Investing.com’s stocks of the week

EUR/USD

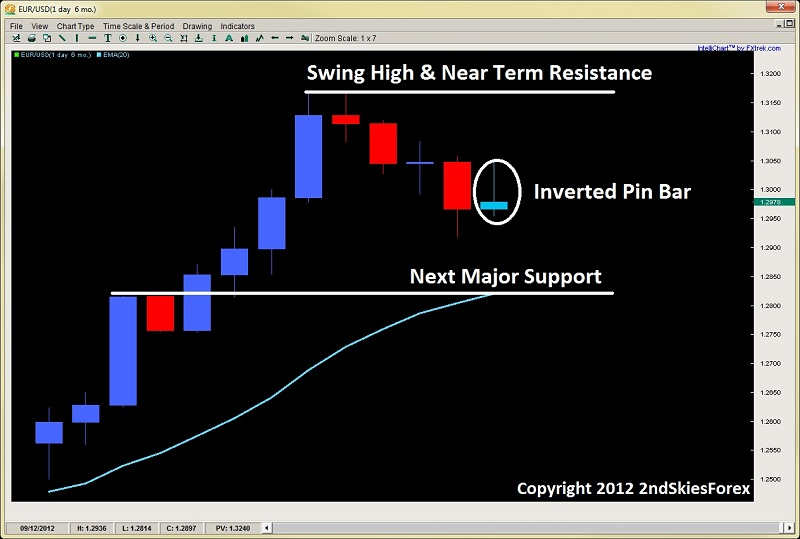

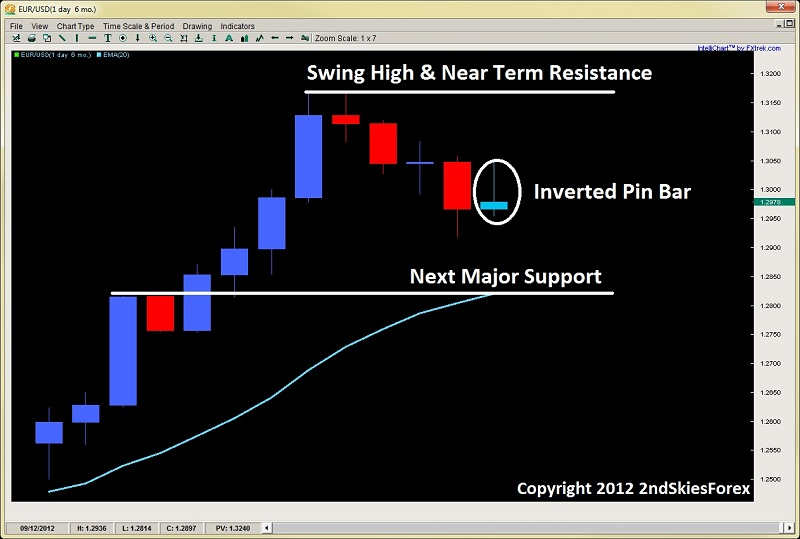

Posting its first bearish weekly close in 6 weeks, the EUR/USD ended the week forming an inverted pin bar which is also doubling as an inside bar. Remember, a bullish inverted pin bar in a bearish pullback is just an attempt to rally that failed. But even though it failed, it indicates there is some buying interest off the 1.2920 lows from Thursday.

The wick of the inverted pin bar is near the Thursday highs at 1.3058 so we have an intraday range that needs to be cleared. Intraday players can look for a possible long off the 1.2920 lows while short-term bears can short around 1.3058 on weakness. Otherwise, bulls can look for a pullback towards the dynamic support (also September 7th swing highs) at 1.2815 to take a long for a possible resumption of the uptrend.

EUR/USD" title="EUR/USD" width="800" height="539">

EUR/USD" title="EUR/USD" width="800" height="539">

GBP/USD

Unlike the euro, the cable ended the week right about where it started. This is interesting considering its been consolidating just below the key resistance at 1.6300 which is the yearly high posted in late April. The pair also formed a pin bar strategy at the key 1.6300 so there is clearly some strong selling interest there.

The overall consolidation at the highs is to be noted so bears shorting near the highs should be picky and look for intraday weakness. If the bears do reject price up here again and push price back below the weekly low at 1.6162, then we could see further unwinding towards 1.6065.

GBP/USD" title="GBP/USD" width="800" height="539">

GBP/USD" title="GBP/USD" width="800" height="539">

NZD/USD

After rejecting last week off of .8350 forming a pin bar reversal, the pair has mostly consolidated in a pretty clean range between .8223 (last weeks low) and the .8353 highs so nice plays for both bulls and bears until the range clears. It should be noted the pair formed a dueling swords pattern to end last week so a pullback towards the .8223 lows is likely. If the intraday price action looks corrective, I’ll look for longs off the weekly lows along with shorts towards the weekly highs should the intraday charts confirm.

NZD/USD" title="NZD/USD" width="1538" height="1061">

NZD/USD" title="NZD/USD" width="1538" height="1061">

Crude Oil

After forming a false breakout two weeks ago, the commodity sold off heavily after being rejected at the $100 mark, losing $9 over 3+ days. Although crude bounced to end last week, it rejected off the role reversal level at $94. If the intraday price action looks corrective heading back into $94, I’ll look for a possible sell here targeting $93 and a possible move towards $91.50.

Original post

Posting its first bearish weekly close in 6 weeks, the EUR/USD ended the week forming an inverted pin bar which is also doubling as an inside bar. Remember, a bullish inverted pin bar in a bearish pullback is just an attempt to rally that failed. But even though it failed, it indicates there is some buying interest off the 1.2920 lows from Thursday.

The wick of the inverted pin bar is near the Thursday highs at 1.3058 so we have an intraday range that needs to be cleared. Intraday players can look for a possible long off the 1.2920 lows while short-term bears can short around 1.3058 on weakness. Otherwise, bulls can look for a pullback towards the dynamic support (also September 7th swing highs) at 1.2815 to take a long for a possible resumption of the uptrend.

EUR/USD" title="EUR/USD" width="800" height="539">

EUR/USD" title="EUR/USD" width="800" height="539">GBP/USD

Unlike the euro, the cable ended the week right about where it started. This is interesting considering its been consolidating just below the key resistance at 1.6300 which is the yearly high posted in late April. The pair also formed a pin bar strategy at the key 1.6300 so there is clearly some strong selling interest there.

The overall consolidation at the highs is to be noted so bears shorting near the highs should be picky and look for intraday weakness. If the bears do reject price up here again and push price back below the weekly low at 1.6162, then we could see further unwinding towards 1.6065.

GBP/USD" title="GBP/USD" width="800" height="539">

GBP/USD" title="GBP/USD" width="800" height="539">NZD/USD

After rejecting last week off of .8350 forming a pin bar reversal, the pair has mostly consolidated in a pretty clean range between .8223 (last weeks low) and the .8353 highs so nice plays for both bulls and bears until the range clears. It should be noted the pair formed a dueling swords pattern to end last week so a pullback towards the .8223 lows is likely. If the intraday price action looks corrective, I’ll look for longs off the weekly lows along with shorts towards the weekly highs should the intraday charts confirm.

NZD/USD" title="NZD/USD" width="1538" height="1061">

NZD/USD" title="NZD/USD" width="1538" height="1061">Crude Oil

After forming a false breakout two weeks ago, the commodity sold off heavily after being rejected at the $100 mark, losing $9 over 3+ days. Although crude bounced to end last week, it rejected off the role reversal level at $94. If the intraday price action looks corrective heading back into $94, I’ll look for a possible sell here targeting $93 and a possible move towards $91.50.

Original post