AUD/USD" title="AUD/USD" height="517" width="451">

AUD/USD" title="AUD/USD" height="517" width="451">

Summary:

The Aussie dollar has looked to consolidate over the new year period as markets have been relatively slow and technical support has been found in a bearish market. Overall though, Australian credit markets looked weak with the latest data showing negative growth in the private sector.

The week ahead looks to be heavy for the Australian dollar, as economic data on the current trade balance, as well as job vacancies are expected to be released. All in all, it is expected that the trade balance will shrink as imports fall. However, job vacancies may take a hit if the market did not pick up as much as anticipated after the new year. Additionally, retail sales will be due out on Thursday and are expected to be gloomy despite the holiday period.

Current resistance levels can be found at 0.8965, 0.9031 and 0.9137; with major resistance found at 0.8965 as the pair rises higher. Current support levels are also found at 0.8889 and 0.8850as the pair has recently looked to consolidate these levels and will likely be tested in the coming weeks as the RBA will likely look to reverse the consolidation and try and push the dollar a little bit lower to its original 0.85 target. EUR/USD" title="EUR/USD" height="517" width="451">

EUR/USD" title="EUR/USD" height="517" width="451">

Summary:

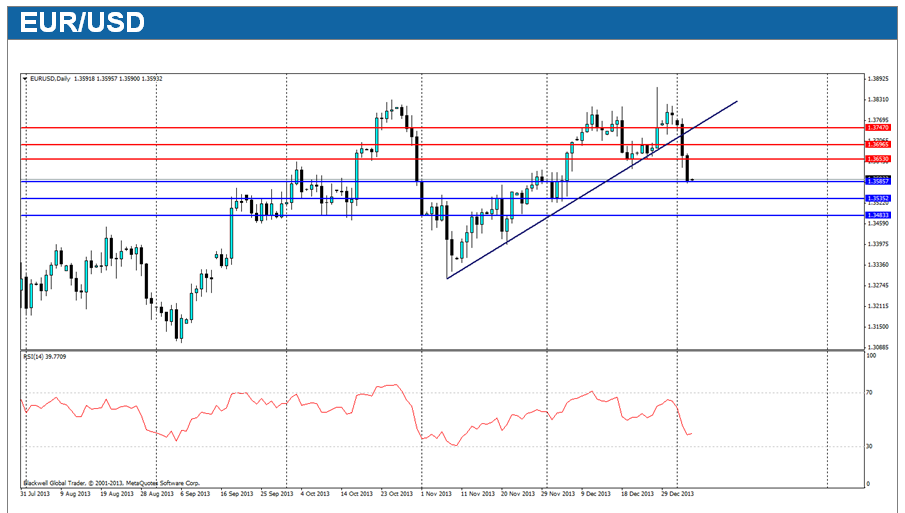

The Euro has fallen sharply after pushing through its current trend line, causing a massive break out amongst traders – despite positive economic data out of the Euro-zone. Overall though, the market will be watching closely over the next weekend as markets become more active and fundamentals may be restored again as currently, technicals are in charge and it looks unlikely to change.

It’s a busy week ahead in the Euro-zone when it comes to economic data, with Services PMI, Retail Sales and the Unemployment Rate due out. All will have major impacts on the EUR/USD pair and all other Euro pairs. Unemployment is expected to stay tight at its current 12.1%, however, a drop is possible given the recent positive economic data.

Current technical movements show that the EUR/USD has turned from bullish to very bearish in the wake of breaking its current trend line. Current resistance levels are at 1.3653, 1.3696 and 1.3747; with major resistance likely to be found at 1.3653. Support levels can be found at 1.3585, 1.3535 and 1.3483; with major support likely to be found at 1.3535. Overall though, the current trend is very bullish, with the market likely to consolidate over the next 24 hours, before economic indicators take effect.  GBP/USD" title="GBP/USD" height="517" width="451">

GBP/USD" title="GBP/USD" height="517" width="451">

Summary:

