AUD/USD" title="AUD/USD" height="242" width="474">

AUD/USD" title="AUD/USD" height="242" width="474">

Summary:

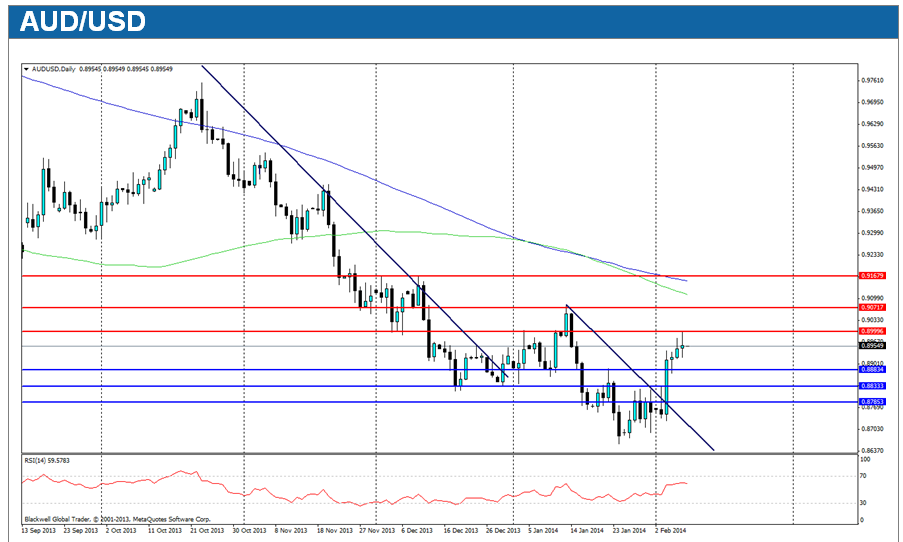

The Aussie dollar managed to claw back ground last week as trade balance data was positive, and as the RBA started to lift forecast’s for the Australian region; as it expects economic growth to now lift in 2015 after recent currency devaluations.

The week ahead is going to be busy for the AUD, with business confidence and unemployment data due out. Business confidence on Tuesday is expected to have a major impact, followed up by consumer confidence 23 hours later. Unemployment data though will be the major mover for the week, and is expected to rise to 5.9%.

Current market technicals show the AUD has touched the 90 cent mark, before being forced back by traders. My overall outlook is still bearish for the pair despite the recent breakout. Current resistance levels can be found at 0.9000, 0.9071 and 0.9167 with the 90 cent mark acting as hard resistance. Support levels can be found at 0.8883, 0.8833 and 0.8785; with 0.8834 likely to be the level that will pose the most problems for a falling Aussie dollar.

EUR/USD" title="EUR/USD" height="242" width="474">

EUR/USD" title="EUR/USD" height="242" width="474">

Summary:

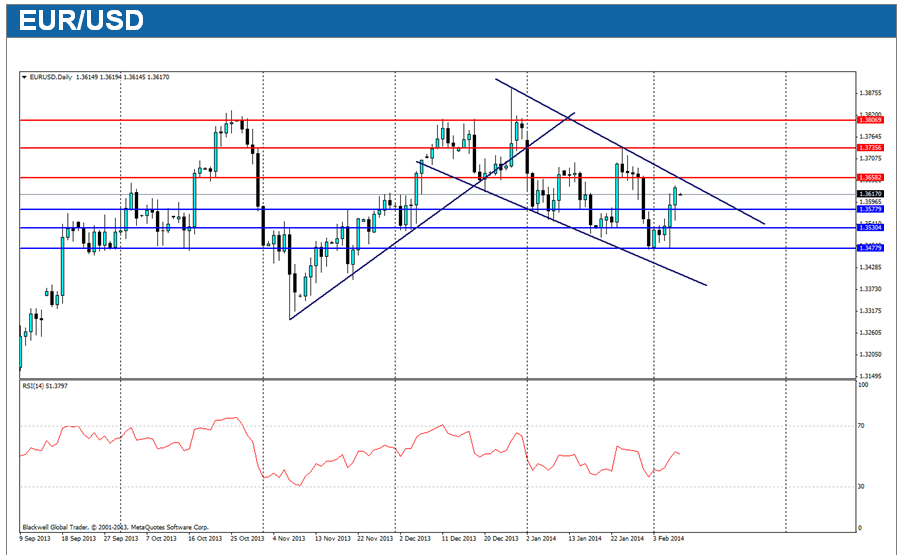

The Euro has continued its momentum lower as of late, as weak economic data like PMI data has helped this trend, however, a weaker USD in the last week also helped to give it some gains before the end of the week.

