Last week we wrote

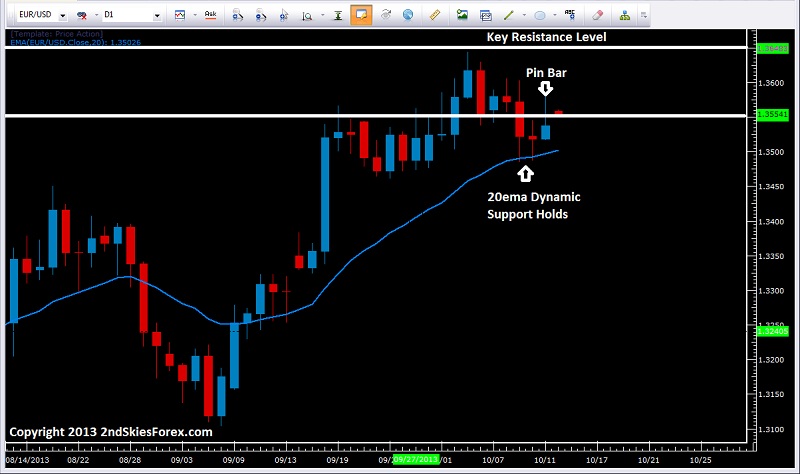

about the critical 1.3550 level for the upside on the Euro. It closed last week forming a pin bar off the 1.3550 level, however today it has gap’d above the level. Although the daily 20ema dynamic support has held, the fact that price action broke above 1.3550, then back below it suggests the trend is weakening. I’ll look for a LH (lower high) or same high at 1.3645 to short off a price action signal. For bulls, they’ll want a daily close above 1.3645 to demonstrate they still have control of the trend.

GBPJPY – Pin Bar Reversal Leads to Break Above Key Level

During last week, we suggesting to sell the GBPJPY off the key role reversal level at 156.65 which played out for over +190 pips which savvy price action traders profited from, so hopefully you did as well. After breaking below the consolidation support at 155.42, the pair formed a pin bar reversal which sparked a 280 pip rally taking out the aforementioned 156.65 level. From here, it formed a textbook pullback setup off that 156.65 level, forming three 4hr pin bar rejections. If those hold, then 157.50 will be up next, so any intraday corrective pullbacks towards 156.76-95 could be used by bulls to get long, targeting the upside resistance, possibly a move towards 158.25.

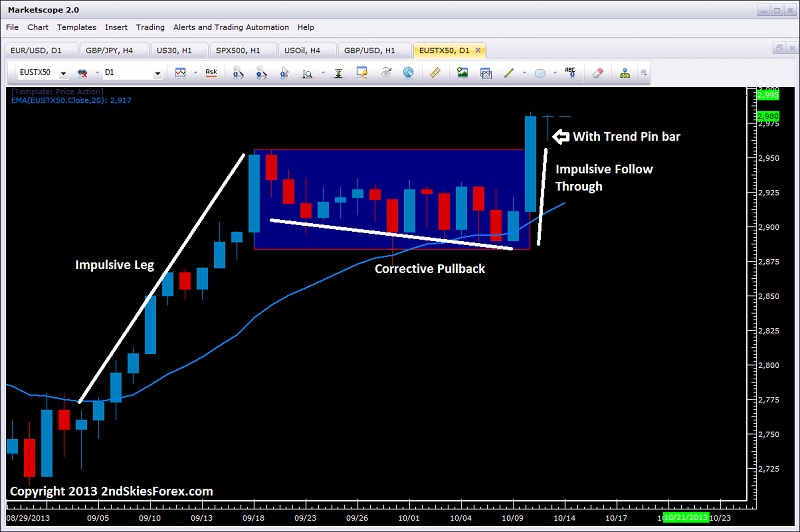

EURO STOXX 50

Outperforming both US and European indices, the EUSTX 50 is hitting multi-year highs. After a heavy impulsive bull run for all of September climbing 225 points, the index formed a two week corrective pullback, but then continued the with trend structure, breaking those prior swing highs above 2954 and closing the week at 2980. Notice the with trend pin bar to close last week which suggests bulls were buying intraday pullbacks.

I suspect a pullback when the markets open in Europe, so bulls can watch for intraday signals at 2954 to get back long, targeting 2980 and the big figure at 3000 which is a multi-year resistance level. Only a daily close below 2950 negates the bullish bias.

Original post