EURUSD – Bearish Tone Short Term Dominates

As we suggested in our 2014 EURUSD currency market outlook, along with our weekly price action commentary last week, the EURUSD looked prime for a sell-off in the month of January, and it obliged. We suggested selling in the 1.3640-1.3700 resistance zone, and this held price action in check with no closes above this level. Anyone selling in this zone would have profited heavily so congrats to them.

We favor staying bearish short term, so will look to short on pullbacks into 1.3600 and 1.3640. Downside targets now become the key support level at the 1.3324/3300 area. Bulls will need to wait till these lower levels before considering longs.

Spot Gold – Sitting At Key Bullish Flag/Channel Support

After holding the line at the 1182 multi-year support level, Gold has been gaining ground consistently for the month of January. Now the precious metal is in a bullish flag/channel, sitting at the bottom of that channel as we speak, so critical that holds for the short term bullish outlook. The key level to watch for the next day or two would be the 1238/40 short term support level. If this holds, then perhaps another round-trip to the top of the channel around 1275, so plenty of upside. Bears should note the last three rejections off the channel support were pretty rapid, with this being the first time its held closely to the level.

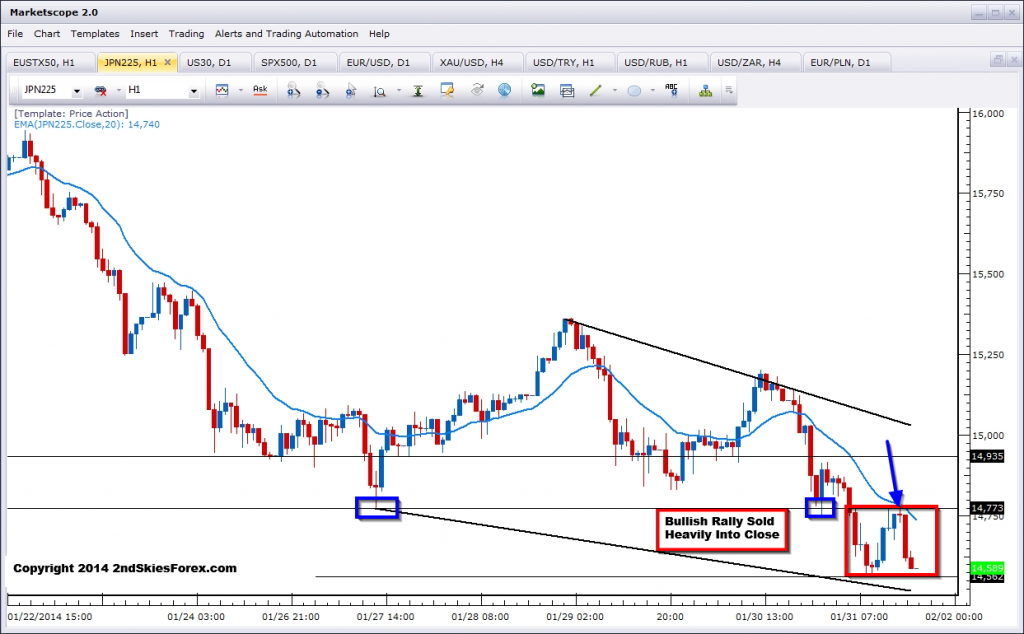

Nikkei 225 – Looking Incredibly Weak Compared to Most Indices

While all the major European and US indices rallied into the weekly close, the Nikkei 225 ended up on the lows. Looking at the intra-day charts below, we can see how the latest bull rally ran into the first layer of resistance, and found heavy sellers waiting, pushing lower into the close. We remain bearish as we’ve been suggesting here and here. We will consider selling into the first resistance zone around 14750/775. If this fails to hold short term, we’ll sell higher up around the 14915-30 area and then again at 15000. Downside targets are 14590, looking for a much deeper sell-off towards 13975.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Price Action Chart Analysis – Super Bowl Edition

Published 02/03/2014, 02:11 AM

Updated 05/14/2017, 06:45 AM

Weekly Price Action Chart Analysis – Super Bowl Edition

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.