AUD/USD" title="AUD/USD" height="502" width="901">

AUD/USD" title="AUD/USD" height="502" width="901">

Summary:

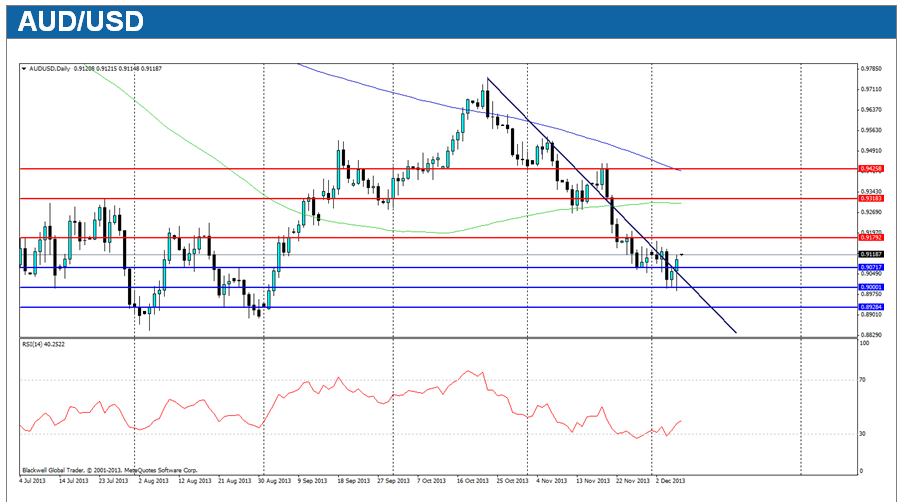

The Aussie dollar continued to fall over the week, as pressure mounted on the currency from overseas markets, and as the RBA continued its crusade against the currency. Markets remained slightly upbeat about the currency though, as it looked to push the 90 cent mark versus the USD before pulling back and consolidating.

The week ahead looks quiet initially, with consumer confidence due out on Tuesday, but the main trading point will be the unemployment data due on Thursday, which is expected to show an increase in unemployment. Markets will likely price in a fall for the AUD in advance, however numbers are unlikely to be upbeat due to the holiday season as the RBA accounts for this in its calculations.

Current resistance levels can be found at 0.9179, 0.9318 and 0.9425 and have not moved since last week as all momentumhave been bearish for the pair. Support levels can be found at 0.9071, 0.9000 and 0.8928, with hard support being found at 0.9000. It’s unlikely the pair will push through unless there is more bad economic data, and it looks more likely that the AUDUSD pair will range and consolidate over the coming week.  EUR/USD" title="EUR/USD" height="502" width="901">

EUR/USD" title="EUR/USD" height="502" width="901">

Summary:

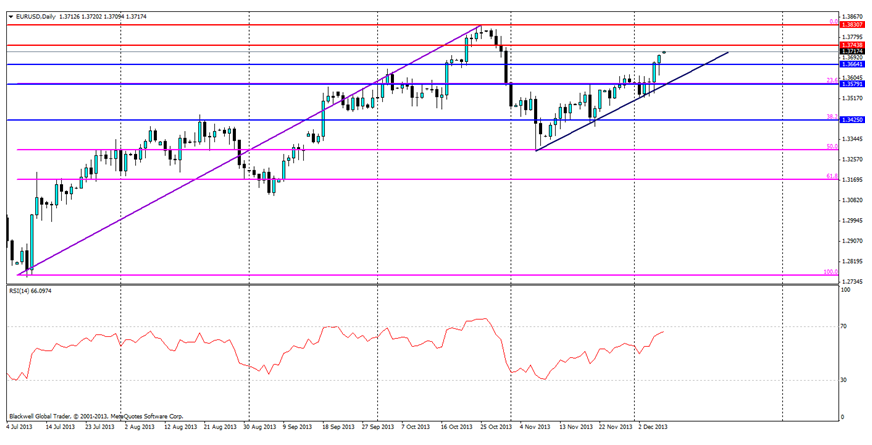

The Euro managed to push its way higher last week, as global rik appetite increased and so did hopes in the euro-zone picking up steam on the back of positive news from Spain and Germany. Overall though, pressure will be back on the Euro and the ECBD as the currency looks to be pushing on hard levels at 1.38 which the EBC believes is a risk to the currency in the short term as the economy recovery is precarious.