Data in the Euro-zone is moderate for the week coming, with industrial production due out on Wednesday likely to be a major mover. Additionally, on Friday, France, Germany and Italy will release GDP data for their respective economies. This is expected to show moderate improvements across the countries.

Current resistance levels can be found at 1.3658, 1.3735 and 1.3806; with major resistance found at 1.3735. Support levels can be found at 1.3577, 1.3530 and 1.3477; with major support at 1.3504. Despite the resistance levels being high, it’s unlikely to push further unless we see more dollar weakness at this current stage, and for the most part, it’s likely that we may see more falls as the Euro looks to channel lower after pushing off its upper boundary.

GBP/USD" title="GBP/USD" height="242" width="474">

GBP/USD" title="GBP/USD" height="242" width="474">

Summary:

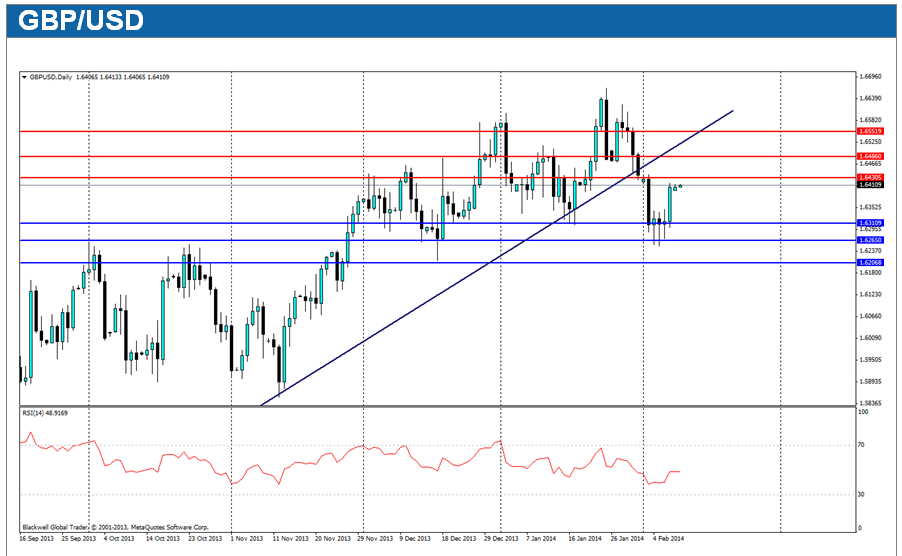

The Pound had a rough start to the week as it looked to fall on weaker economic data as concerns mounted that the Pound may lose traction after weeks of positive economic data. Overall though the outlook is promising.

The marketsare set for a relatively quiet week for the Pound overall, as the only major event this week is the BoE governor Mark Carney speaking. Where it'sexpected, he will talk about the strong position of the Pound, and the recovery of the UK market despitelast week's negative economic data.

Current market technicals show that the Pound has been ranging heavily in the last week, before trying to push lower on three days before being stopped in its tracks. Current resistance levels can be found at 1.6430, 1.6486 and 1.6651; with major resistance at 1.6430. Current support levels are very tight at 1.6310, 1.6265 and 1.6206; with major support found at 1.6310. It’s unlikely this will be tested further though, unless we see some very positive US dollar movements in the current days. Overall outlook still remains relatively bullish for the currency amid market appetite and an increasing RSI reading.

NZD/USD" title="NZD/USD" height="242" width="474">

NZD/USD" title="NZD/USD" height="242" width="474">

Summary:

