher lows and higher highs.

You can see in the chart below I am currently long this pair (whoa, a price action trading mentor showing a actual live trade), entering at my suggested area, up about +2400 pips and 900+ locked in. Initial risk was about 400 pips, so already up about 6R on this trade and +2.5R locked in.

I am open to taking profit soon as the precious metal is approaching a key resistance zone between 1270 and 1278. Clearing the air up there will likely put 1289 and 1309 on deck and suggest a larger bull move is underway. Daily close below 1238 will negate the short term bullish bias.

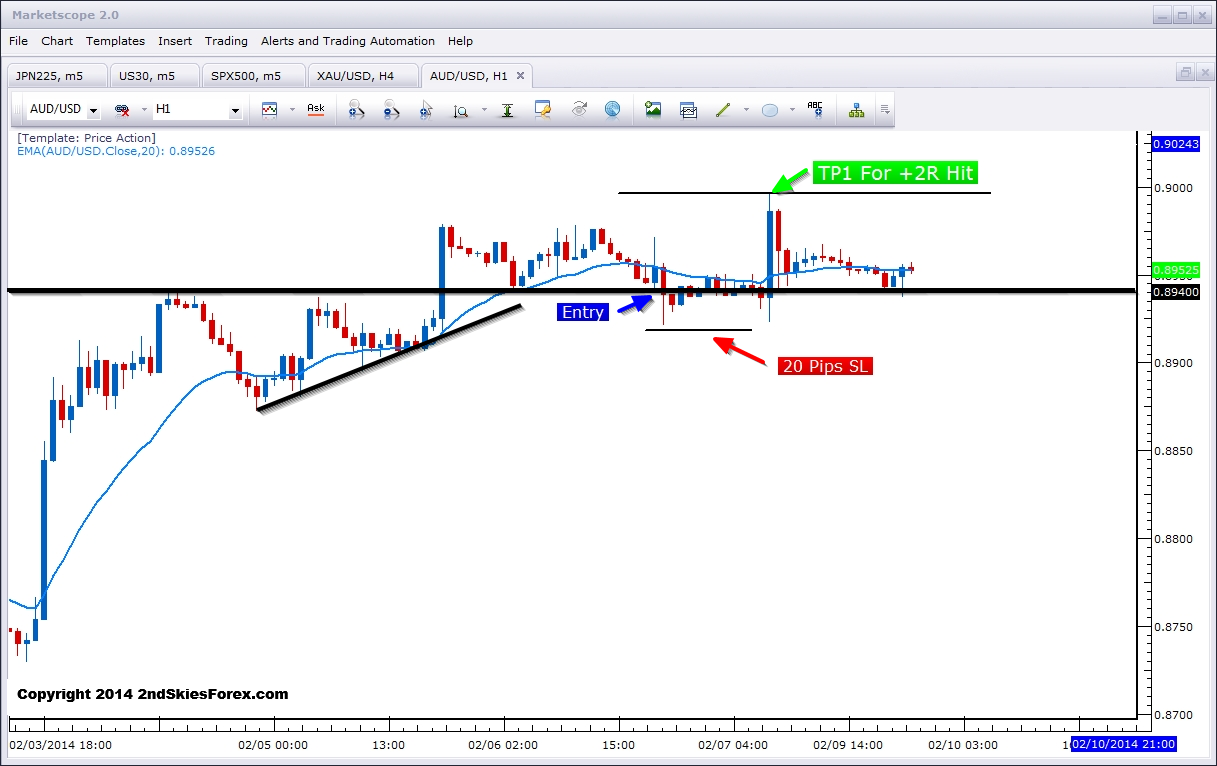

AUDUSD – Intra-Day Breakout Trade Hits +2R TP1

Our intra-day breakout trade recommendation to buy at 8940 hit the 8996 +2R target in less than a day. Anyone with a 20 pip stop would have survived (by a few pips) and walked away with a handsome 2R profit in under a day, so congrats to those who profited from this trade.

For now, the pair is consolidating and will need to have a 4hr close above 9000 to gain some fresh momentum. Until then, a slight bullish bias can be maintained short term while there are no daily closes below 8830/45.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Price Action Outlook & Key Levels

Published 02/10/2014, 03:50 AM

Weekly Price Action Outlook & Key Levels

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.