Markets are poised for new economic data to help break the current resistance levels, and may get a chance with German Industrial production due out. However, major market movements will likely come from UK and US data which is likely to play a bigger role this week compared to previous weeks.

Current technical movements show that the EURUSD is very close to pushing the 1.38 mark and resistance levels can be found at 1.3473 and 1.3830, with the 1.3830 level being the major level. Markets will look to bounce off. Support levels can be found at 1.3664, 1.3579 and 1.3425 with major support being found at 1.3579. However, it's unlikely to be touched unless there is a bearish breakout, given the current strong bullish trend line in the marketplace.  GBP/USD" title="GBP/USD" height="502" width="901">

GBP/USD" title="GBP/USD" height="502" width="901">

Summary:

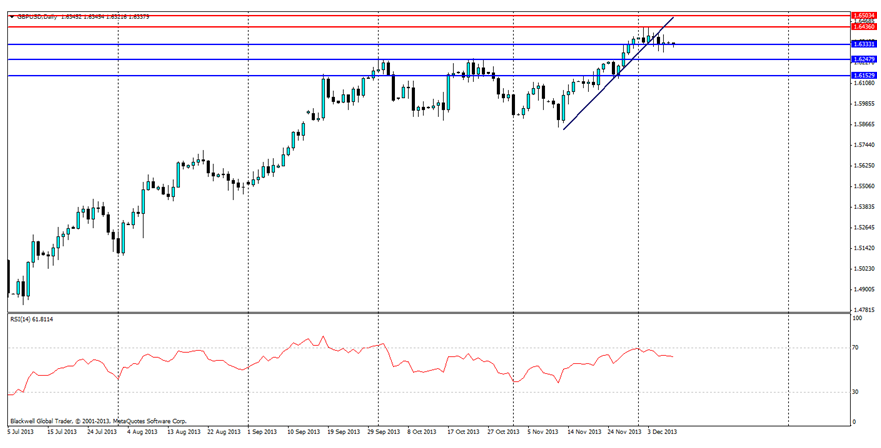

The Pound experienced more buying pressure over the last week, as markets looked favourably at the stable economy of the UK and active central bank. However, it has hit market highs and broken through its bullish trend line, showing that the rapid rise might have been too quick for the market’s liking.

The markets are poised for a big week for the Pound as Industrial Production data is due out on Tuesday, along with trade balance data. With Industrial Production expected to fall, it’s likely that any boost to this could easily help push through recent highs not seen since last year.

Current market technicals show resistance at 1.6436 and 1.6503; with major resistance currently at 1.6436 as the market has tested it twice in the last week. Additionally, support levels can be found at 1.6333, 1.6247 and 1.6152; with major support found at 1.6247. RSI currently shows buying pressure being heavy but it is starting to taper off, after crashing through the bullish trend line in the market. NZD/USD" title="NZD/USD" height="502" width="901">

NZD/USD" title="NZD/USD" height="502" width="901">

Summary:

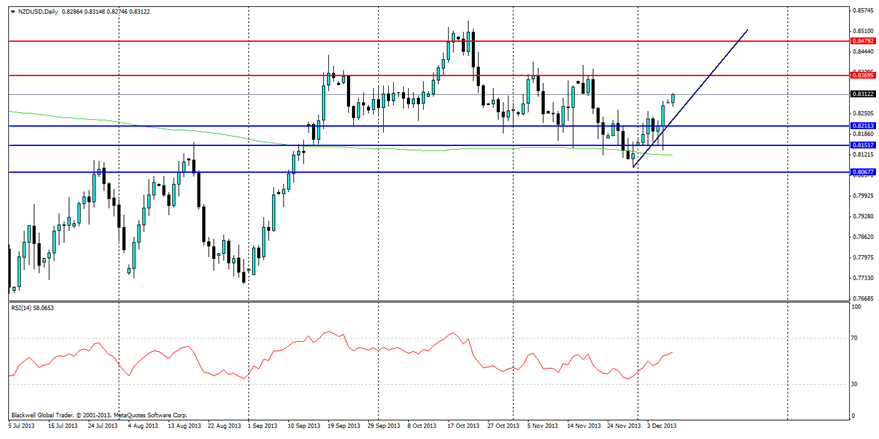

The New Zealand Dollar has looked to consolidate itself in the market place after touching on monthly lows in the .80 cent range. The NZD though looks to be stuck in no discernable trend currently, and is ranging and consolidating after touching the 0.83 cent mark in the last two weeks.