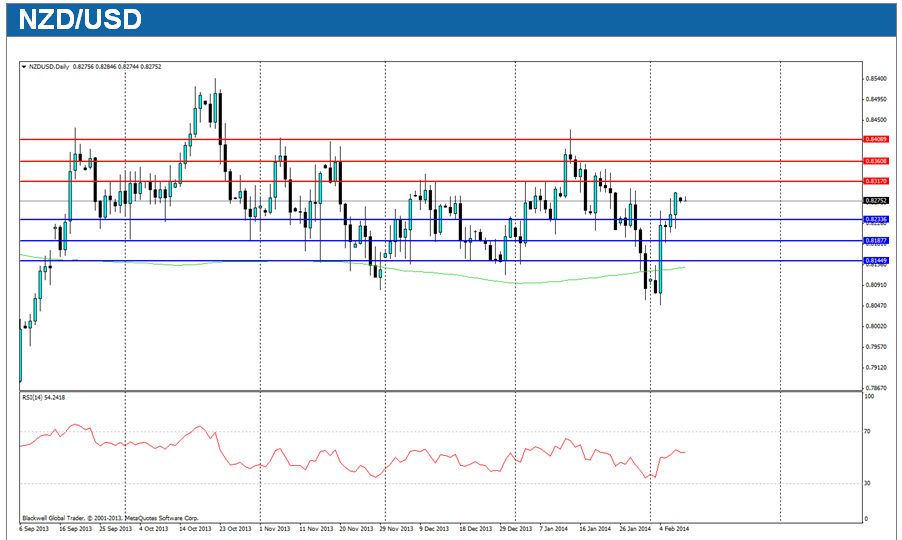

The New Zealand dollar continued its fall into last week, before positive employment data helped push the dollar up heavily, helping to claw back losses over the week. USD weakness also helped, pushing it back into its 82-83 cent range.

Traders in the coming week should see two large movements as manufacturing performance as well as CPI data is due out for the month of Janurary. Manufacturing on Wed is expected to be positive, while NZD CPI data is expected to show minor increases in inflation, overall strengthening his case for a rate rise.

Market technicals show the NZ dollar has now moved out of its bearish trend line and looks likely to range between its current support and resistance levels. Resistance can be found at 0.8317, 0.8360 and 0.8408; with heavy resistance at 0.8360. Support levels can be found at 0.8220, 0.81855 and 0.8144; with 0.8220 acting as heavy support. Overall, it looks likely that the NZD will continue to range in the present time, despite the RSI pointing to heavy buying.

USD/JPY" title="USD/JPY" height="242" width="474">

USD/JPY" title="USD/JPY" height="242" width="474">

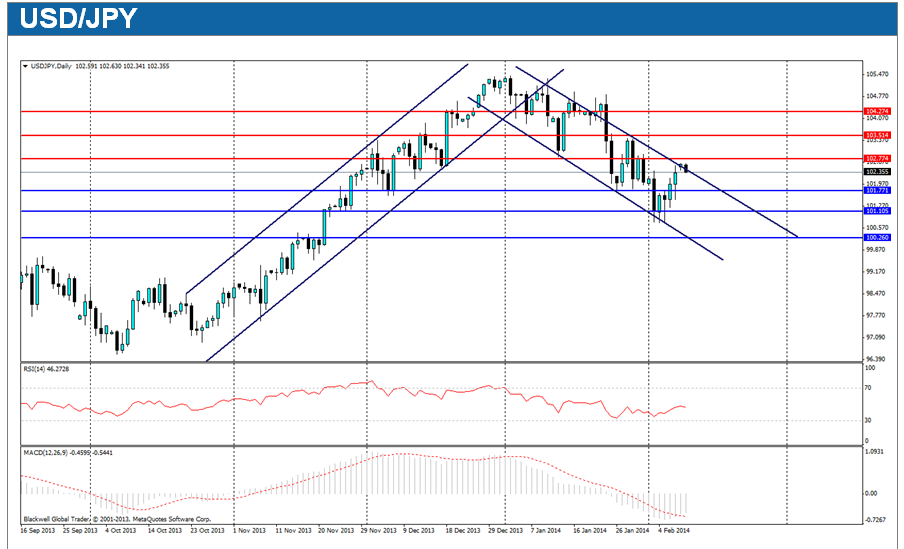

Summary:

The Yen has continued to drift lower against the USD, as markets look for relative safety amid mounting concerns over the emerging markets. However, the Yen has been a stand out last month over CPI data, and may now believe Abenomics will work.

The week looks to be moderate for the Yen, with machine orders due out on Tuesday which will point to economic growth and the private sector's outlook. Money Supply is also due out, but is expected to be relatively stable overall.

Looking at market technicals, we can see that the USDJPY has been in a channel ranging downwards over the past few weeks. Current market resistance can be found at 102.774, 103.514 and 104.274; with 102.774 acting as the level to break. Current support levels can be found at 101.771, 101.105 and 100.260; with heavy support found at 101.105. MACD is also showing trend starting to show current momentum slowing.

DISCLAIMER

The report provided by Blackwell Global Investments Limited ("Blackwell Global") is meant for informative reading and should not be relied upon as a substitute for extensive independent research . The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global. It should not be construed as financial advice for a purchase or sale of any foreign currency, contracts-for-differences, precious metals or any other products offered by Blackwell Global mentioned herein. Any projections or views of the market provided by Blackwell Global may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any losses incurred directly or indirectly made by readers and clients as a result of any person or group of persons acting on the information contained herein.

The Blackwell Global's Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. This report is prepared for the use of Blackwell Global's clients and may not be reproduced, distributed or published by any person for any purpose without the prior consent of Blackwell Global.