EURUSD

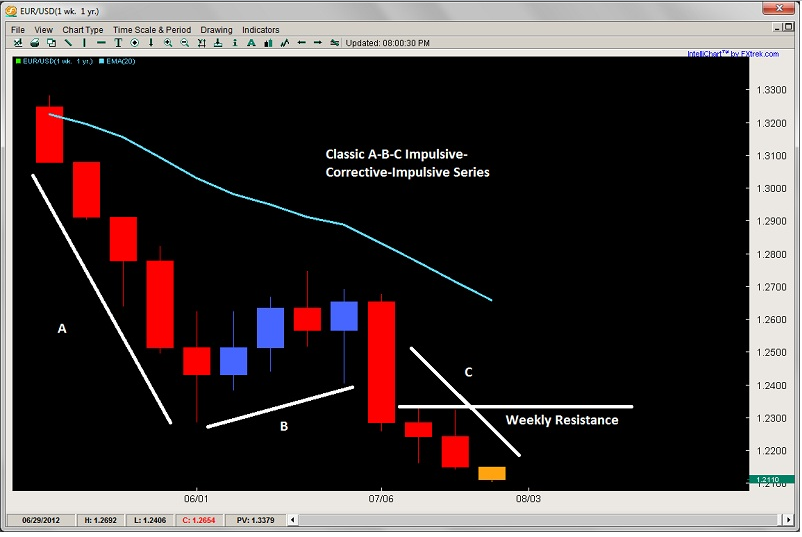

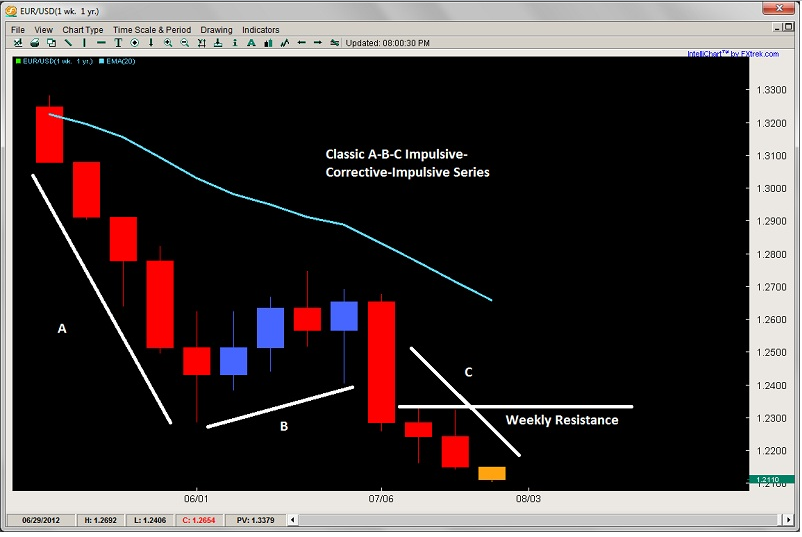

After forming a corrective pullback last week comprised of an outside bar, a double pin bar and an inside bar, the euro resumed its natural selling posture and rightfully so considering what is happening in the EZ. The financial cancer in Spain has been metastasizing and is entering what I feel is its terminal phase with every region starting to request bailout funding. The truth is there will not be enough for all of them so something has to break.

This resulted technically in the EURUSD selling off more on friday than it had gained in the last seven days reminding us the market will continue to be more inclined to sell euros than buy them, which it did by breaking the prior yearly lows, almost forming a maribozu.

Sell Opportunities

Although the pair is at a major channel bottom, i’ll take price action pullbacks or rallies as opportunities to sell as I’m expecting more selling and more economic turmoil to give investors reasons to sell euros. Immediate upside resistance is now parked above at 1.2322, which was a double weekly rejection for the prior two. Intraday players can look to short between 1.2169 and 1.2157 looking for an eventual break of 1.2100 targeting the big figure at 1.2000.

