EUR/USD

Repeating a pattern for the last 10 days, every time the Euro has posted a bull day, it’s followed with a down day and last week was no exception. After forming a combo pin bar + outside bar last Thursday, the pair reversed almost all the losses after initially climbing higher. This is going to really put pressure on the bears at the 1.2815 support level. Any break and close below here could see the pair unwind quickly to the 1.2754 level before finding any bulls, and possibly to 1.2700 in a hurry. Short term goes to the bears camp so watch for clues at 1.2815.

EUR/USD" title="EUR/USD" width="658" height="422">

EUR/USD" title="EUR/USD" width="658" height="422">

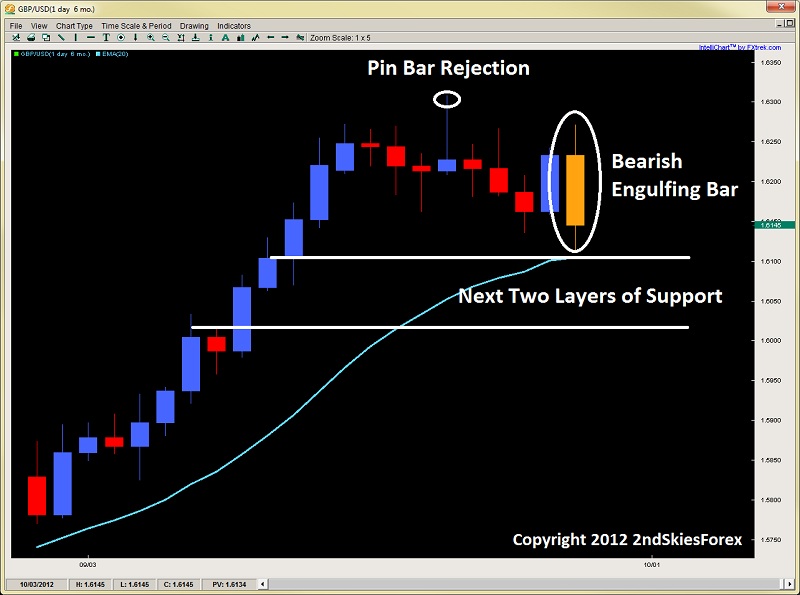

GBP/USD

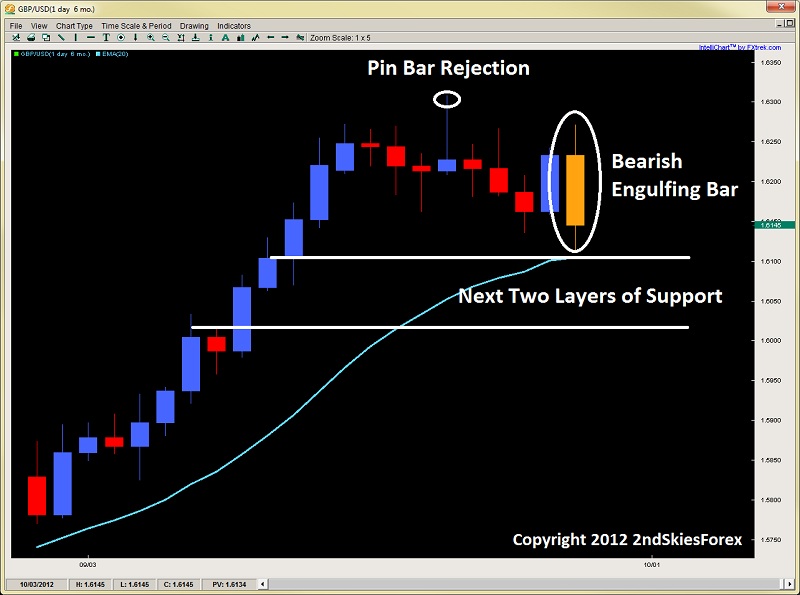

Showing a little more resistance to the greenback charge last Friday, the cable also closed lower on the day forming a bearish with trend engulfing bar setup. The tricky part about this price action is a) it’s a corrective pullback after the parabolic price action run up to 1.6300, and b) it’s also in an expanding range or mini-triangle. Friday’s candle put the goal posts up with the highs and lows forming a short term range. If 1.6100 and the dynamic support at the daily 20ema breaks, expect more downside, likely to the big figure at 1.6000. Upside, traders need to watch both the Friday high at 1.6271 + the swing highs at 1.6300.