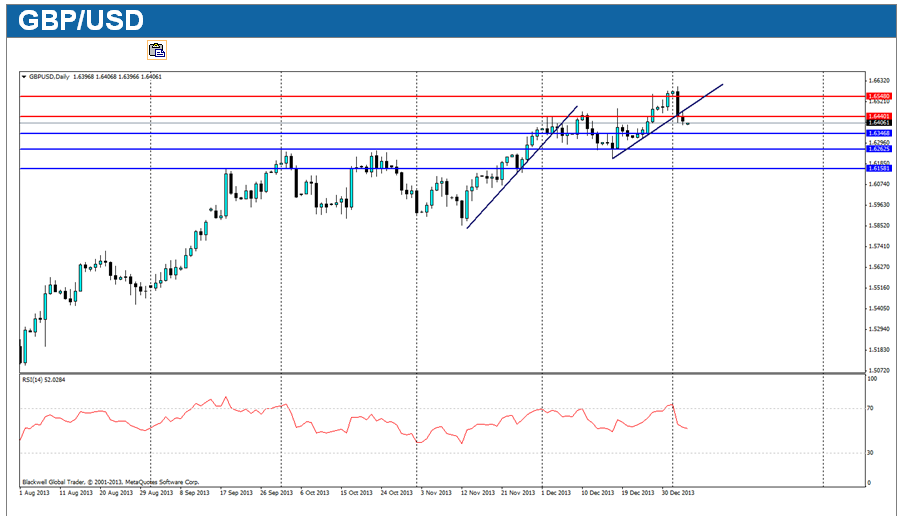

The Pound fell over the new year period as investors exited after it climbed to highs not seen since August 2011. Markets will now be looking to see if the positive UK economic sentiment can be extended further as monetary policy remains strong and as economic data remains upbeat.

The markets are certainly looking busy for the Pound as the Trade Balance is set to be released on Thursday, which will prompt heavy trading in the UK currency. Additionally, the Asset purchase facility and interest rates are likely to be reviewed on the same day and it is expected that positive sentiment will likely be talked up about the UK economy and its continuing recovery.

Current market technicals show that the Pound has recently pulled back after being heavily overbought. Current resistance levels can be found at 1.6440 and 1.6548; with major resistance found at 1.6548 and looking unlikely to break in the next week. Current support levels can be found at 1.6346, 1.6262 and 1.6158; with major support found at 1.6346 as the market drifts lower. NZD/USD" title="NZD/USD" height="517" width="451">

NZD/USD" title="NZD/USD" height="517" width="451">

Summary:

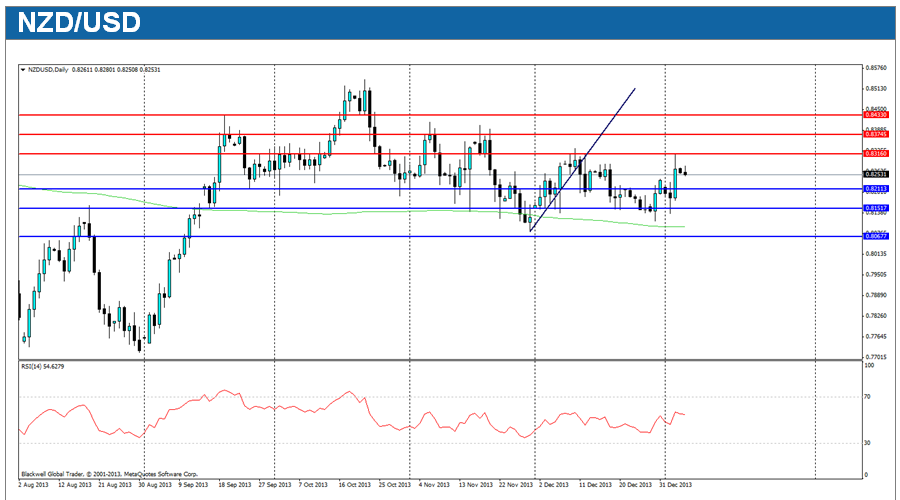

The New Zealand Dollar is ranging heavily after going through a heavy consolidation period as the holidays have left technicals in charge with little fundamentally able to move the Dollar in any direction. With a strong NZ economy, and a weak Australian economy dragging, it looks certain that the NZD may remain within the 80 cent range for some time.