EUR/USD" title="29" width="802" height="537" />

EUR/USD" title="29" width="802" height="537" />

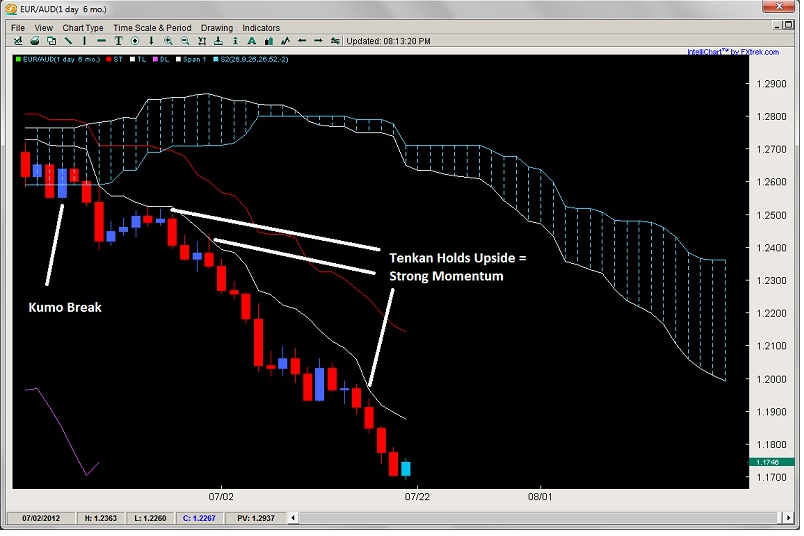

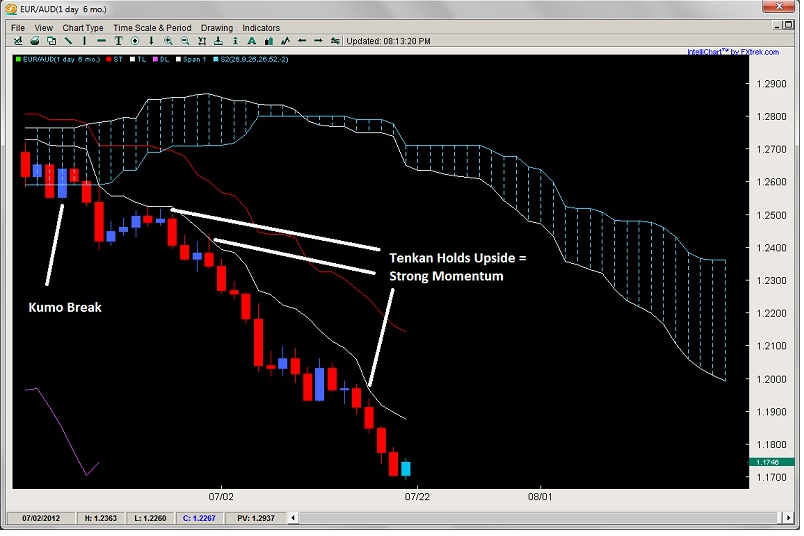

EURAUD

Playing on the sell-the-euro theme, which I think will continue for the majority of this week and for some time ahead, I like selling EUR vs. AUD. From an ichimoku perspective, the pair has remained below the tenkan now since the first week of June for quite an impressive run.

Natural Pullback

This is communicating incredibly strong momentum to stay below it for such a long period of time, and considering the current separation from it, we’d rather wait for a pullback to sell a rally and get back into the trend then playing a break lower. And I’m confident I’ll get it -- perhaps this week with tight stops above. I’ll even consider a pullback to the Kijun to sell along with waiting for a future downward TKx signal but short is where I would like to be on the EUR vs. the AUD as it has now been selling off for nine weeks straight. Thus, I’m expecting a natural pullback, but will take them to sell again.

EUR/AUD" title="30" width="804" height="536" />

EUR/AUD" title="30" width="804" height="536" />

USDCAD

Last week in our price action and ichimoku weekly commentary, we talked about how bulls should look for longs off the channel bottom and key support area around 1.0050/70 area. This is exactly where price stopped last week, bouncing over 100pips to end the week. Many of our price action course members made profits on this with little risk, so hopefully you did as well. Traders can wait for the channel play toward the upside to sell, or another pullback into the aforementioned support zone to buy the pair targeting the daily 20-ema and other side of the channel.