GBP/USD" title="GBP/USD" width="648" height="416">

GBP/USD" title="GBP/USD" width="648" height="416">

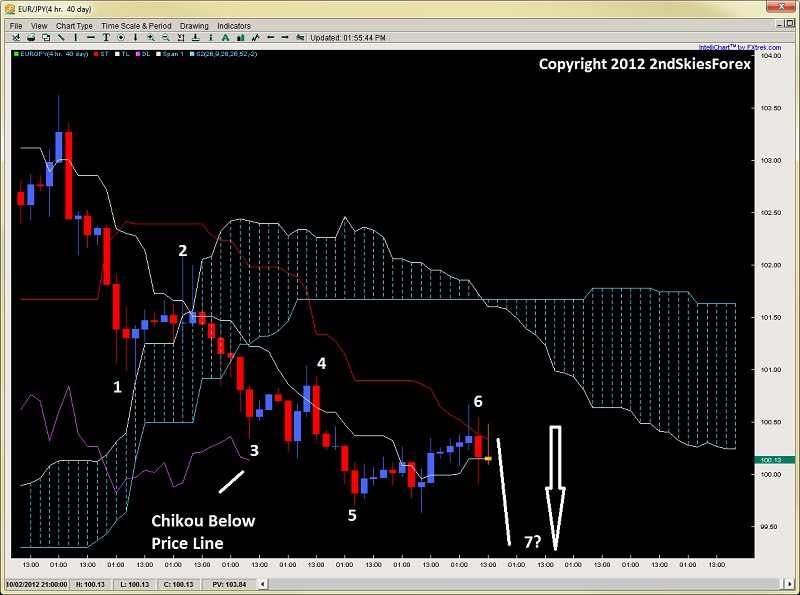

EUR/JPY

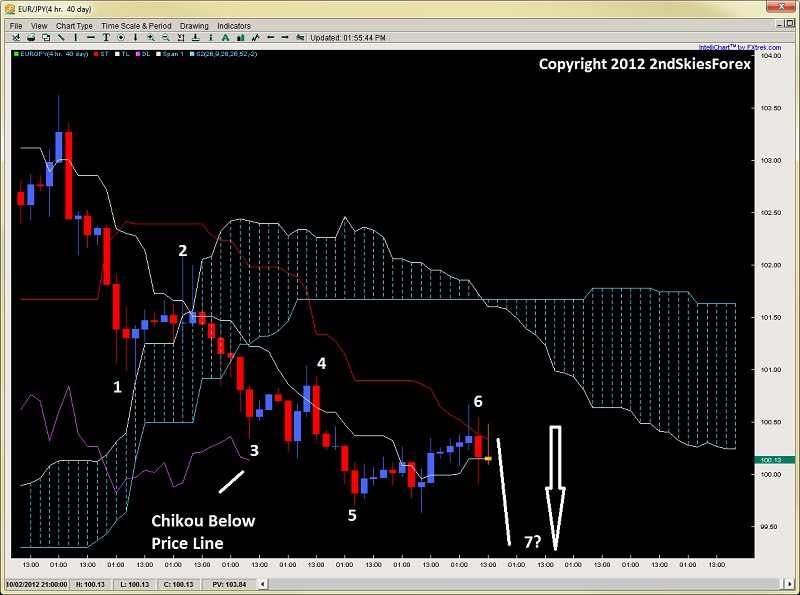

After peaking at 103.50 about a week and a half ago, the EURJPY has formed two N waves down which is leg 6 of the wave count. This is hinting there is likely another leg down and the price action confirms that with the last pullback being corrective. Also, the chikou is below the price line, and there is a thick kumo ahead, so watch for a potential strong downward tenken-sen kijun-sen cross early this week to catch the next potential leg down.