Traders in the coming week will have little to chew on, as only one light piece of information is due out on new homebuilds in the country. Instead,the focuswill be on US market data, as well as Australian economic data, which is expected to be heavy for the economy.

Market technicals show that resistance can be found at 0.8316, 0.8374 and 0.8433; with major resistance at 0.8316. Current support levels can be found at 0.8211, 0.8151 and 0.8083. Overall though, current market sentiment remains bullish, but consolidation is more likely than large rapid movements.  USD/JPY" title="USD/JPY" height="517" width="451">

USD/JPY" title="USD/JPY" height="517" width="451">

Summary:

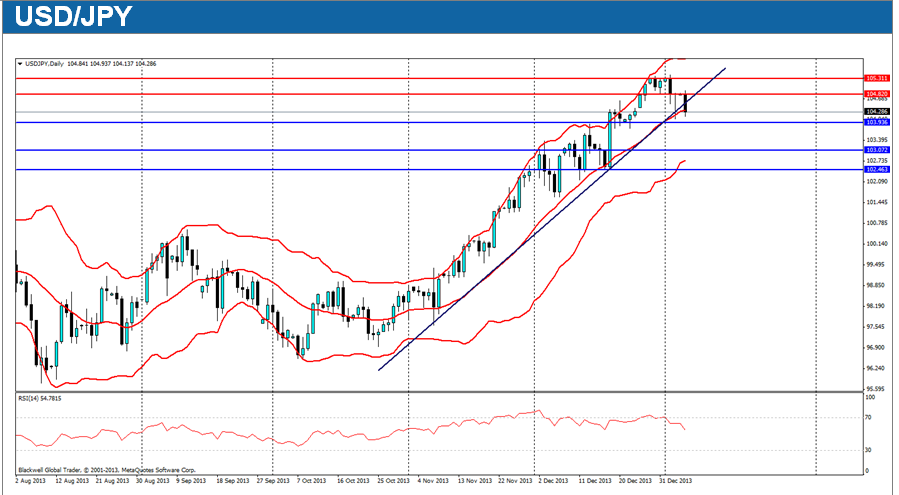

The Yen has hit a wall at the start of the new year as it touched on the 105 level against the USD before falling back downwards and starting to consolidate. This new high is likely to remain for some time though, as further upward trending looks to have been broken by the recent trend line breakthrough.

The week ahead looks likely to show further strengthening of the Yen, as the US is likely to have a mixed bag of data. However, the breakthrough may be fake and it could resume upwards if we have a case of strong US economic data. Either way, traders will likely look to use the new top as heavy resistance.

Looking at market technical, we can see that current resistance is at 104.820 and 105.311; with the hard level of resistance at 105.311 as it forms a new high after 2 years. Current support levels at 103.936, 103.072 and 102.463; with the hard level of support at 102.463. Overall the RSI shows a pullback from the insane buying pressure for the USD over the Yen, so we could be in for Yen strengthening or just consolidation for the pair.

DISCLAIMER

The report provided by Blackwell Global Investments Limited ("Blackwell Global") is meant for informative reading and should not be relied upon as a substitute for extensive independent research The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global. It should not be construed as financial advice for a purchase or sale of any foreign currency, contracts-for-differences, precious metals or any other products offered by Blackwell Global mentioned herein. Any projections or views of the market provided by Blackwell Global may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any losses incurred directly or indirectly made by readers and clients as a result of any person or group of persons acting on the information contained herein.

The Blackwell Global's Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. This report is prepared for the use of Blackwell Global's clients and may not be reproduced, distributed or published by any person for any purpose without the prior consent of Blackwell Global.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Outlook: EUR/USD Turns From Bullish To Very Bearish

Published 01/06/2014, 05:15 AM

Updated 05/14/2017, 06:45 AM

Weekly Outlook: EUR/USD Turns From Bullish To Very Bearish

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.