EURUSD

After bottoming on the year with an engulfing reversal bar, the pair has gained 4 of the last 5 weeks for the first time this year. The bulls were on parade all last week till they ran into the weekly 20ema before being rejected back 81pips from the highs. So far this year, the pair has closed all but 3 weeks above the 20ema so breaking and closing above it would be an interesting technical event.

However, I cannot imagine investors being excited about being long EUR vs. anything other than the IQD (Iraqi Dinar) as many inside Germany and other countries are preparing for a possible Grexit. The rejection from last week was decent enough to warrant intraday shorts at last weeks high and the 20ema. Beyond this, bears can look to short at 1.2650 which was the Jan swing lows, along with the weekly/pullback highs from June before a strong sell-off ensued. Bulls meanwhile can wait for a technical close above the weekly 20ema before getting long but if I had a preference, it would be short than long.

Dow

After gaining for 5 weeks straight, the US index produced its first weekly bear close, and did so in interesting fashion forming a bearish engulfing bar at a key mutli-year high which I talked about two weeks ago as being a great area to look for shorts. The index didn’t disappoint as it sold off over 200+pts from this level which some of my price action students got in on.

Looking at the engulfing bar closer, the rejection to the downside is significant and actually is larger than the body itself, communicating there still are plenty of interested buyers in this market. I personally will be looking for weakness on the 4hr and 1hr charts as it approaches the yearly highs again for a possible price action reversal trigger off this level to get short with stops above the weekly high. If the bulls manage another weekly bull close and it communicates strength, then I will wait for additional signals before taking a direction, but I think there are short plays available here.

Gold

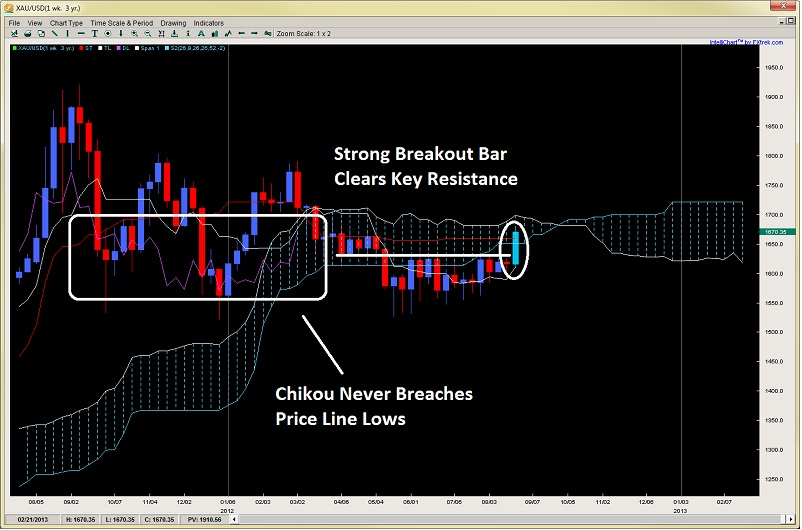

Now that the summer consolidation and foreplay is over, Gold has broken and closed above the key $1630 area which it has not done so since early May this year. It has also broken above the weekly Kijun which it has been below since March. The weekly bull close and breakout bar above the key consolidation area is impressive to say the least and I think the tie is broken on where the next leg is for the metal.

From an ichimoku perspective, what is interesting to note is two things;

1) How the Tenkan cradled the metal for the last 8 weeks which is common during an accumulation period before a big upside breakout.

2) How the Chikou span during the entire sell off since last august never broke the price line lows to the downside – a common ichimoku formation during consolidation periods instead of reversals. The Chikou span is also close to clearing the upside of the price line above the Kumo.

Both of these points above are suggestive the metal should be underpinned and well supported to gain more ground medium and long term, especially if it clears the Kumo which it has not seen the topside of since early March this year.

I personally have been long since $1633 and have been adding on positions (2x last week) as I’m expecting more upside gains medium term. I will buy any pullbacks into the $1630/33 area to accumulate longs (barring an adverse Jackson Hole meeting this week) as I’m expecting a minimum upside target of $1700 medium term, possibly $1772 and $1804 and $1900 before year end.

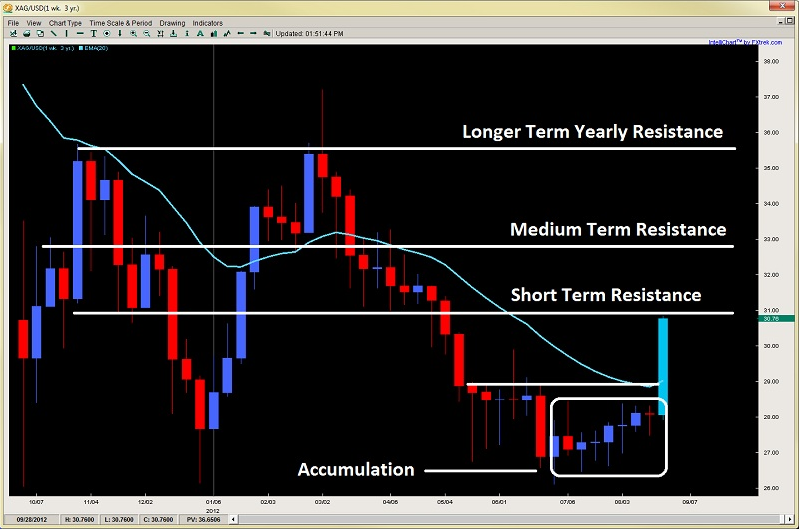

Silver

After a long consolidation and price action accumulation period, Silver broke the stalemate also closing above a key resistance level at $28.61 which it has not closed above since early May this year. What is also impressive about this upside breakout is a) the strong close (only $.06 off the highs), b) that its the largest weekly open-close gain for the year, and c) the weekly close above the 20ema which has not happened since March this year, all strong bullish indications.

I think we will continue to see more volatility and upside gains for the shiny metal and am also long on the breakout. Intraday traders can look for longs around $30.22 whereas more conservative players can look to get long at key intraday support levels from last week, such as $29.50 and $28.67. Only a weekly close below $28 changes by medium term bullish bias, but I am both long paper and physical and see possible upside targets of $32.57, $35 and $37.15 before year end.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Price Action & Ichimoku Outlook Aug. 26th – 31st

Published 08/27/2012, 03:35 AM

Updated 05/14/2017, 06:45 AM

Weekly Price Action & Ichimoku Outlook Aug. 26th – 31st

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.