EUR/JPY" title="EUR/JPY" width="653" height="419">

EUR/JPY" title="EUR/JPY" width="653" height="419">

Gold

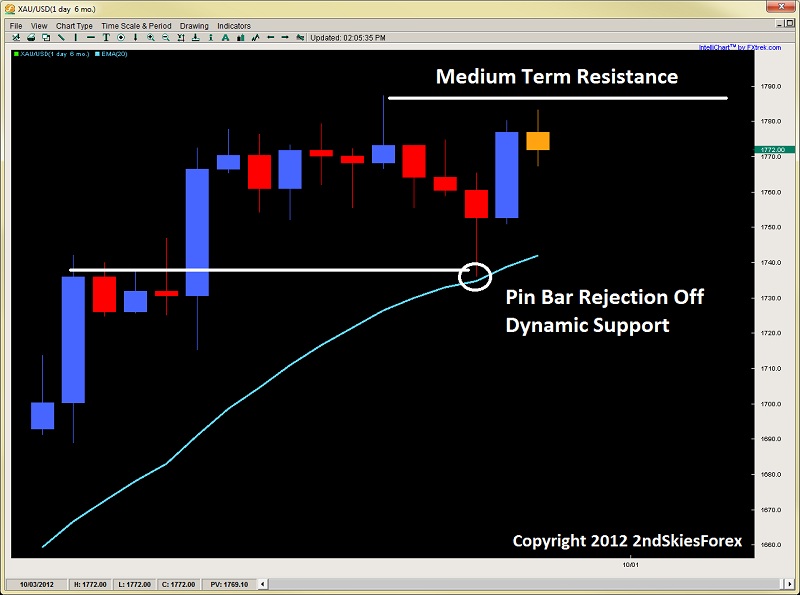

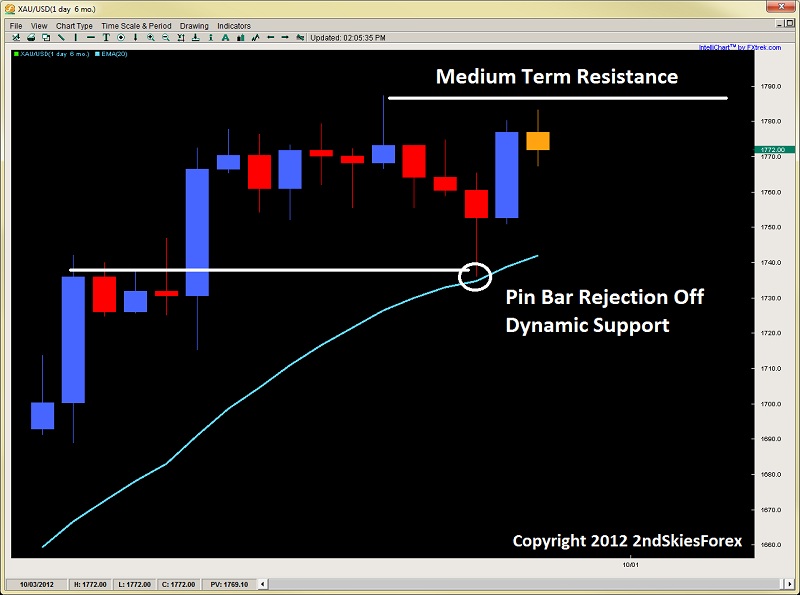

After rejecting just shy of the $1790 level last week, Gold started to sell off and show some potential weakness and definitely some profit-taking. However, the precious metal was bought back up on the dip which formed a pin bar rejection off the 20ema and followed it up with an impressive $24 gain to end the week. I suspect the pullback into the daily 20ema wasn’t just profit-taking from all those that were long around the breakout at $1633, but also a punish the johnny-come-late players who entered this uptrend towards the highs around $1775.

With the dip being bought so aggressively, it shows the institutionals are happy to buy this on the dip so the trend is still well supported with no structural breakdown. Watch for price action pullbacks into the $1737-42 area for potential longs while bears can look to short on corrective weakness heading into $1787.

Repeating a pattern for the last 10 days, every time the Euro has posted a bull day, it’s followed with a down day and last week was no exception. After forming a combo pin bar + outside bar last Thursday, the pair reversed almost all the losses after initially climbing higher. This is going to really put pressure on the bears at the 1.2815 support level. Any break and close below here could see the pair unwind quickly to the 1.2754 level before finding any bulls, and possibly to 1.2700 in a hurry. Short term goes to the bears camp so watch for clues at 1.2815.

EUR/USD" title="EUR/USD" width="658" height="422">

EUR/USD" title="EUR/USD" width="658" height="422">GBP/USD

Showing a little more resistance to the greenback charge last Friday, the cable also closed lower on the day forming a bearish with trend engulfing bar setup. The tricky part about this price action is a) it’s a corrective pullback after the parabolic price action run up to 1.6300, and b) it’s also in an expanding range or mini-triangle. Friday’s candle put the goal posts up with the highs and lows forming a short term range. If 1.6100 and the dynamic support at the daily 20ema breaks, expect more downside, likely to the big figure at 1.6000. Upside, traders need to watch both the Friday high at 1.6271 + the swing highs at 1.6300.

GBP/USD" title="GBP/USD" width="648" height="416">

GBP/USD" title="GBP/USD" width="648" height="416">EUR/JPY

After peaking at 103.50 about a week and a half ago, the EURJPY has formed two N waves down which is leg 6 of the wave count. This is hinting there is likely another leg down and the price action confirms that with the last pullback being corrective. Also, the chikou is below the price line, and there is a thick kumo ahead, so watch for a potential strong downward tenken-sen kijun-sen cross early this week to catch the next potential leg down.

EUR/JPY" title="EUR/JPY" width="653" height="419">

EUR/JPY" title="EUR/JPY" width="653" height="419">Gold

After rejecting just shy of the $1790 level last week, Gold started to sell off and show some potential weakness and definitely some profit-taking. However, the precious metal was bought back up on the dip which formed a pin bar rejection off the 20ema and followed it up with an impressive $24 gain to end the week. I suspect the pullback into the daily 20ema wasn’t just profit-taking from all those that were long around the breakout at $1633, but also a punish the johnny-come-late players who entered this uptrend towards the highs around $1775.

With the dip being bought so aggressively, it shows the institutionals are happy to buy this on the dip so the trend is still well supported with no structural breakdown. Watch for price action pullbacks into the $1737-42 area for potential longs while bears can look to short on corrective weakness heading into $1787.