USD/CAD" title="31" width="805" height="538" />

USD/CAD" title="31" width="805" height="538" />

NZDUSD

Looking at the Kiwi lately, I am noticing how it has been failing to hold above the flat top kumo even though it has rejected off of it twice -- yet failed to grab hold of the upside play. This, combined with the chikou failing to clear the Kumo, suggests minimally likely range play short term but a possible breakdown coming soon back into the Kumo. When the chikou span struggles like this to break the Kumo in strong fashion, it usually means breakdown so I am waiting for either a sell around .8051 or a break through key support levels at .7839 and .7809 for the downside targets of .7650 and potentially .7450.

NZD/USD" title="32" width="804" height="534" />

NZD/USD" title="32" width="804" height="534" />

After forming a corrective pullback last week comprised of an outside bar, a double pin bar and an inside bar, the euro resumed its natural selling posture and rightfully so considering what is happening in the EZ. The financial cancer in Spain has been metastasizing and is entering what I feel is its terminal phase with every region starting to request bailout funding. The truth is there will not be enough for all of them so something has to break.

This resulted technically in the EURUSD selling off more on friday than it had gained in the last seven days reminding us the market will continue to be more inclined to sell euros than buy them, which it did by breaking the prior yearly lows, almost forming a maribozu.

Sell Opportunities

Although the pair is at a major channel bottom, i’ll take price action pullbacks or rallies as opportunities to sell as I’m expecting more selling and more economic turmoil to give investors reasons to sell euros. Immediate upside resistance is now parked above at 1.2322, which was a double weekly rejection for the prior two. Intraday players can look to short between 1.2169 and 1.2157 looking for an eventual break of 1.2100 targeting the big figure at 1.2000.

EUR/USD" title="29" width="802" height="537" />

EUR/USD" title="29" width="802" height="537" />EURAUD

Playing on the sell-the-euro theme, which I think will continue for the majority of this week and for some time ahead, I like selling EUR vs. AUD. From an ichimoku perspective, the pair has remained below the tenkan now since the first week of June for quite an impressive run.

Natural Pullback

This is communicating incredibly strong momentum to stay below it for such a long period of time, and considering the current separation from it, we’d rather wait for a pullback to sell a rally and get back into the trend then playing a break lower. And I’m confident I’ll get it -- perhaps this week with tight stops above. I’ll even consider a pullback to the Kijun to sell along with waiting for a future downward TKx signal but short is where I would like to be on the EUR vs. the AUD as it has now been selling off for nine weeks straight. Thus, I’m expecting a natural pullback, but will take them to sell again.

EUR/AUD" title="30" width="804" height="536" />

EUR/AUD" title="30" width="804" height="536" />USDCAD

Last week in our price action and ichimoku weekly commentary, we talked about how bulls should look for longs off the channel bottom and key support area around 1.0050/70 area. This is exactly where price stopped last week, bouncing over 100pips to end the week. Many of our price action course members made profits on this with little risk, so hopefully you did as well. Traders can wait for the channel play toward the upside to sell, or another pullback into the aforementioned support zone to buy the pair targeting the daily 20-ema and other side of the channel.

USD/CAD" title="31" width="805" height="538" />

USD/CAD" title="31" width="805" height="538" />NZDUSD

Looking at the Kiwi lately, I am noticing how it has been failing to hold above the flat top kumo even though it has rejected off of it twice -- yet failed to grab hold of the upside play. This, combined with the chikou failing to clear the Kumo, suggests minimally likely range play short term but a possible breakdown coming soon back into the Kumo. When the chikou span struggles like this to break the Kumo in strong fashion, it usually means breakdown so I am waiting for either a sell around .8051 or a break through key support levels at .7839 and .7809 for the downside targets of .7650 and potentially .7450.

NZD/USD" title="32" width="804" height="534" />

NZD/USD" title="32" width="804" height="534" />