Traders in the coming week will be focused on the Interest Rate Statement due out on Wednesday, however, this is unlikely to be changed given the high state of the NZD as it has not fallen in line with the AUD recently. Most likely, the RBNZ will look to raise interest rates next year and when the Dollar has fallen.

Market technicals show that resistance can be found at 0.8369 and 0.8479; with major resistance at 0.8369 where the market has tested the level twice in the last month. Current support levels can be found at 0.8211, 0.8151 and 0.8067. Overall though, current market sentiment is bullish, however, consolidation seems more likely than any rapid rises for the currency pair at this given time. USD/JPY" title="USD/JPY" height="502" width="901">

USD/JPY" title="USD/JPY" height="502" width="901">

Summary:

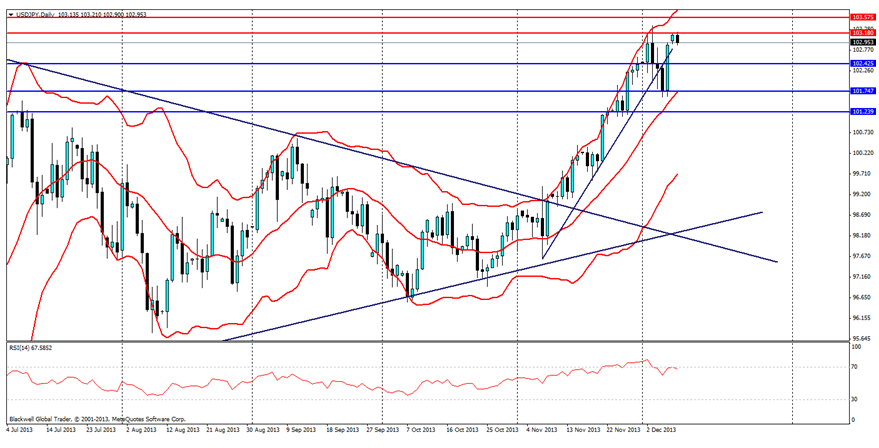

The Yen continued its fall against the USD last week, as US data was very strong compared to the Yen and as traders pushed on the Yen to extend it further after its breakout from its technical triangle. GDP coming in weaker did no favours to the push for further economic growth.

The week ahead looks likely to show consolidation from the Yen pair as news is light for the coming week except for the Tertiary Index due out late tonight. Markets will instead be focused on further US developments in order to move the pair.

Looking at market technical, we can see that current resistance is at 103.180 an 103.575, with 103.180 the current major level of resistance which has been tested three times in the past seven trading days. Current support levels can be found at 102.425,101.747 and 101.239. The RSI shows heavy buying pressure for the USD. The Yen, however, is likely to consolidate over the next few days in response to the rapid movements it has been through in the past few weeks.

DISCLAIMER

The report provided by Blackwell Global Investments Limited ("Blackwell Global") is meant for informative reading and should not be relied upon as a substitute for extensive independent research . The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global. It should not be construed as financial advice for a purchase or sale of any foreign currency, contracts-for-differences, precious metals or any other products offered by Blackwell Global mentioned herein. Any projections or views of the market provided by Blackwell Global may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any losses incurred directly or indirectly made by readers and clients as a result of any person or group of persons acting on the information contained herein.

The Blackwell Global's Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. This report is prepared for the use of Blackwell Global's clients and may not be reproduced, distributed or published by any person for any purpose without the prior consent of Blackwell Global.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Outlook: Aussie Falls, Euro Moves Higher, Pound Hits Highs

Published 12/09/2013, 02:39 AM

Updated 05/14/2017, 06:45 AM

Weekly Outlook: Aussie Falls, Euro Moves Higher, Pound Hits Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.